A Very Good Economic Outlook

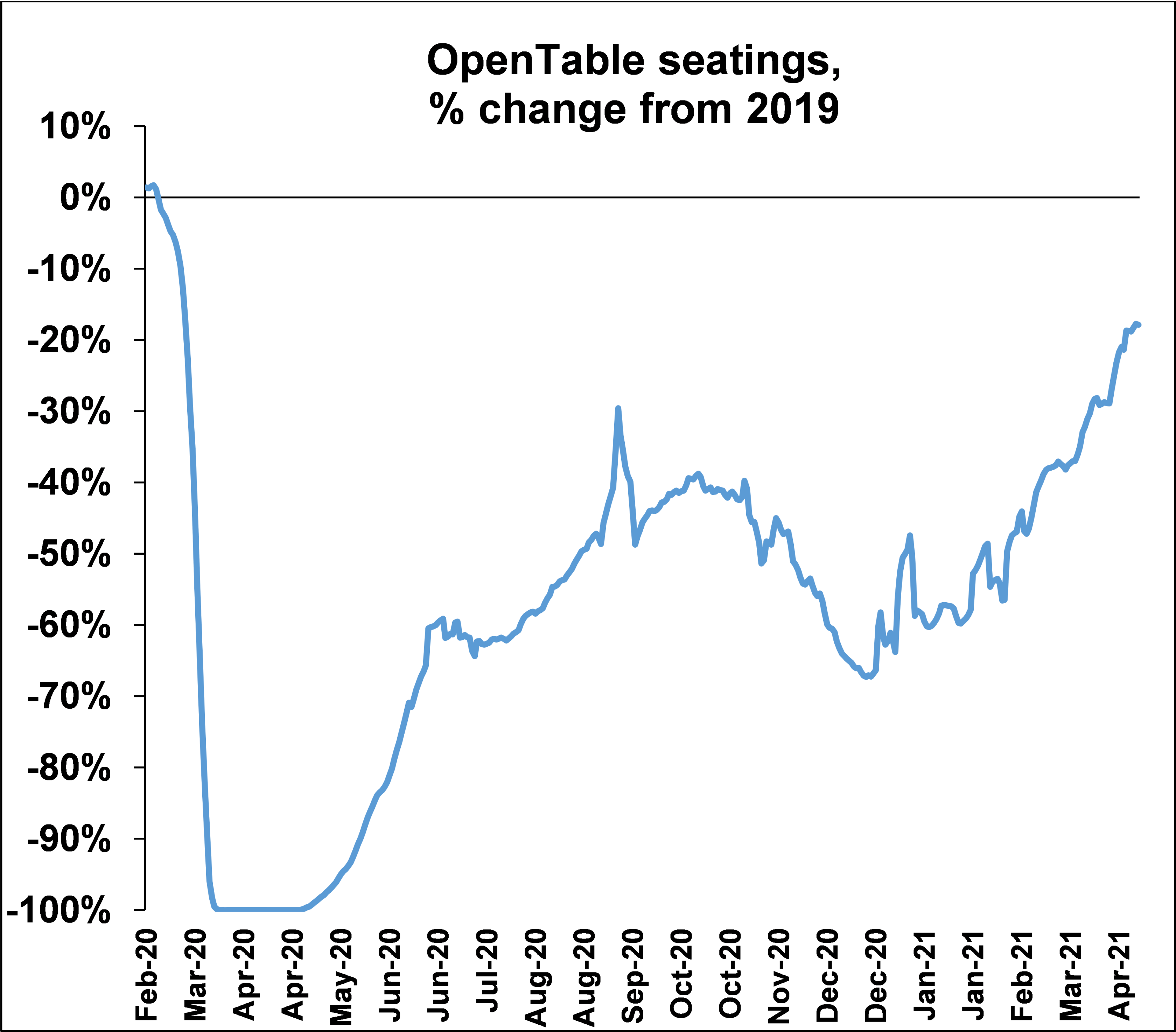

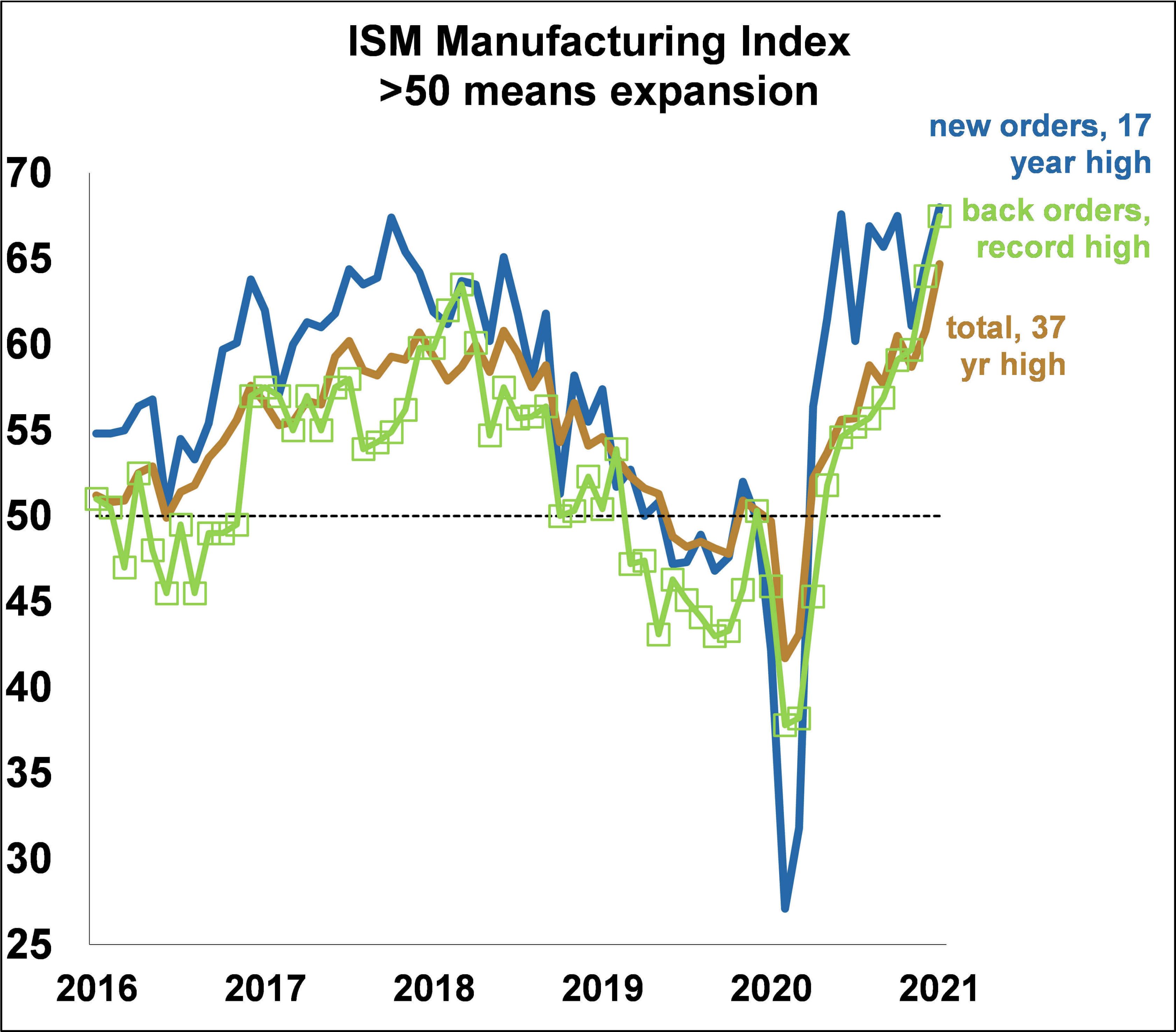

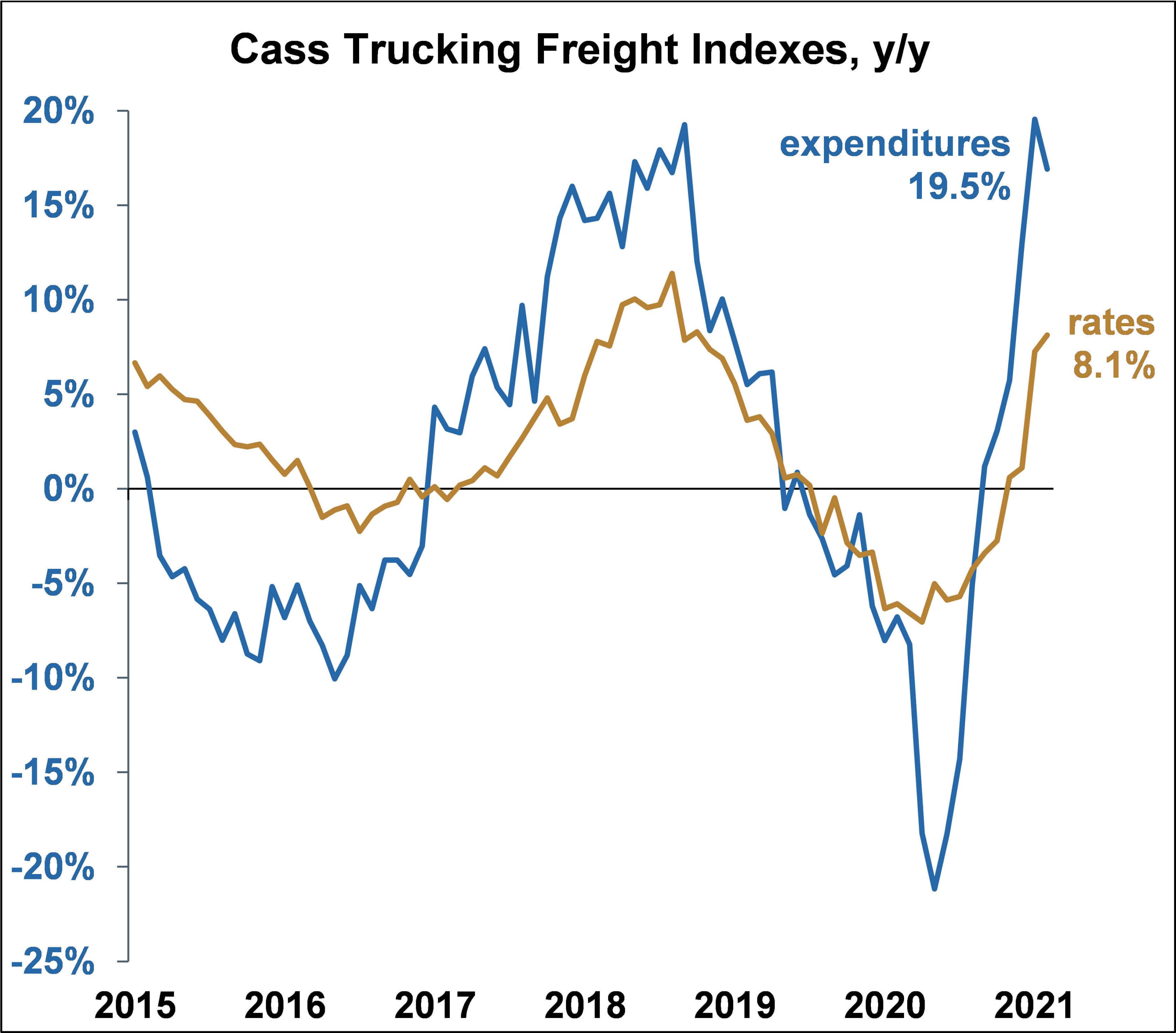

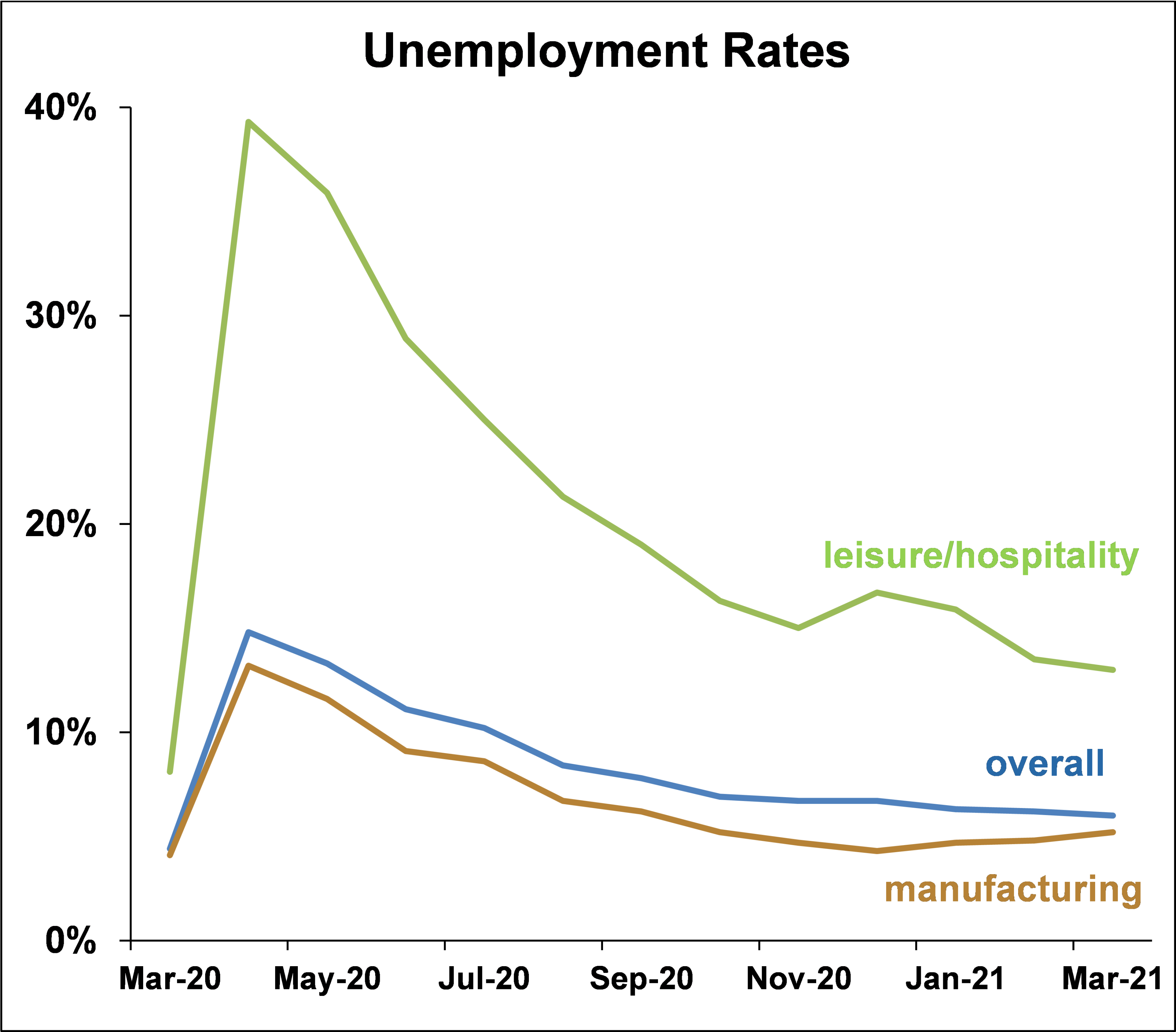

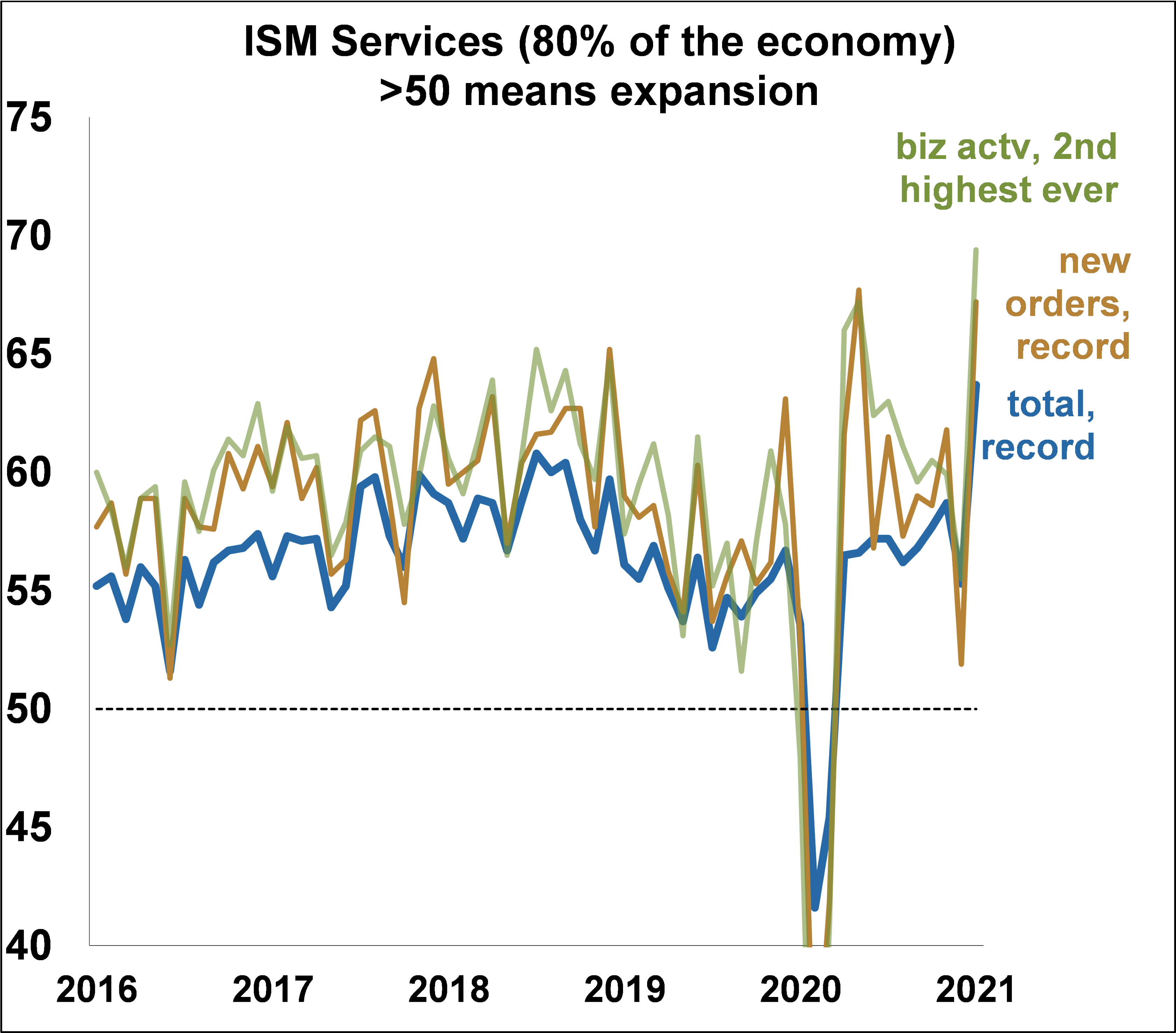

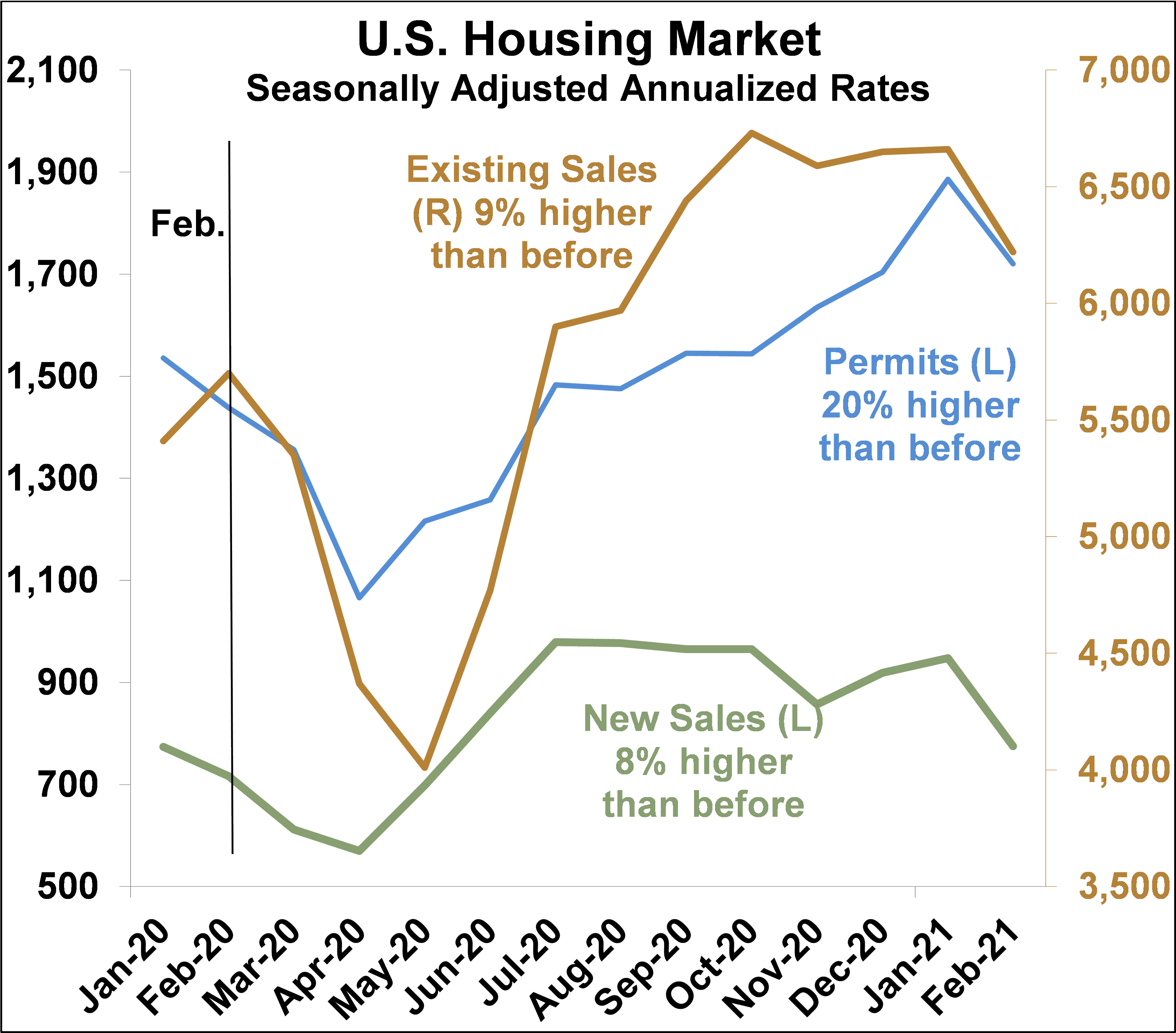

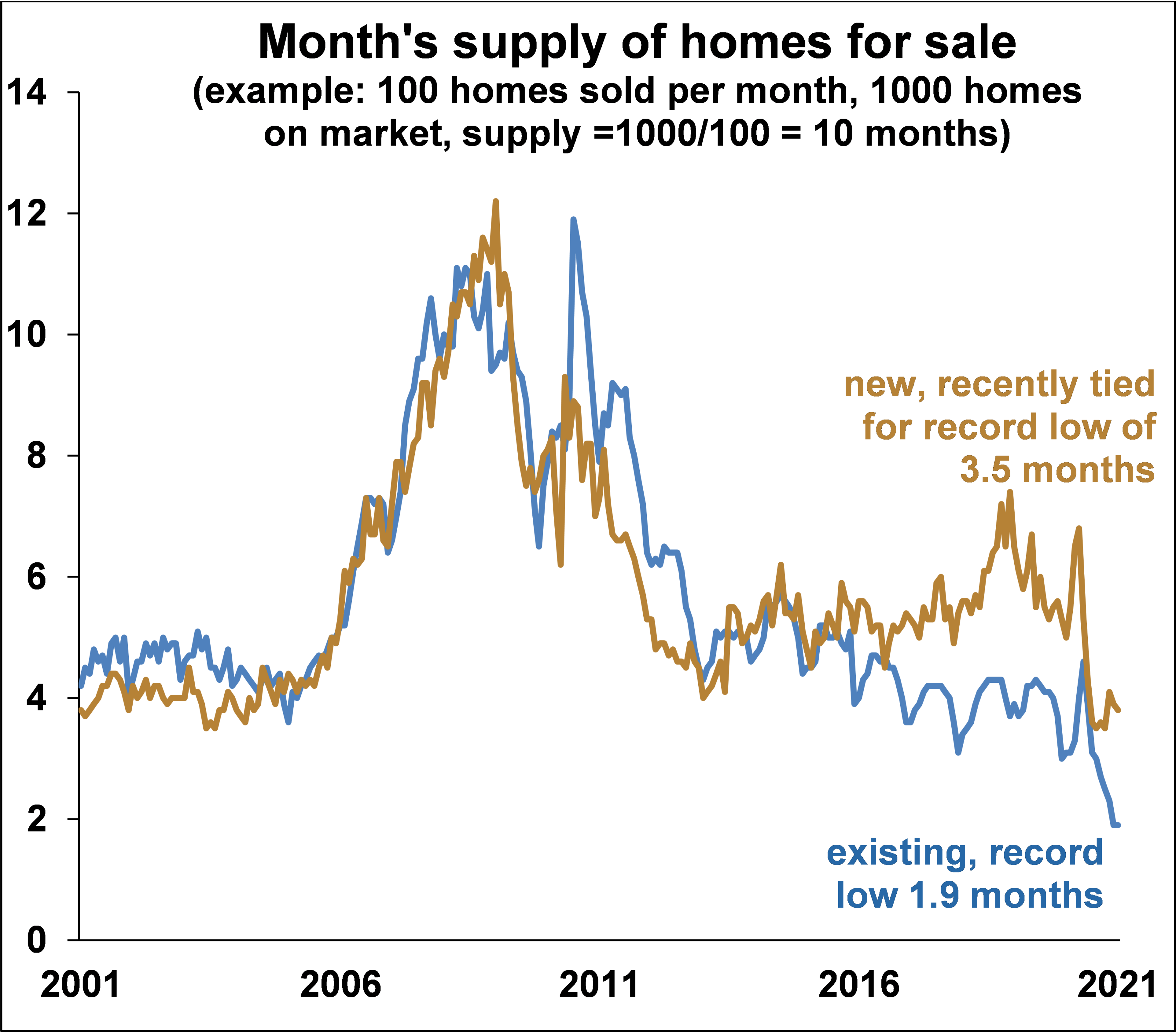

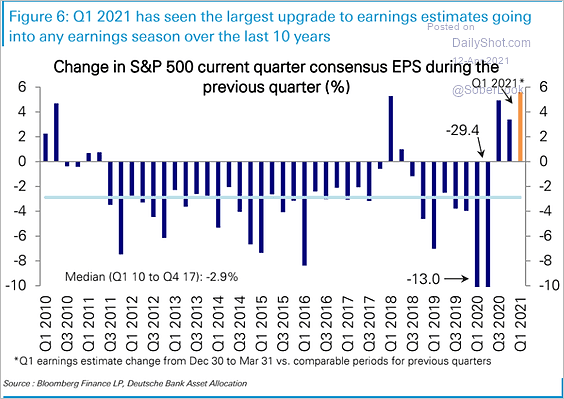

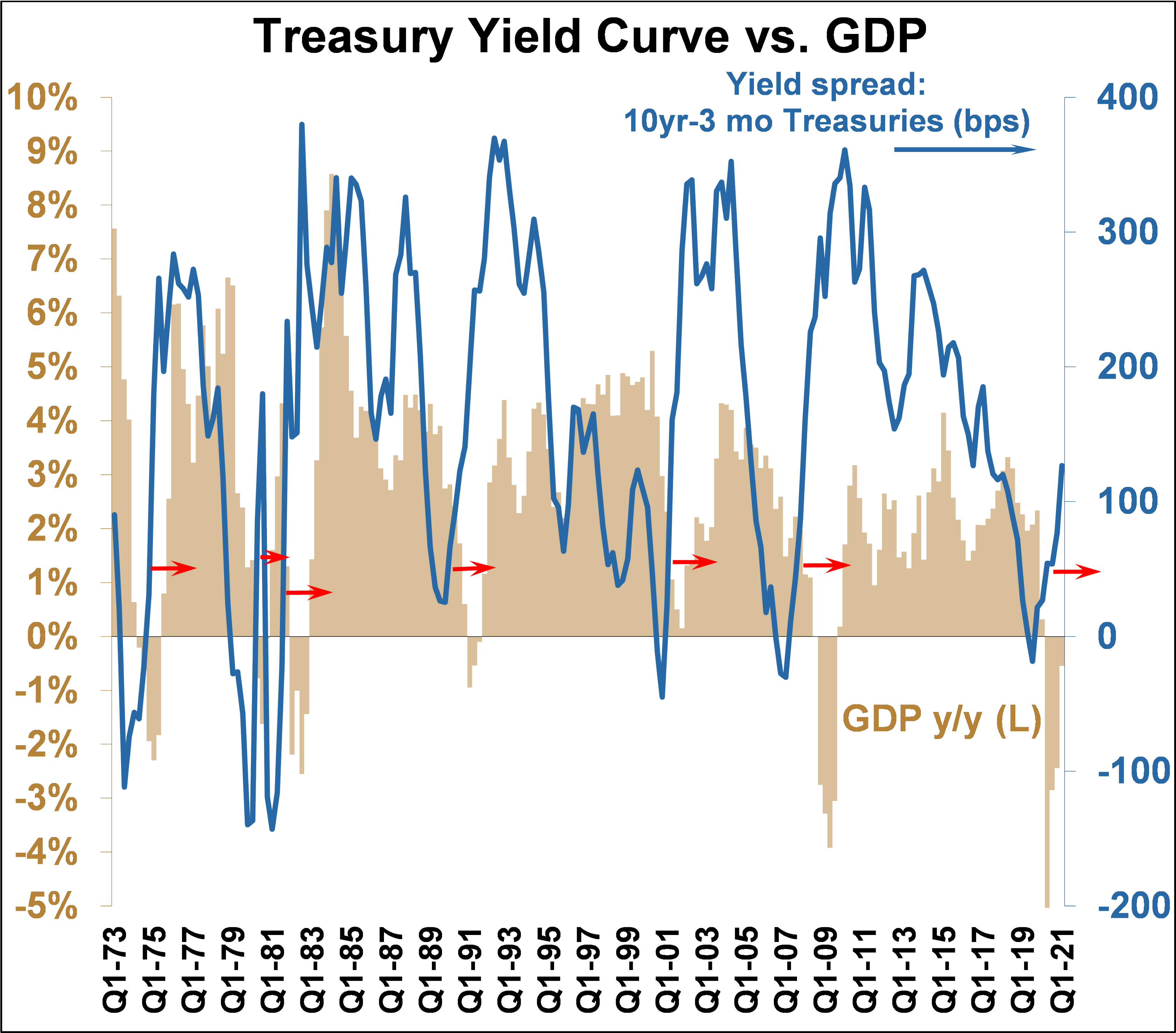

The U.S. economy is poised for the strongest growth in over 30 years as we enter the spring of 2021. Extraordinary stimulus packages have provided Americans with plenty of spending power, the labor market is red hot, the housing market is fierce, and both manufacturing and services are soaring.

All of this activity is supported by the arrival of warmer weather, and despite a recent rise in cases, the Covid situation continues to improve, with herd immunity likely to be reached before summer. In this report, we examine several factors that indicate a very good economic outlook into 2021.

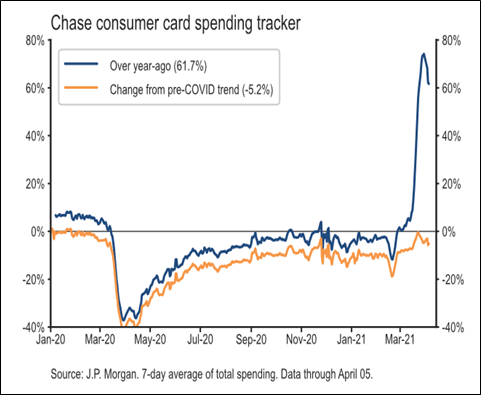

Consumers Already on a Spree

Almost 70% of all economic activity is driven by consumers, and as a group, consumers are flush with cash from the federal government’s massive (perhaps overly massive) fiscal stimulus programs. The first round of stimulus came in April 2020 with the CARES Act, which sent $1,200 direct payments to individuals, totaling around $300B. The next round came in December 2020 with the Consolidated Appropriations Act (CAA), which sent $600 checks totaling $166B. And the most recent round of stimulus came in the American Rescue Plan (ARP), which is delivering $1,400 checks totaling about $400 billion.

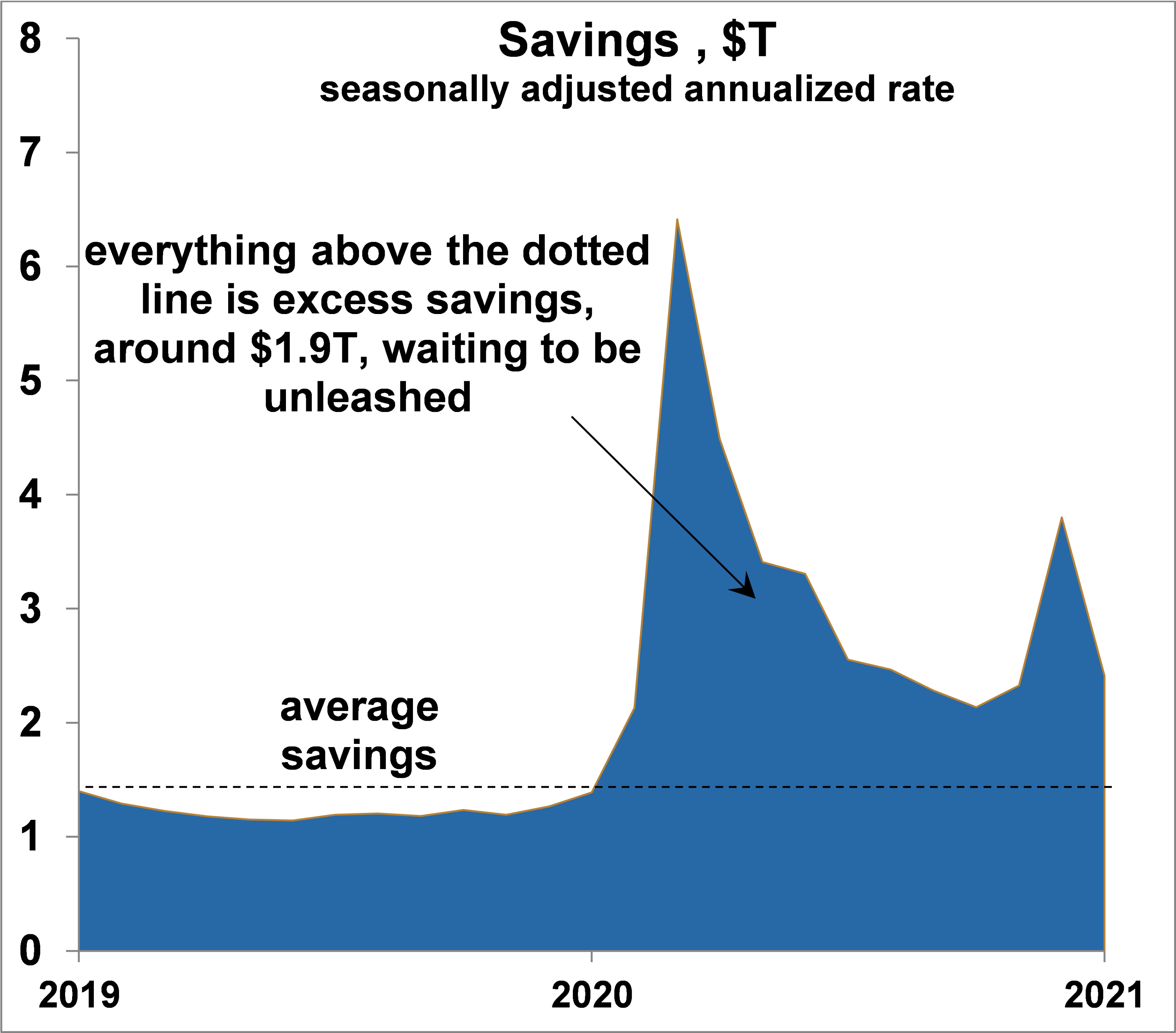

In addition to those direct payments, there have been huge extra unemployment benefits in place since April 2020. As a result, consumers have approximately $1.9T of excess savings, which are already being unleashed with vigor on the economy. That amount is equivalent to a gigantic 11% increase on top of what consumers might normally spend in a year and is a formidable 7% of Gross Domestic Product (GDP).

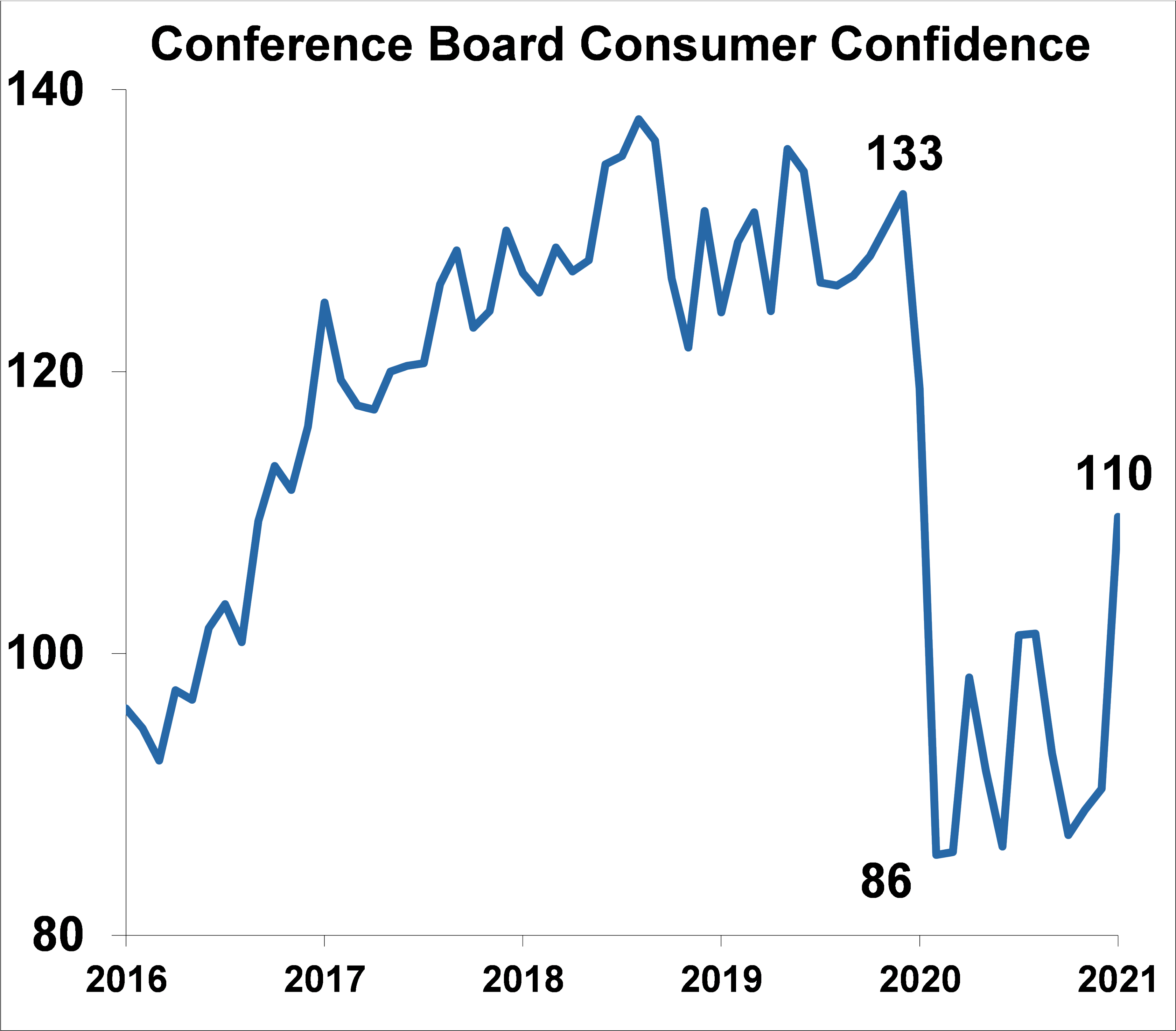

And now in addition to having the ability to spend, consumers are also regaining the willingness to spend as shown by The Conference Board’s Consumer Confidence Index (see below). The Index soared in March to 110, recovering half of the plunge from the pandemic, and landing well above the long-term average of 95.