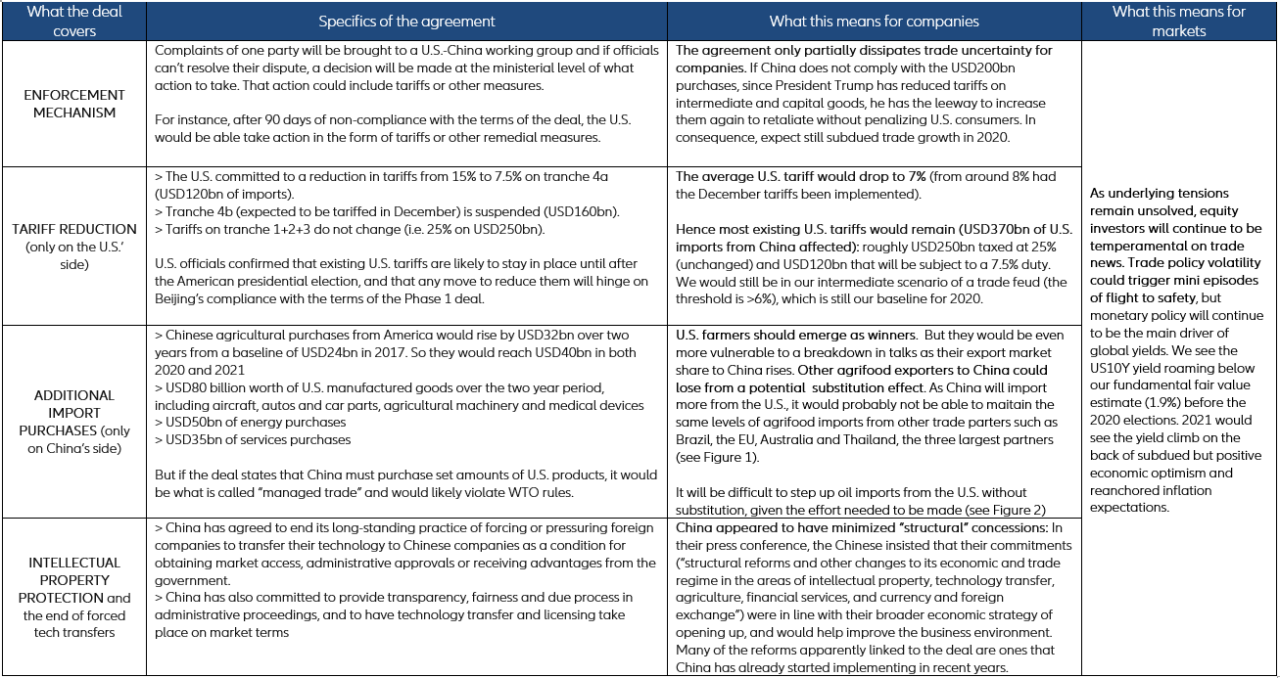

Executive Summary

- The U.S. and China officially signed a “Phase 1” trade deal on 15 January: The U.S. will halve its 15% tariff on about USD120 billion of Chinese goods and suspend planned duties that were set to take effect last December. China should increase its imports from the U.S. by USD200 bn over the next two years and also agreed to greater intellectual property (IP) protection.

- There are three main takeaways from the deal: (i) It is a short-term relief as it partly dissipates uncertainty and the average U.S. tariff drops 1pp to 7%; (ii) the agreed enforcement mechanism leaves room for policy volatility and does not entail any further tariff reduction this year. While we see no further sizable escalation, we still expect that the U.S. average tariff could fluctuate this year; (iii) don’t expect phase 2 to be agreed this year, as the issues remaining are more controversial.

- U.S. trade policy volatility could impact Europe: The digital tax, the European car sector, potential retaliation against Boeing subsidies and climate policy could become irritants, triggering (limited) U.S. retaliation.

- What does this mean for markets? As underlying tensions remain unsolved, equity investors will continue to be temperamental on trade news. Trade policy volatility could trigger mini episodes of flight to safety, but monetary policy will continue to be the main driver of global yields. We see the US10Y yield roaming below our fundamental fair value estimate (1.9%) before the 2020 elections.

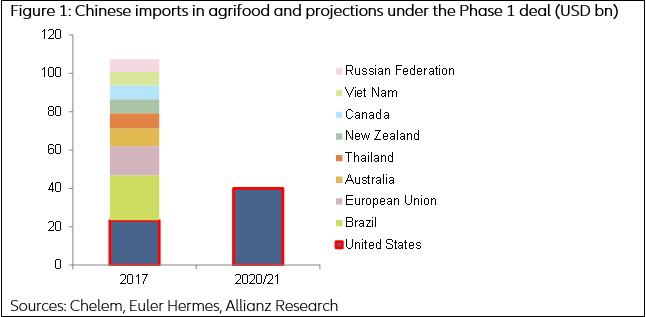

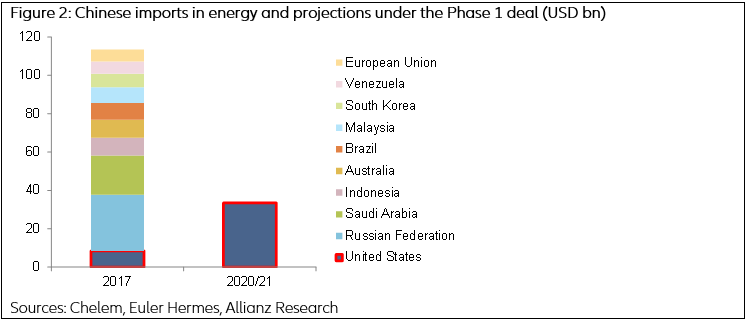

- What does this mean for companies? All the purchases that China committed to are not equally feasable: While stepping up agricultural imports could be within China’s reach and would be the priority, increasing energy and manufacturing imports could be more challenging. American farmers should benefit from additional Chinese purchases. Yet Brazilian, EU and Australian agrifood exports could be at risk of being susbtituted by imports from the U.S. Similarly for energy, where Russian and Saudi Arabian exports are at risk of being substituted, and manufacturing, where Japanese and EU exports are at risk. At a global level, although 2020 will see a modest improvement from 2019, trade growth will remain subdued.