We expect significant volatility around our central Brent crude price forecast of USD 41/bbl as an unprecedented inventory build battles with a hope-driven news flow.

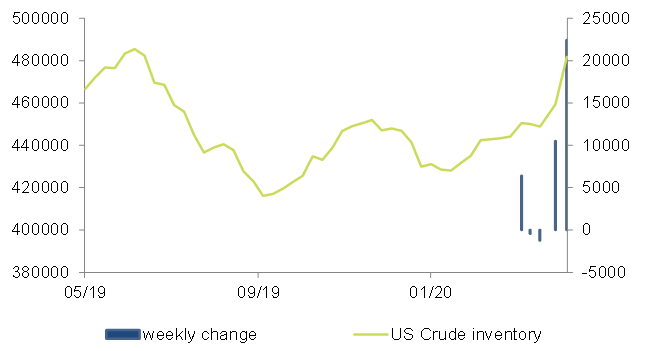

This week, API U.S. crude inventories show a second very large increase of 11.9mb. This follows from a record 10mb stock build last week. These numbers are only a glimpse of global inventories. The EIA estimates that oil demand could be in decline by 20mbpd. At the same time, indications are that Saudi Arabia is pumping in excess of 12mbpd, +up 1.5mpd. We see scope for further output growth from Saudi Arabia of at least another 1mbpd, and another 3-4mbpd from other producers. With this, we expect a prolonged period of rising inventories.

Global oil storage capacity, estimated at c 6mb, might get exhausted in less than one quarter if pessimistic demand estimates come true, according to our calculation. This could lead to negative oil prices at times and forced production shutdowns. The same holds for the resumption of talks between Opec and Russia. To be meaningful, any agreement would have to foresee production cuts in the order of 10mpbd. Given the three-way nature of the oil-price war, the U.S. remains an important factor. Whether or not brokered by the U.S., the inclusion of the U.S. industry in administered production cuts seems less likely, though largely for cartel law issues. This could prove a stumbling block for a deal and lead to other forms of escalation between the parties.

Figure 1 – U.S. crude inventories