Executive Summary

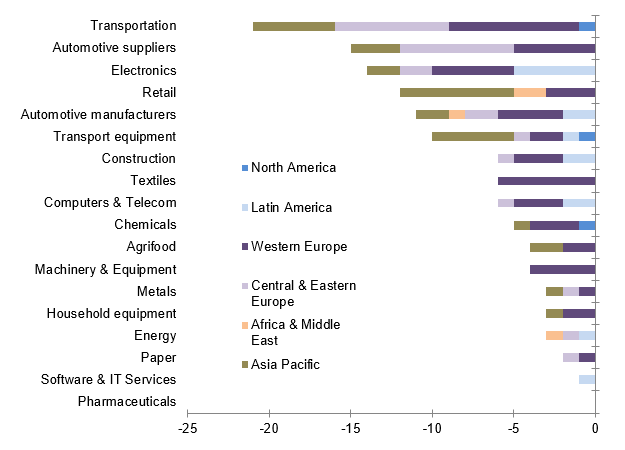

- As the Covid-19 pandemic accelerates, hardly any global industry will be spared, according to our analysis. For Q1 2020, we register a record level of 126 sector risk-rating[1] downgrades, the highest since we began monitoring in 2012. All these downgrades come from the direct and indirect impacts of Covid-19 on demand (5 out of 10 downgrades), profitability (4 out of 10) and liquidity (1 out of 10). In 6 out of 10 cases, downgrades are from "medium" to "sensitive" level of risk.

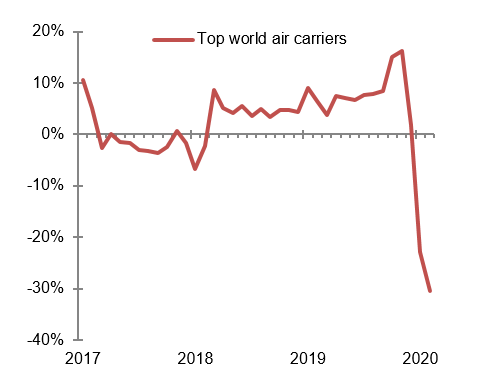

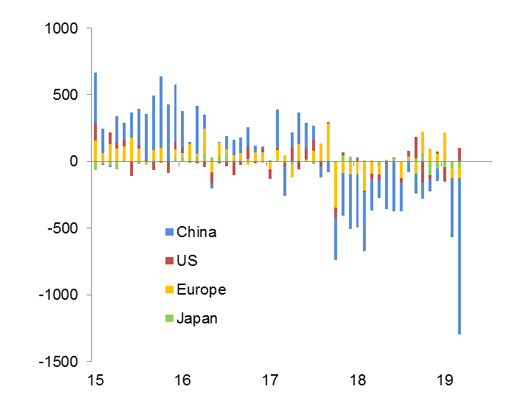

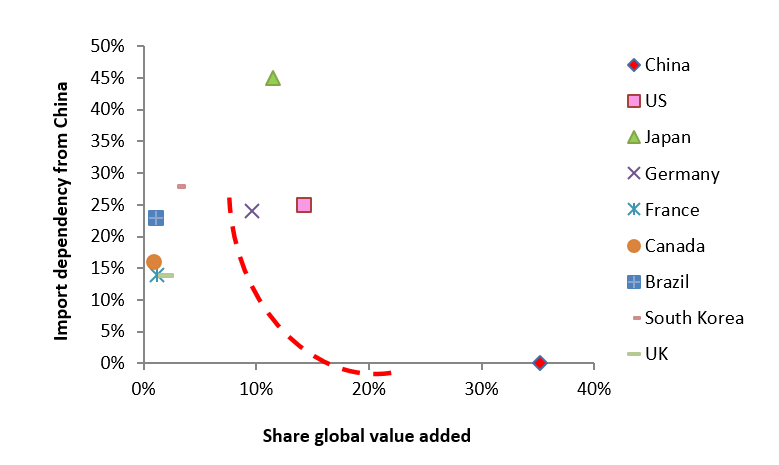

- Which global sectors are most at risk? Transportation, automotive, electronics and retail. Global lockdowns are wreaking havoc on airlines, with the RPK or Revenue Passenger Kilometers for top air carriers plummeting by -40% since last December. Collapsing stock prices are also jeopardizing indebted and unprofitable (low-cost) airlines. Meanwhile, the pandemic is exacerbating problems for the automotive sector, already struggling with existing structural challenges. The global market is facing a slump of over -10% in 2020 (after -4% in 2019). Retailers/ wholesalers are on the front line, but suppliers are not immune, in particular to cross-country supply-chain risks. The electronics sector is battling a demand-driven deterioration in Europe, with expectations of much weaker electronics sales to local industries. And within the retail sector, Asia-Pacific discretionary retailers have been hurt badly by prolonged store closures and the collapse of Chinese tourist flows.

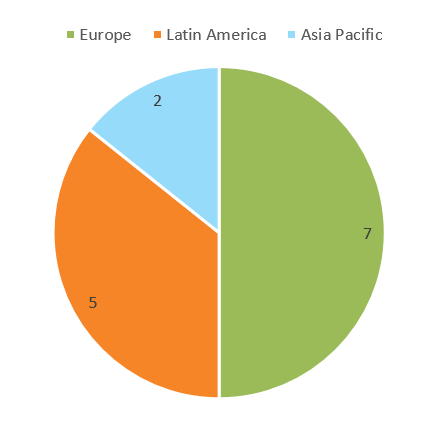

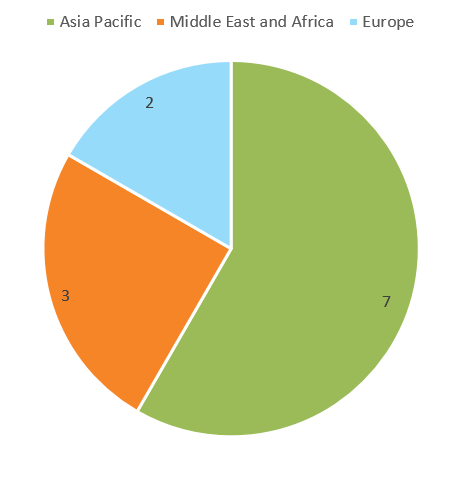

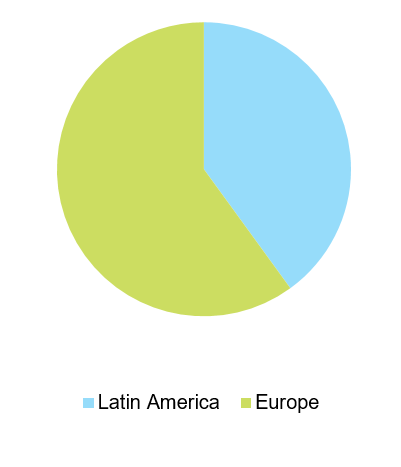

- Overall, Western Europe and Asia are the hardest hit. The bulk of downgrades occurred in Western Europe (52) – the region with the highest number of countries (17) ahead of Asia and Central & Eastern Europe (29 and 14, respectively). However, North America is not immune with three downgrades in the U.S.

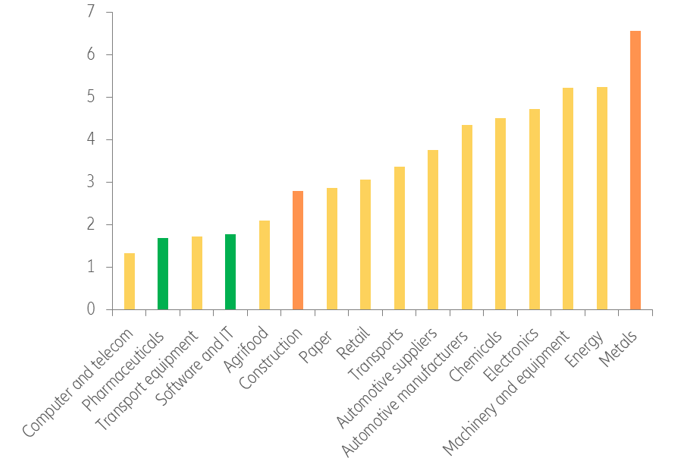

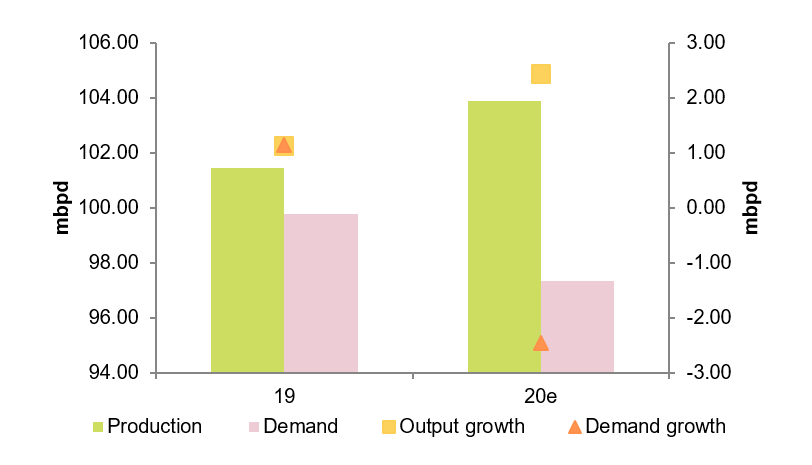

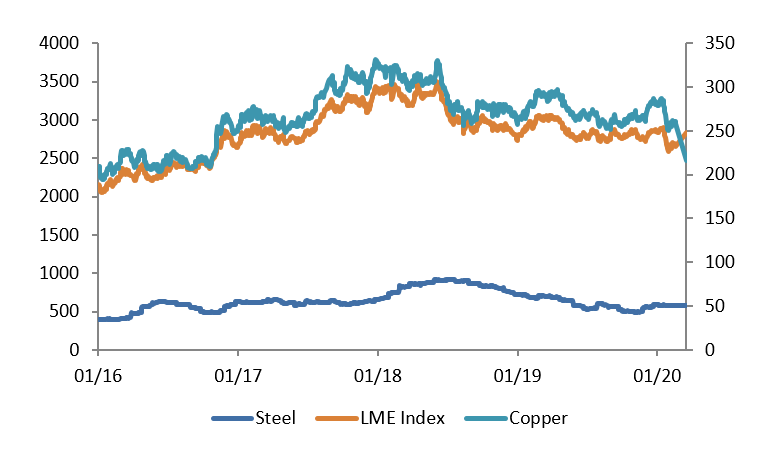

- Here are the main findings by sector: The lockdown of one third of world population is wreaking havoc on transportation, especially the air transport segment, which could receive public support. In automotive, the strong dependency on the top three markets is aggravating ongoing structural challenges. The impact in the electronics sector is most felt in APAC, with low value-added players at risk across all regions. Lockdowns will hit sales badly in non-food retail and squeeze margins of already vulnerable companies. In energy we find significant risk ahead for U.S. shale and solar. Metals is already weak, with structural challenges. Machinery faces challenges from a fragile global backdrop in many end markets due to the weak economic environment, and we identify potential insolvency risk across APAC in construction, primarily in China.

Hardly any industry will be spared from the impact of Covid-19

Since the beginning of the Covid-19 outbreak, global sectors have been facing mounting challenges. The first round of impacts arrived via China’s drastic containment measures, which shut down several large cities, triggering a freeze in production, retail and trade activity in the country. Travels to and from China also grinded to a halt. Then, as other economies (South Korea, Italy) started to implement China-style measures to contain the spread, a strong adjustment in stock indices followed. Now, with large swathes of the global economy under lockdown, especially in Europe and North America, local consumption has taken a strong hit, on top of production and trade. Lower demand in these regions will also take a toll on products (typically consumer durables) manufactured in and imported from emerging economies.

For Q1 2020, we register a record level of 126 sector risk-rating downgrades, the highest since we began monitoring in 2012. All these downgrades come from the direct and indirect impacts of Covid-19 on demand (5 out of 10 downgrades), profitability (4 out of 10) and liquidity (1 out of 10).

Figure 1: Changes in sector risk ratings by sector and region (Q1 2020 vs Q4 2019)

[1] Click here to read the full sector risk rating methodology on our website.