Executive Summary

- The elimination of Iranian General Qassem Soleimani after a targeted U.S. airstrike could be a game-changer for the whole stability of the Middle East. An escalation of the conflict between the U.S. and Iran seemed to be irreversible, as evidenced by the launch of ballistic missiles by Iran targeting U.S. troops. However we don’t expect a scenario of a full-fledged war, as confimed by a more conciliatory tone of communication recently adopted by President Trump.

- In the short-term, we expect a contained impact on oil prices, growth and inflation. Our model suggests an upward revision of our central oil price scenario from 62 USD/bbl to USD 65.5 in 2020. A short-lived temporary peak of 100 USD/bbl is conceivable should a situation of extreme tensions re-occur repeatedly. A sustainable increase of 10 USD/bbl in oil prices would cut global growth by around -0.1pp per year and increase global inflation by +0.3pp per year.

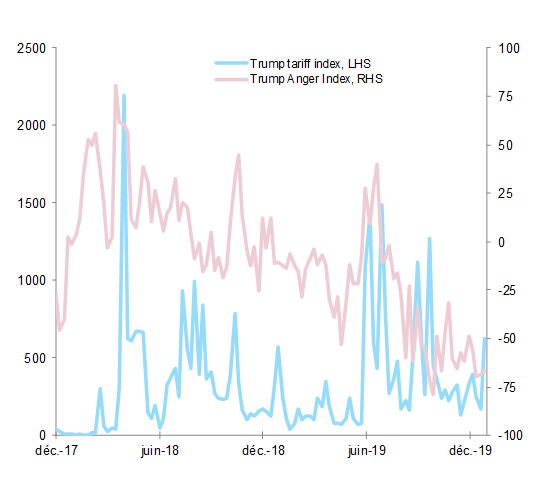

- In the medium-term, U.S. foreign policy is likely to continue being a source of uncertainty. The U.S. is progressively disengaging from being an important provider of world public goods (of security), President Trump’s foreign policy could be influenced by domestic factors such as the impeachment proceedings or 2020 Presidential elections, while the theory of game (maximax players) or US history (Nixon Madman Theory) show us how difficult it is to deal with unpredictable presidents. The confrontation between Iran and the U.S. is likely to remain high over the next months, while uncertainty originitating in the US will weigh on global growth.

- What does it mean for markets? Inflation expectations and equity markets are expected to react to short-term volatility only, as the negative impact on fundamentals is likely to remain limited. According to our estimates, a stabilization of oil prices at 80 USD/bbl at an horizon of one year would only trigger a correction of 2% of MSCI world. However, the negative impact on the MSCI world index increases significantly after one year, to -9% (after 20 months) should oil prices remain at 80 USD/bbl. Given the fact that we describe a regime of higher uncertainty, gold prices are the likely winners of this situation.

On 3 January 2020, the U.S. killed General Qassem Soleimani, the Head of Iran’s Islamic Revolutionary Guards Corps, in a targeted airstrike at Bagdad airport in Iraq. Jamal Mohammad Jaafar al-Tamimi, also known as Abu Mahdi al-Muhandis, the Iraqi deputy commander of the Popular Mobilisation Units (PMUs) and commander of the Iranian proxy Kataib Hizbullah in Iraq, was also killed. Soleimani was widely considered to be the second most powerful man in Iran behind Supreme Leader Ali Khamenei. The latter promised ‘harsh vengeance’ for the assassination. On 8 January 2020 (2am local time), Iran carried out missile attacks on two Iraqi air bases housing U.S. forces, in retaliation for the killing of Soleimani, declaring the assault as an act of self-defense. This was the most direct attack by Iran on the U.S. since the seizing of the U.S. embassy in Tehran in 1979. At the end of the day, President Trump mentioned that there were no victims in targeted sites and adopted a rather more conciliatory tone of communication, while confirming further sanctions on Iran.

Limited impact on oil prices, growth and inflation

The most obvisous consequence of the escalation between the US and Iran deals with oil prices. A new regime of uncertainty will be key in regards to the fluctuations of oil prices. We use the US Economic Policy Uncertainty index as a proxy of global political uncertainty and introduce this variable in an equation estimating the log of oil prices in function of other variables such as the log of the US GDP and the log of Dollar index.

Our estimates show that an increase by 1% of this proxy of global political risk triggers an appreciation by 0.25% of oil prices. We assume a long-lasting change in the current regime of uncertainty embodied by a yearly rise of 25% in our political risk indicator. In this case, oil prices are expected to increase by USD 3.5 per barrel. This is the reason why we decide to revise our central scenario for oil prices in 2020, from USD 62 per barrel to USD 66. A peak at 100 in the case of extreme tensions is conceivable considering the level of risk, should the EPU Index hit record-high observed in recent years.

A sustainable increase of 10 USD/bbl in oil prices would cut global growth by around -0.1pp per year and increase global inflation by +0.3pp per year

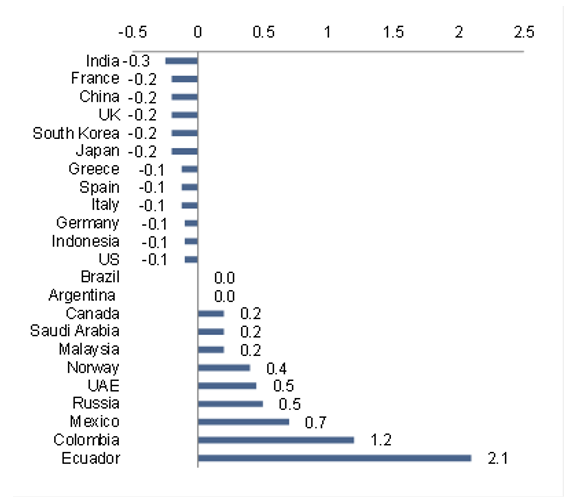

Higher oil prices would have a negative impact on oil importers (India, China, France) but favor oil exporters. We estimate that 10 USD/bbl higher oil prices would cut real GDP growth by -0.2pp per year for the Eurozone and China and by around -0.1pp for the US (see Figure 1 below). The main channel would be a squeeze in household purchasing power lowering consumer spending. Besides the oil sector, beneficiaries would be renewable energy/power generation, construction in oil exporting countries, while consumer-oriented sectors would be hit. In terms of inflation, were oil prices to rise durably to 80 USD/bbl, reflationary pressures should take over. In the Eurozone for example, inflation should increase to 1.8% in 2021 from the current 1.5% expected. In general a 10% increase in oil prices push global inflation up by +0.4pp per year.