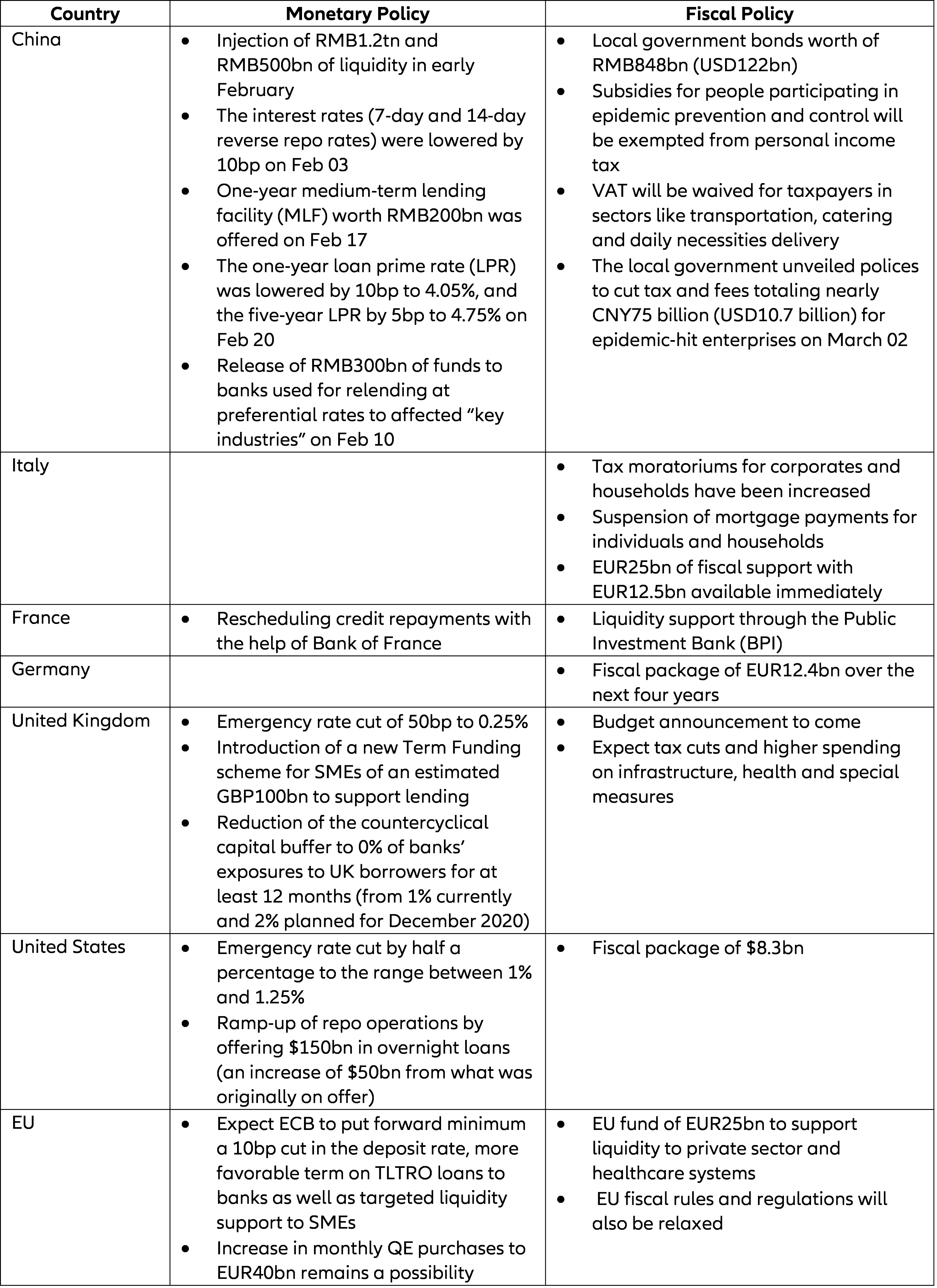

This week, policy makers stepped up, as containment measures could cost between 0.7pp to -3.0pp of GDP growth depending on the country and the severity of the lockdowns. Next to steps aimed at keeping a lid on contagion and boosting the resilience of national health systems, fiscal and monetary policy measures, from Italy to the UK and Germany, to the ECB, have been –or will– be announced in an effort to cushion the sharp economic contraction that is in the cards for H1 2020. Despite this, it is important to stress that these measures will only provide balance sheet supports and mitigate negative effects, attempting to prevent a full-fledged financial crisis and/or a sharp rise in insolvencies and unemployment. Figure 1 summarizes policy mix in response to Covid19, to date.

Italy: EUR25bn fiscal package looks like a lot but is palatable. Our interim forecast for Italy is -2.5% growth in 2020. As a result, Italy’s public debt level is likely to climb to over 140% of GDP next year. 10y BTP spread could widen further as economic activity negative news flow (PMI, Industrial Production, first GDP estimates) confirm the extent of the shock in H1 2020, so the ECB’s safety net will be pivotal. Half of the package will be released on March 13, the rest acts as reserve, they include: emergency sanitation measures, and (i) compensation for worker facing temporary layoff; (ii) guarantee fund for SME; (iii) tax moratorium and postponement of mortgage and loan payments (in cooperation with private banks); (iv) compensation for companies suffering a turnover loss beyond 25%. It cannot be ruled out that parts of the package will have to be spent on the banking sector later in the year as local banks continue to exhibit high NPL ratios.

German Chancellor Merkel’s “whatever it takes” does not seem to be Europe’s motto (yet). First, the European Commission has announced the set-up of a timid EU investment fund of EUR25bn (0.2% of the Eurozone GDP) to support liquidity to the private sector and boost the resilience of national healthcare systems. In addition, the EU fiscal and state aid rules will be loosened to allow countries to spend more on health systems and/or tax relief measures for the private sector. However more fiscal support from the European level would be desirable, to address limited fiscal room for maneuver in countries including Italy – even if EU fiscal rules are likely to be temporarily suspended. For now though EU fiscal policy is lacking coordination. All European and national fiscal measures combined for now account for only around EUR75bn (compared to EUR200bn announced in November 2008).

The ECB cannot disappoint. President Lagarde has declared that the central bank will jump on the global easing trend as soon as this week. Given the notable appreciation in the EUR and in a nod to global policy coordination we expect the ECB to cut the deposit rate by 10bps to -0.6%. However while blanket monetary policy measures such as rate cuts may help prop up market confidence and prevent an undue tightening of financial conditions they are unlikely to help address disruptions of production and supply chains or convince people to spend more if they are afraid to leave their homes. Hence the bulk of the ECB measures to be announced this week should focus on providing sufficient liquidity to the real economy including via more favorable TLTRO terms together with incentives to lend to SMEs. In addition there is a rising probably that the ECB will increase monthly asset purchases to EUR40bn/per month and tilt part of the purchases to corporate bonds in a response to widening credit spreads. After all, decreasing the cost of credit will only go so far in convincing banks to extent or prolong credit lines. It would be much more effective in contrast, if governments became “lenders of last resort” for instance by putting forward publicly guaranteed schemes that banks can resort to keep a lid on their credit exposure. In order to boost its room for maneuver an implicit or explicit increase in the issuer limit will be necessary.

The UK in whatever it takes mode to protect companies. A fiscal package of GBP30bn (i.e. 1.3% of GDP), and a bold move by the Bank of England were announced today. On March 11, the UK announced an expansionary budget of which GBP7bn to support business and individuals to cope with the “temporary disruption” including tax cuts, loans and grants for SMEs. The government will: (i) refund the cost of statutory sick pay for up to 14 days to SME at a cost of GBP2bn; (ii) support up to a further GBP1bn lending to SMEs through the “Coronavirus Business Interruption Loan Scheme” but also guarantee bank loans to SMEs on amounts up to GBP1.2mn; (iii) cover for bank losses for up to 80%; (iv) business tax rates will be abolished for smaller firms in retail, leisure and hospitality (tax cut of up to GBP1bn) for almost half of all business properties; (v) give cash grant worth a total of GBP2bn to small businesses; (vi) tax relief for entrepreneurs worth GBP3bn. Infrastructure spending will also be accelerated: more than GBP27bn of new road building and GBP5bn for gigabit broadband into remote areas of the country. The additional cut in the corporate tax rate to 17% in April 2020 (from 19% currently) has been cancelled as expected and has been replaced with more investment for the public health system (NHS), equivalent to GBP5bn as an emergency response fund for public services.

The overall budget exceeded expectations by around GBP10bn and is expected to support GDP growth by an annual 0.2pp, thus offsetting part of the Covid-19 outbreak negative impacts, notably should containment measures be implemented. The rise in the minimum wage has been maintained (to over GBP10.50 an hour) but a tax cut has been implemented through higher national insurance thresholds. As expected R&D tax credit has been increased from 12 to 15%.

The Bank of England (BoE) has joined the club of those acting in an emergency manner in order to cope with the “temporary, but significant disruptions to supply chains and weaker activity that could challenge cash flows and increase demand for short-term credit from households and for working capital from companies.” The move has been larger than expected with decision to cut rates by -50bp to 0.25% and introducing a new Term Funding scheme for SMEs of an estimated GBP100bn to support lending taken unanimously. In addition, the BoE reduced the countercyclical capital buffer to 0% of banks’ exposures to UK borrowers for at least 12 months (from 1% currently and 2% planned for December 2020).

In Germany, Chancellor Angela Merkel pledged to do “whatever is necessary” to face the crisis after previously announcing a timid fiscal package to the tune of EUR12.4bn. Measures are aimed at supporting affected companies with liquidity problems via access to KfW credit and credit guarantees. Additionally the government loosened restrictions on short-term work compensation (‘Kurzarbeit'). Short-term work compensation is now also paid by the state when 10% of employees are experiencing significant working time reductions down from one third. Furthermore, the government pledged to increase investments over the period of 2021-24, however, this is unlikely to help the economy in the short term. However as the economic downturn unfolds in Germany we expect targeted fiscal measures to be ramped up notably.

Figure 1: Array of fiscal and monetary measures

Italy: EUR25bn fiscal package looks like a lot but is palatable. Our interim forecast for Italy is -2.5% growth in 2020. As a result, Italy’s public debt level is likely to climb to over 140% of GDP next year. 10y BTP spread could widen further as economic activity negative news flow (PMI, Industrial Production, first GDP estimates) confirm the extent of the shock in H1 2020, so the ECB’s safety net will be pivotal. Half of the package will be released on March 13, the rest acts as reserve, they include: emergency sanitation measures, and (i) compensation for worker facing temporary layoff; (ii) guarantee fund for SME; (iii) tax moratorium and postponement of mortgage and loan payments (in cooperation with private banks); (iv) compensation for companies suffering a turnover loss beyond 25%. It cannot be ruled out that parts of the package will have to be spent on the banking sector later in the year as local banks continue to exhibit high NPL ratios.

German Chancellor Merkel’s “whatever it takes” does not seem to be Europe’s motto (yet). First, the European Commission has announced the set-up of a timid EU investment fund of EUR25bn (0.2% of the Eurozone GDP) to support liquidity to the private sector and boost the resilience of national healthcare systems. In addition, the EU fiscal and state aid rules will be loosened to allow countries to spend more on health systems and/or tax relief measures for the private sector. However more fiscal support from the European level would be desirable, to address limited fiscal room for maneuver in countries including Italy – even if EU fiscal rules are likely to be temporarily suspended. For now though EU fiscal policy is lacking coordination. All European and national fiscal measures combined for now account for only around EUR75bn (compared to EUR200bn announced in November 2008).

The ECB cannot disappoint. President Lagarde has declared that the central bank will jump on the global easing trend as soon as this week. Given the notable appreciation in the EUR and in a nod to global policy coordination we expect the ECB to cut the deposit rate by 10bps to -0.6%. However while blanket monetary policy measures such as rate cuts may help prop up market confidence and prevent an undue tightening of financial conditions they are unlikely to help address disruptions of production and supply chains or convince people to spend more if they are afraid to leave their homes. Hence the bulk of the ECB measures to be announced this week should focus on providing sufficient liquidity to the real economy including via more favorable TLTRO terms together with incentives to lend to SMEs. In addition there is a rising probably that the ECB will increase monthly asset purchases to EUR40bn/per month and tilt part of the purchases to corporate bonds in a response to widening credit spreads. After all, decreasing the cost of credit will only go so far in convincing banks to extent or prolong credit lines. It would be much more effective in contrast, if governments became “lenders of last resort” for instance by putting forward publicly guaranteed schemes that banks can resort to keep a lid on their credit exposure. In order to boost its room for maneuver an implicit or explicit increase in the issuer limit will be necessary.

The UK in whatever it takes mode to protect companies. A fiscal package of GBP30bn (i.e. 1.3% of GDP), and a bold move by the Bank of England were announced today. On March 11, the UK announced an expansionary budget of which GBP7bn to support business and individuals to cope with the “temporary disruption” including tax cuts, loans and grants for SMEs. The government will: (i) refund the cost of statutory sick pay for up to 14 days to SME at a cost of GBP2bn; (ii) support up to a further GBP1bn lending to SMEs through the “Coronavirus Business Interruption Loan Scheme” but also guarantee bank loans to SMEs on amounts up to GBP1.2mn; (iii) cover for bank losses for up to 80%; (iv) business tax rates will be abolished for smaller firms in retail, leisure and hospitality (tax cut of up to GBP1bn) for almost half of all business properties; (v) give cash grant worth a total of GBP2bn to small businesses; (vi) tax relief for entrepreneurs worth GBP3bn. Infrastructure spending will also be accelerated: more than GBP27bn of new road building and GBP5bn for gigabit broadband into remote areas of the country. The additional cut in the corporate tax rate to 17% in April 2020 (from 19% currently) has been cancelled as expected and has been replaced with more investment for the public health system (NHS), equivalent to GBP5bn as an emergency response fund for public services.

The overall budget exceeded expectations by around GBP10bn and is expected to support GDP growth by an annual 0.2pp, thus offsetting part of the Covid-19 outbreak negative impacts, notably should containment measures be implemented. The rise in the minimum wage has been maintained (to over GBP10.50 an hour) but a tax cut has been implemented through higher national insurance thresholds. As expected R&D tax credit has been increased from 12 to 15%.

The Bank of England (BoE) has joined the club of those acting in an emergency manner in order to cope with the “temporary, but significant disruptions to supply chains and weaker activity that could challenge cash flows and increase demand for short-term credit from households and for working capital from companies.” The move has been larger than expected with decision to cut rates by -50bp to 0.25% and introducing a new Term Funding scheme for SMEs of an estimated GBP100bn to support lending taken unanimously. In addition, the BoE reduced the countercyclical capital buffer to 0% of banks’ exposures to UK borrowers for at least 12 months (from 1% currently and 2% planned for December 2020).

In Germany, Chancellor Angela Merkel pledged to do “whatever is necessary” to face the crisis after previously announcing a timid fiscal package to the tune of EUR12.4bn. Measures are aimed at supporting affected companies with liquidity problems via access to KfW credit and credit guarantees. Additionally the government loosened restrictions on short-term work compensation (‘Kurzarbeit'). Short-term work compensation is now also paid by the state when 10% of employees are experiencing significant working time reductions down from one third. Furthermore, the government pledged to increase investments over the period of 2021-24, however, this is unlikely to help the economy in the short term. However as the economic downturn unfolds in Germany we expect targeted fiscal measures to be ramped up notably.

Figure 1: Array of fiscal and monetary measures