In Europe, both new car registrations and the business climate slumped in April. High frequency indicators based on Google trends now point to a renewed interest in cars but with the exception of Germany, that won’t be enough to drive a strong revival in car purchases before Q3.

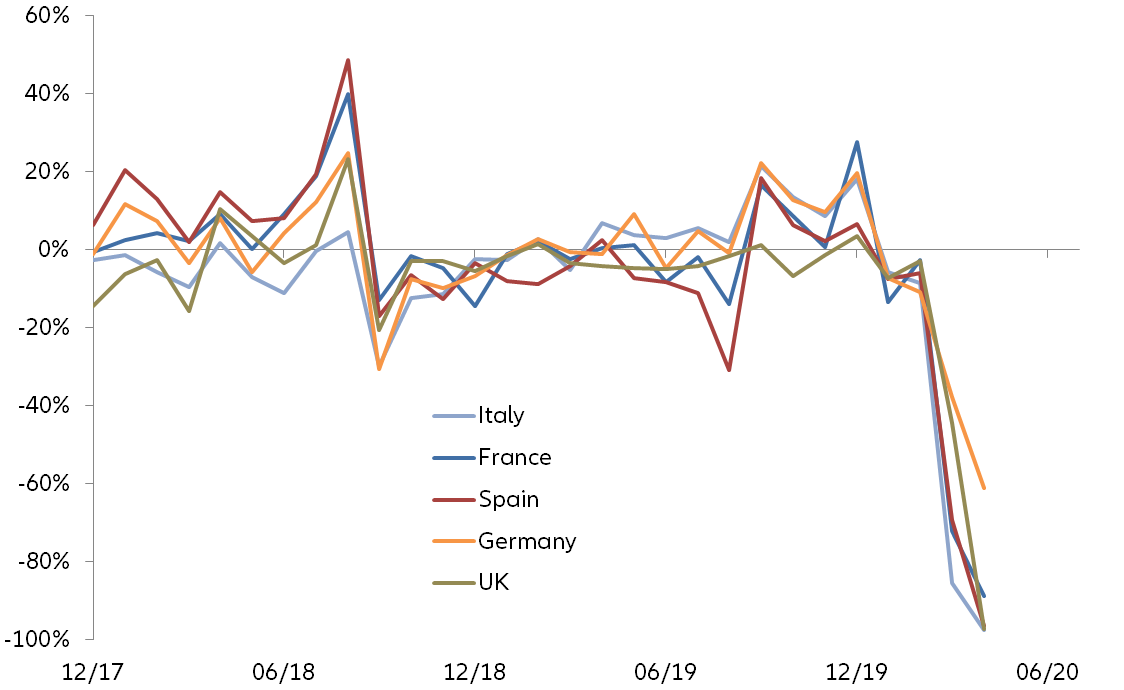

A historic slump in new car registrations. Due to confinement measures all across the region, which led to a massive restriction of public mobility and the closure of both car dealers/showrooms and registration agencies, the European automotive markets posted unprecedented slumps in April. According to national figures released since the beginning of May (see Figure 1), Germany was down by -61% y/y in April, France by -89%, Spain by -97%, the UK by -97% and Italy by –98%. As of the end of April, the downturn of the automotive market now stands at -31% ytd for Germany, -43% for the UK, -48% for France, -49% for Spain and -51% for Italy. For the top five markets that represent 75% of the EU market, the decline reached -84% in April, pushing the ytd to -42%, - which corresponds to a significant drop of -1.6 million new cars.

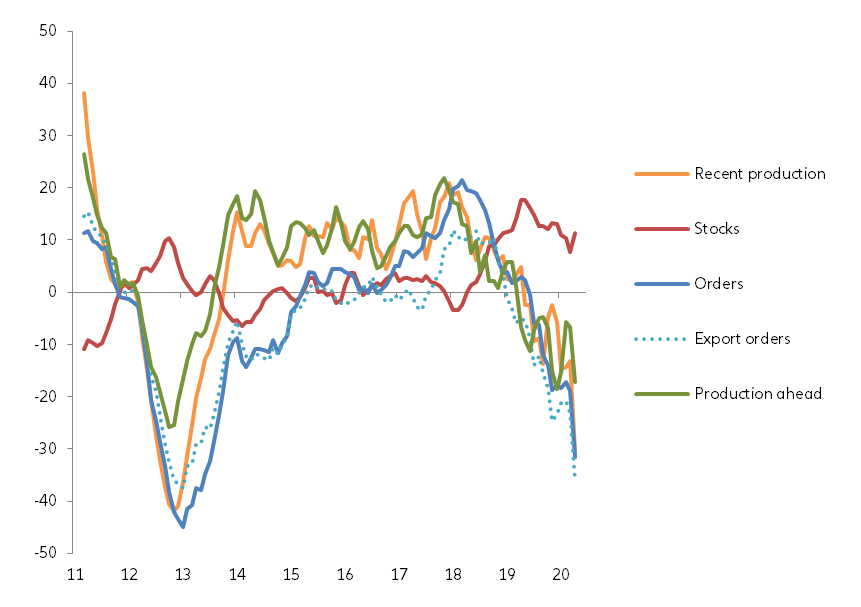

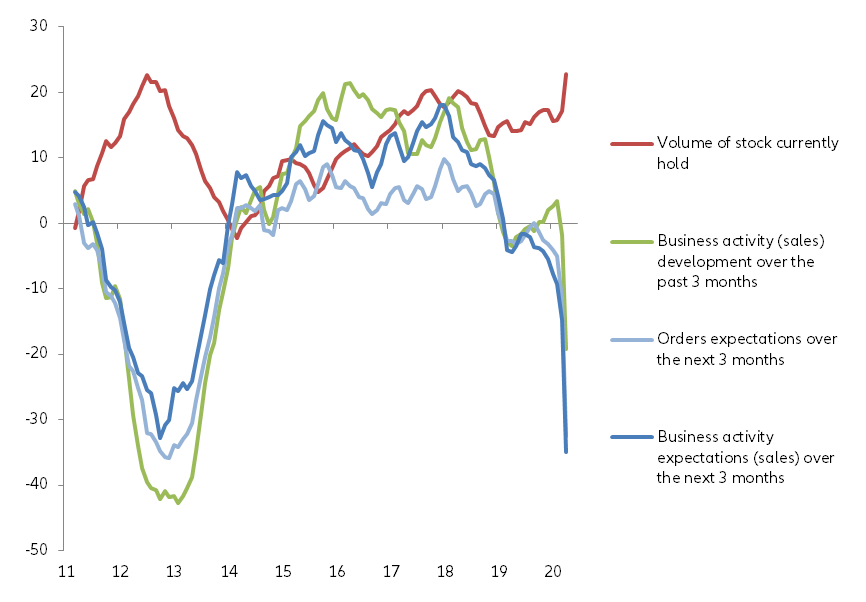

Business climate surveys reach new lows. Confidence indicators released at the end of April by Eurostat (see Figure 2) pointed to a renewed deterioration of both the current and future business climate for the manufacturing and retail sides of the industry. This decline was largely driven by the German sub indicators, with many of them pointing to historic lows in April — Germany accounts for ~45% of European production in value terms (~25% in volume terms) — but similar drops were also seen in most other car manufacturing countries, notably regarding orders and production expectations.

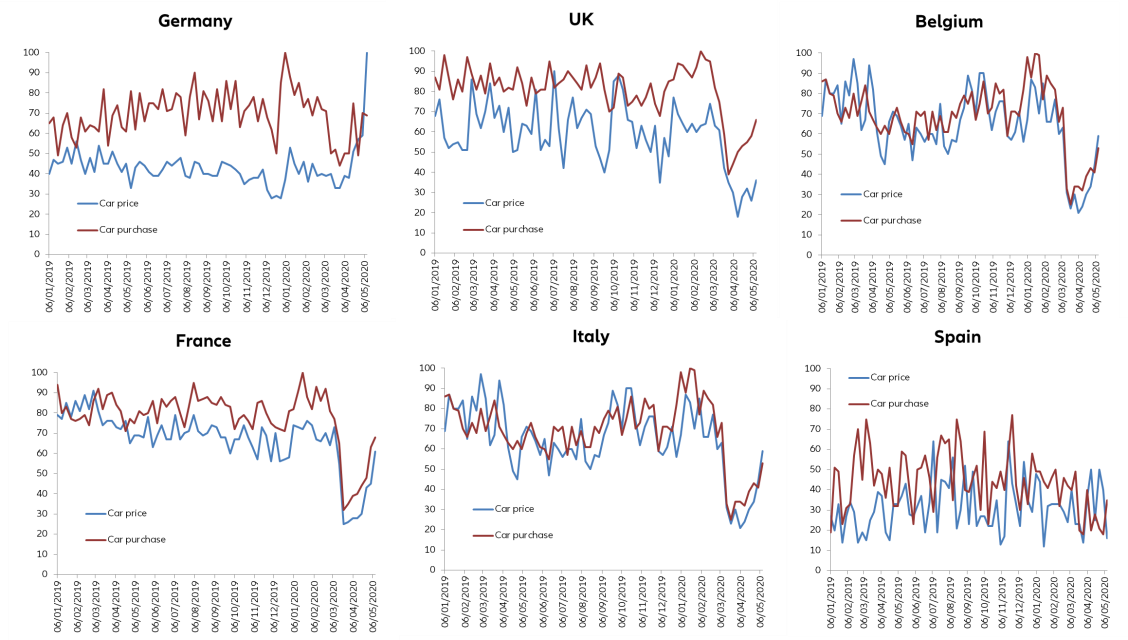

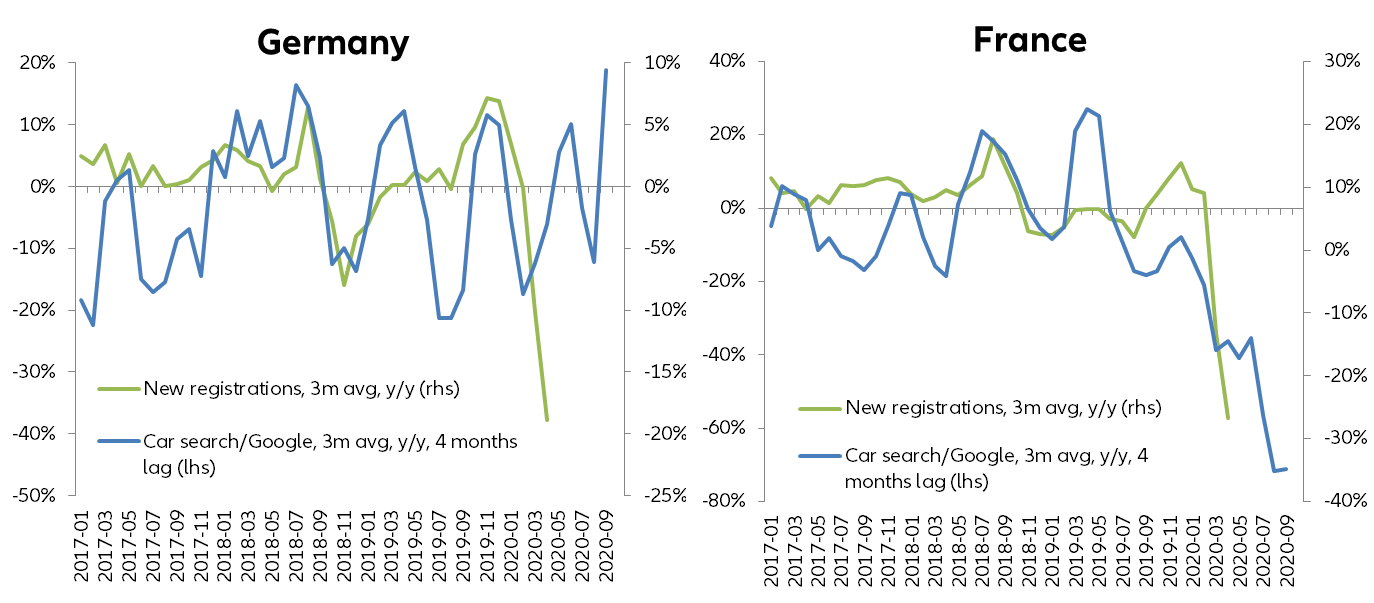

High frequency signals point to renewed household interest in cars, but this does not yet look strong enough to turn into car purchases soon, except in Germany (see Figures 3 and 4). We look at the frequency of searches on the internet for ‘car purchase’ and ‘car price’ as a proxy for households’ interest in cars, and in particular their willingness to buy one vehicle in the near term. There is usually a three to four-months lag on average between the rebound of interest in cars on the internet and a recovery in new car registrations.

Based on the weekly figures available through Google trends, up to 10 May, the interest in cars deeply declined from February to the end of March/first days of April for the six countries of our sample (Germany, UK, France, Italy, Spain and Belgium). April marked the beginning of a trend reversal in most cases, which was confirmed by data for the first two weeks of May. It was by far most obvious in Germany, where searches for ‘car purchase’ and ‘car price’ have already surged above pre-crisis levels, suggesting that households are gearing up to buy new cars in the coming weeks. However, for the other countries of our sample, the interest in cars has not yet recovered to the pre-crisis levels (France, Italy, the UK and Belgium) or even not restarted yet (Spain). Given the average lag, new car registrations look unlikely to recover in France before the end of the summer (see Figure 4).

What does this mean for companies? The reopening of showrooms and dealers across the region is the first priority for the recovery of demand - apart from the ending of mobility restrictions. Destocking actions could help, notably for first acquisitions (Covid-19 being a fear factor for people using public transportation), but Europe is a mature market mainly driven by replacement needs, and car purchases are not soon expected to become a priority for a majority of households unless they are ‘motivated’ to do so. To this regard, the resuming of production will contribute to the recovery by resulting in new models, but this will be gradual and not sufficient to fully revive demand. In the absence of any specific measures dedicated to boost demand one way or another, such as incentives/subsidies/fiscal stimulus – notably in favour of lower emission vehicles – we should expect the European market to decline by ~30% in 2020. This would put it on course to record its worst performance since the beginnings of these statistics in 1999, with 12 million units sold, down by 6 million units from 2019.