Since the Great Financial Crisis and the advent of unconventional monetary policy, capital markets have become obsessed with quantitative easing (QE) and its potential expansion, extension or tapering. Motivating this obsession is the widely held view that “people have to put their money somewhere”, be it in goods, services, or financial assets. Hence, the more central banks expand their balance sheets, the more conventional wisdom deems it beneficial for the real economy and capital markets. To what extent should we embrace this view? Is it overlooking some important issues?

Friedman’s legacy and some forgotten controversies about money

The central role given to the quantity of money issued by central banks is part of Milton Friedman’s legacy. First of all, Friedman judged the monetary policy conducted by the Federal Reserve after 1929 as “inept” for its failure to provide liquidity to a fractional reserve banking system facing a depositors’ run. According to him, had the Fed increased its security holdings, the banking crisis of the 1930s would not have been so severe. Next, as regards broad money - the money created by commercial banks and their clients-, Friedman argued that its velocity - the frequency at which it changes hands during a given time - is essentially stable in the short- to medium-run. Velocity rises “somewhat” during expansions; it falls “somewhat” during contractions. In other words, barring exceptional circumstances like the ones experienced during the Great Depression, when the velocity of broad money fell sharply, one should assume money velocity to be stable. The quantity of central banks’ money tells the whole story, a simple and easy to remember one.

These views would have raised eyebrows among early economists. First of all, they emphasized, instead, the role of the velocity of money. According to Mark Blaug, “Cantillon is the first to leave absolutely no doubt that the effect of an increase in money velocity is equivalent to an increase in money alone”. Published in 1755, Richard Cantillon’s seminal work was written in the 1720s.

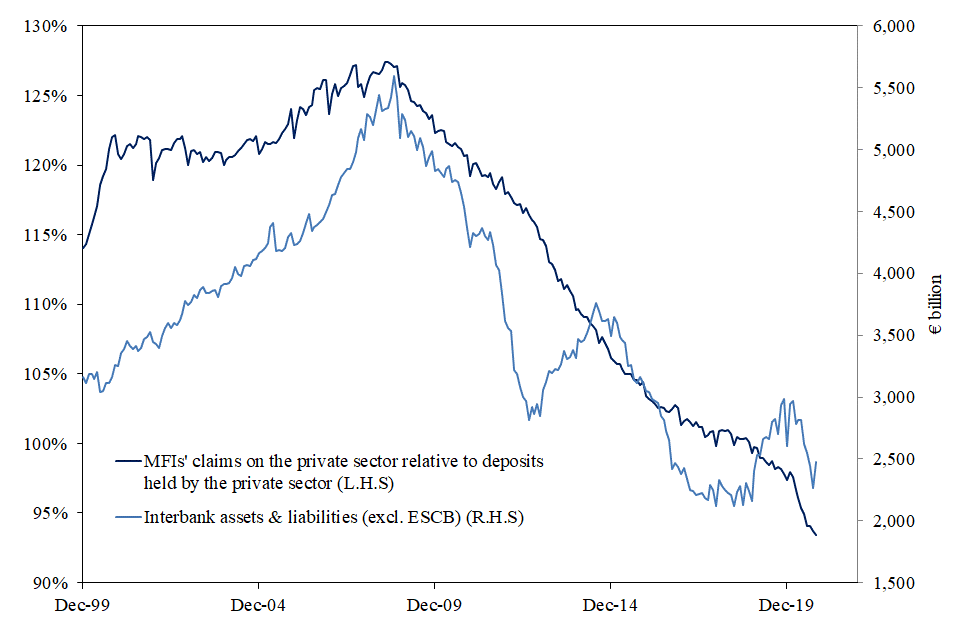

Then, the Banking School challenged the Currency School’s claim that money creation is exogenous and that it is possible for a central bank to control the quantity of broad money through its own balance sheet. The Banking School did so by invoking arguments, which economists nowadays summarize by observing that in a fractional reserve banking system “loans make deposits”. If bankers do not always perceive this way of describing the money creation process to be valid at the level of an individual bank, especially if a banking system is made of “long-loans/short-deposits” banks raising funds in the interbank markets from “long-deposits/short-loans” banks, economists have no doubt that it is correct at the level of any banking system. In this respect, it is telling that the words “debt” or “indebtedness” are nowhere to be found in the index of Friedman’s magnus opus.

QE has not prevented a decline in broad money velocity

If anything, contemporary monetary developments, in the EMU (like in other major economies), are a reminder that it is simplistic and therefore risky to sum up the fuzzy concept of liquidity with QE as if it was the alpha and omega of monetary phenomena. For the sake of brevity, the following investigation will only refer to EMU data, but its key observations are, to a large extent, valid in other developed economies. In recent years, the EMU has indeed experienced the following monetary phenomena.

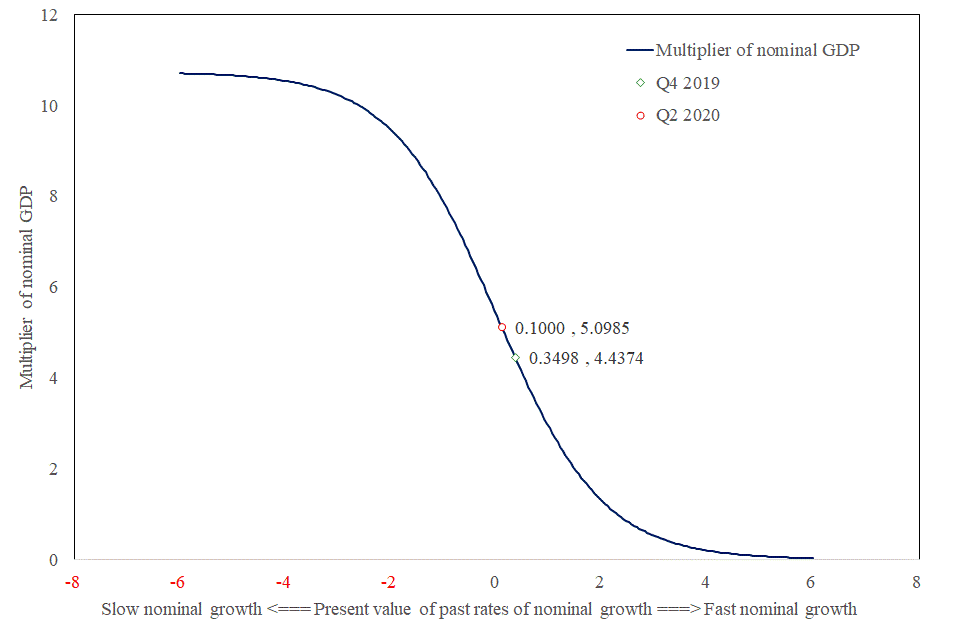

Broad money (M3), which is mainly created by commercial banks and their clients, has grown at a much slower pace (+3.7% a year on average since September 2008, +5.6% since December 2014) than the ECB’s balance sheet (+12.5% a year on average since September 2008, +16.7% since December 2014). Up until the Great Financial Crisis, a EUR 1 increase in the ECB’s balance sheet used to be accompanied by a fourfold increase in M3. Over the last five years, this multiplier has fallen to 0.60. So much for the ability of a central bank to control broad money through its own balance sheet!5

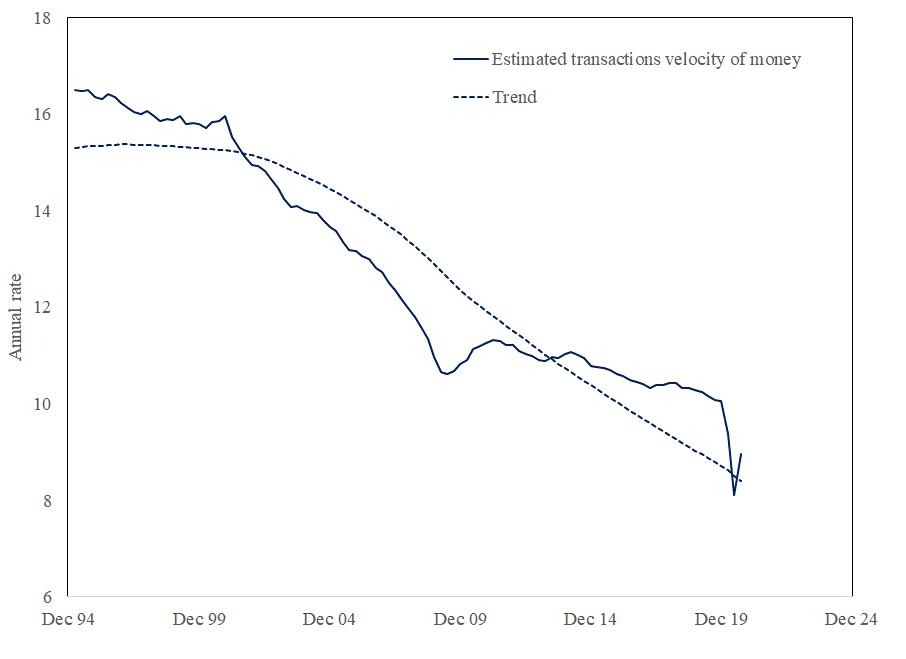

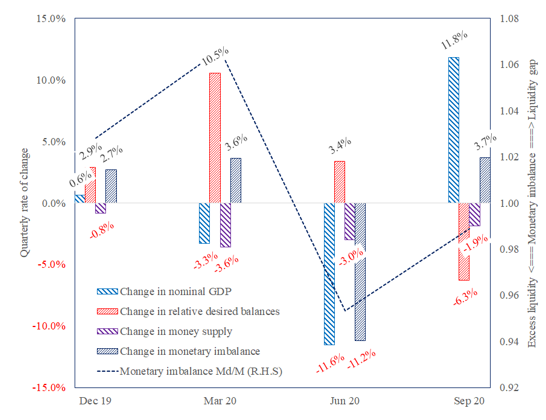

Derived from the ratio of nominal GDP-to-M3, the transactions-velocity of broad money has furthermore slowed down (by an average 2% a year since September 2008, 3.2% a year since December 2014), to about 10 times a year before the Covid-19 outbreak, as shown in Figure 1. As such, it has further widened the gap between the ECB’s quantitative impulse and the response of private agents. In other words, since the Great Financial Crisis, the decline in the velocity of money has neutralized or sterilized the first 2 to 3 pp of broad money growth, that is, about 55% of the total. In 2020, the velocity of broad money has exhibited some unusually large fluctuations: declines in Q1 and Q2 of -6.6% and -13.6% respectively, followed by a 10.5% rebound in Q3. So much for the alleged stability of money velocity!

Figure 1 – Estimated transactions-velocity of EMU M3