Figure 1 – Vaccine economics (example Germany)

Figure 1 – Vaccine economics (example Germany)

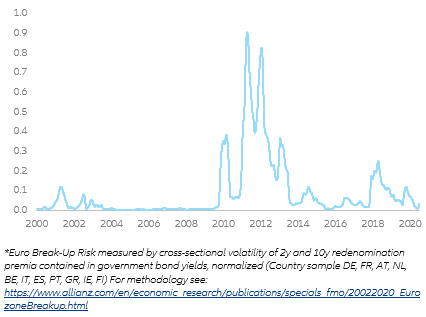

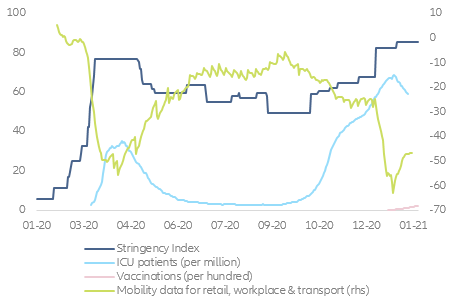

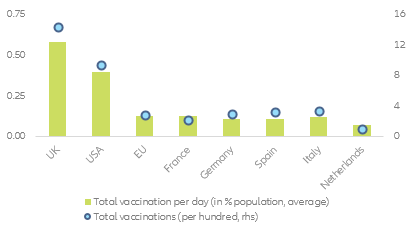

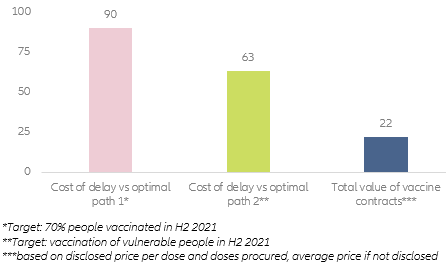

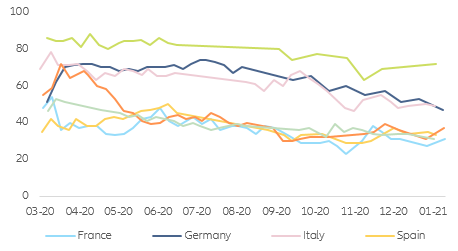

The EU Commission has recently communicated its goal of vaccinating 70% of the adult population by summer 2021. However, reaching this target would call for a vaccination pace that is roughly six times higher than currently observed (see Figure 2). In fact, our calculations show that EU countries are already five weeks behind schedule. As every week of prolonged sanitary restrictions reduces quarterly nominal EU GDP growth by -0.4pp, the current delay represents the equivalent of -2.0pp or close to EUR90bn (see Figure 3). This is more than four times the value of the agreements the EU Commission signed with vaccine producers for the 2.5 billion doses so far procured.

Figure 2 – Covid-19 immunity race for main EU countries

Even based on this less ambitious optimal path, the delay in vaccination tallies up to three weeks, in turn carrying a cost of EUR63bn. It should be noted that these costs will continue to increase for as long as the vaccination rate continues to be below the optimal path. But conversely, this also means the delay can be quickly reduced if the vaccination rate rises significantly above that of the optimal path. This would be conceivable if the bottlenecks in production dissipate at the end of Q1 2021. For example, through the approval of a new vaccine (which in the best case only requires one shot) or the development of new production sites. If a speed of around 1% of the population is reached in this way (which would roughly correspond to the German government's goal of vaccinating 5million per week), then by early Q3 2021 the delay would indeed be made up for.

Figure 3 - Weekly cost of targeted lockdown measures (EUR bn)

Figure 4 – Cost of delay vs. cost of vaccine in the EU (as of 31 January 2021, EUR bn)

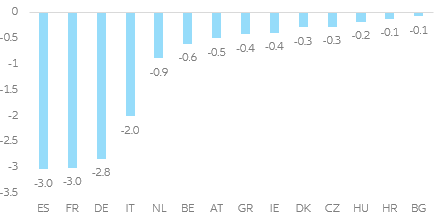

The accumulated costs to-date associated with the vaccination delay already exceed the total grants that we expect the EU recovery fund to disburse in 2021. The economic fallout from a delayed return to normalcy calls for a “whatever it takes” sequel. Policymakers will continue to have to run the show in 2021-22. Expect fiscal policy support – which governments had hoped to reduce in most European economies in 2021 – to remain aggressive as public safety nets are prolonged and reinforced to prop up household incomes and keep a lid on long-term scarring of the economy.

The ECB meanwhile will be sure to continue to provide cover to EU governments’ fiscal responses. PEPP still has an unused capacity of around EUR1trn but another ammunition boost to the tune of EUR500bn would probably be necessary in 2021 to ensure favorable financing costs are maintained. The vaccination delay will hence further accentuate the lingering Covid-19 effects on the economy by reinforcing fiscal dominance, further strengthening the role of the state in economic affairs and providing another boost to debt burdens and central bank balance sheets. The expected economic recovery detour, thanks to the delayed vaccination rollout, is even on course to eclipse Europe’s Hamiltonian trial balloon moment: The cost of the vaccination delay to-date already exceeds the EUR50bn in grants we expect the EU recovery fund to disburse in 2021.

Economic spillover effects could fuel centrifugal political forces. Given insufficient progress on the vaccination front by mid-2021, the EU will need to maintain restrictions in place to avert a third wave and in turn a triple-dip. Political discontent is likely to skyrocket once countries including Israel, newly-departed EU member Britain and/or the US enter a consumption-led growth spurt in the second half of 2021. Should the EU face a delayed return to normalcy, confidence in the European project stands to suffer a substantial blow. In particular, we are concerned about the risk of a notable increase in political uncertainty and polarization – at the national as well as the European level:

- Heightened political uncertainty around key elections. Up until now incumbent governments in many European countries have seen their popularity rise, thanks to an appreciation of how they have handled the Covid-19 crisis. However, should Europe face a delayed return to economic normality compared to other economies, expect trust in national governments to drop markedly. The result will be heightened political uncertainty at the national as well as the European level, given that some economic heavyweights are facing key elections in the next 18 months - including Germany in September 2021 and France in April 2022.

- “National first” is back in fashion as governments scramble to rebuild trust at home. The EU’s crisis response has been known to fall short on timing and magnitude in the past, with key examples including the great financial crisis as well as the sovereign debt crisis. Should delegating the responsibility on vaccine orders to the EU be seen as a major mistake, confidence in the EU should take a severe beating. EU national governments will likely disassociate from the EU’s botched crisis response and increasingly turn inwards to fix problems on their own in an effort to revive popular support at home. From reduced willingness to coordinate economic and/or health policy to bilateral vaccine purchase agreements, the renewed focus on national matters is worrying at a time when Europe is far from out of the woods

Figure 5 – Approval of government Covid-19 crisis management (in %)

Figure 6 – ECB and “Hamiltonian moment” at work – capital markets still price very low Euro break-up risk*