Bond vigilantes are testing the Fed on tapering. Against the backdrop of growing confidence in the global recovery and rising inflationary pressures, yields on 10-year US Treasuries have risen 60bp since the beginning of the year to 1.4%. This increase is not due to higher expectations for short-term rates or long-term inflation, but rather based on the uncertainty component of nominal yields, the term premium. This comprises the inflation risk premium (uncertainty of expected inflation) but also embodies the yield-dampening effects of Quantitative Easing (duration extraction). The recent rise in the term premium (+60bp YTD) for the 10-year maturity to 30bp - in positive territory for the first time in over two years – implies investors are pricing in higher inflation uncertainty and pricing out parts of the QE effects. The bond markets in their current early post-pandemic euphoria have thus increasingly embraced the tapering narrative and are now testing the Fed's commitment to long-lasting loose monetary policy.

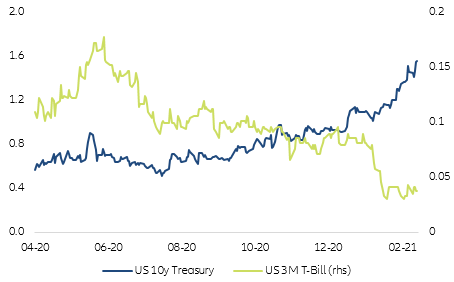

An unusual steepening pattern, with diverging trends at the extremities of the curve. The repricing of the term premium has led to a significant steepening of the US curve (3M-10Y spread from ~80bp to ~140bp). However, the underlying pattern is unusual, with a sharp rise at the long end seen in parallel with a decline at the short end (Figure 1).

Figure 1 – US short end and long end drifting apart (yield in %)

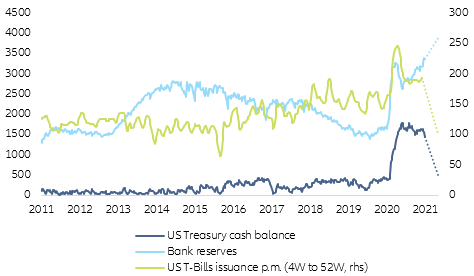

US T-bills with a maturity of three months are trading at only 4bp after 9bp a month ago. The US money market is currently experiencing dislocations due to the coincidence of excessive liquidity and a growing lack of safe collateral. So while all investors are closely watching the long end, the hit might come from the short end. Most recently, collateral squeezes have already caused distortions on longer repo rates (i.e. 10Y repo rate). But the much bigger risk comes from the increasing scarcity of short-term collateral (US T-bills) which has a much greater importance for the repo market. Indeed, the supply of US T-bills supply could tighten significantly in the coming months. The US Treasury has already started to reduce its USD1.7trn cash buffer and it could shrink to USD500bn in the next few quarters under the new stimulus plan. In the process, the monthly issuance of US T-bills is expected to decline to around USD100bn (Figure 2).

Figure 2 - Treasury balance, bank reserves and T-bills issuance (in USD bn)

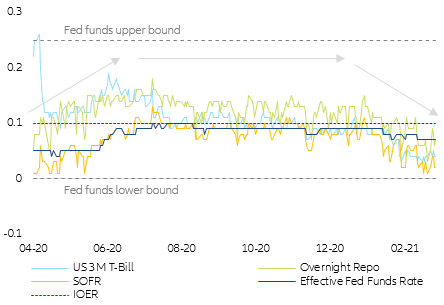

In turn, the reduction in the US Treasury's cash balance will cause bank reserves to rise. The combination of reduced T-bills supply and the increase in bank reserves will lead to further downward pressure on ultra-short money market rates. Effective Fed Funds rates are already trading at only 7bp. The SOFR (reference rate for the repo market) is trading very close to zero (Figure 3). Money market rates sliding into negative territory is now quite possible. But would it be such a big deal?

The Fed is exposed to credibility risk and the money market could be destabilized. Indeed, the risks at the short end of the US yield curve currently appear to us to be higher than those associated with the rise in long-term interest rates. First, the Fed runs the risk of losing credibility as it has always spoken out clearly against negative interest rates. If money market rates, in particular the effective Fed Funds rates, break through the key rate corridor (currently 0-25bp) on the downside, this could give the impression that the Fed is losing its grip on the core area of its monetary policy: ultra-short rates. It would not take long for market participants to test the Fed's credibility at the long end as well. The Fed would then find itself in the unpleasant situation of having to simultaneously counter falling interest rates at the short end and rising interest rates at the long end. Second, negative interest rates could put pressure on money market funds. With nearly USD4trn of assets under management, US money market funds are a main pillar of the US money market, and the stability of the global financial system depends on the smooth functioning of the US money and repo market. Many depositors use them like bank accounts as their NAV normally trades constantly at USD1. If this value is undershot (breaking the buck) due to too low (negative) interest income, distortions could quickly occur that would spill over into the entire financial system (see the 2008 Great Financial Crisis).

Figure 3 – Ultra short US money market rates sliding downwards (in %)

A new “Operation Twist” would be a smart solution. We are therefore convinced that the Fed is likely to support money market rates if the downtrend continues. What might such an intervention look like? Raising the IOER (interest on excess reserves) or the overnight repo rate would be an appropriate tool. Raising the IOER from the current 10bp to 15-20bp could already significantly reduce the downward pressure.

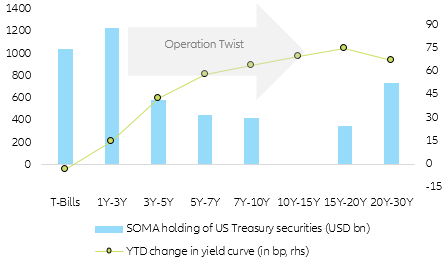

Figure 4 – Twisting the Fed’s US Treasury holdings

To counter the decline in collateral (T-bills) the Fed could simultaneously intensify reverse repo operations. However, the net effect of these two measures would be to take liquidity out of the system. A renewal of “Operation Twist” (simultaneous purchase of long-term and sale of short-term securities) could also do the trick. In doing this, the Fed would actually kill two birds with one stone: prevent negative interest rates at the short end and counteract an excessive steepening trend at the long end. Many investors could be caught on the wrong foot by such a twist.

To anticipate the Fed's next move, watch the short end of the curve. But in any case, with the interaction of expansive fiscal policy and loose monetary policy, we will have to live with opposing trends at both ends of the curve. A curve stretched in this way is more susceptible to volatility and we already see early signs that this is temporarily affecting the liquidity of US Treasuries. If tensions build up here and increase the risk of market accidents, the Fed will definitely intervene more strongly again. If you want to find the trigger, you should keep a watchful eye on the short end.