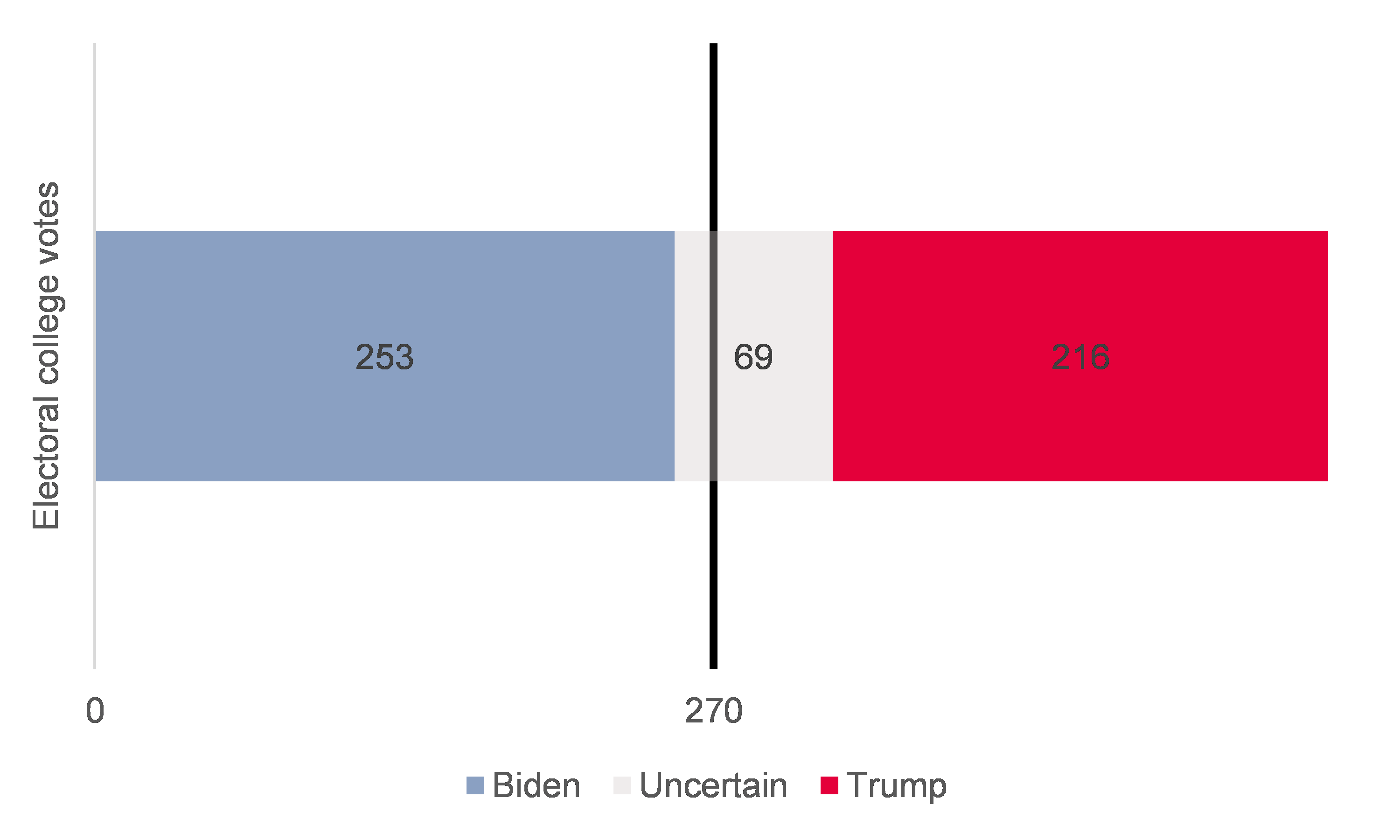

The political situation in the U.S. could be frozen until January 2021, even as government intervention is urgently needed to smooth the economic impact of a second Covid-19 wave. As of 06 November, Joe Biden appears to have the higher chance of becoming the next U.S. President (264 potential electors (without Arizona not being confirmed yet we are at 253) against 214 for Donald Trump), with the Senate possibly remaining in the hands of the Republicans. Five states have yet to provide clear projections: Georgia, Pennsylvania, Arizona, Nevada, and North Carolina. If Biden can hold on to his lead in Arizona and Nevada, or win at least two of the previously mentioned states, he will reach the 270 Electoral College vote threshold. However, without official results, a Trump victory remains possible. The Trump campaign has already requested recounts in several states and we expect Trump to use every possible means to contest the election results if they appear to be against him.

A judiciary battle could last until 08 December (deadline for re-counting and legal disputes, six days before the Electoral College meets on 14 December 4 to vote for President and Vice President) , potentially requiring the intervention of the Supreme Court.

Figure 1: Presidential election (06 November 2020)

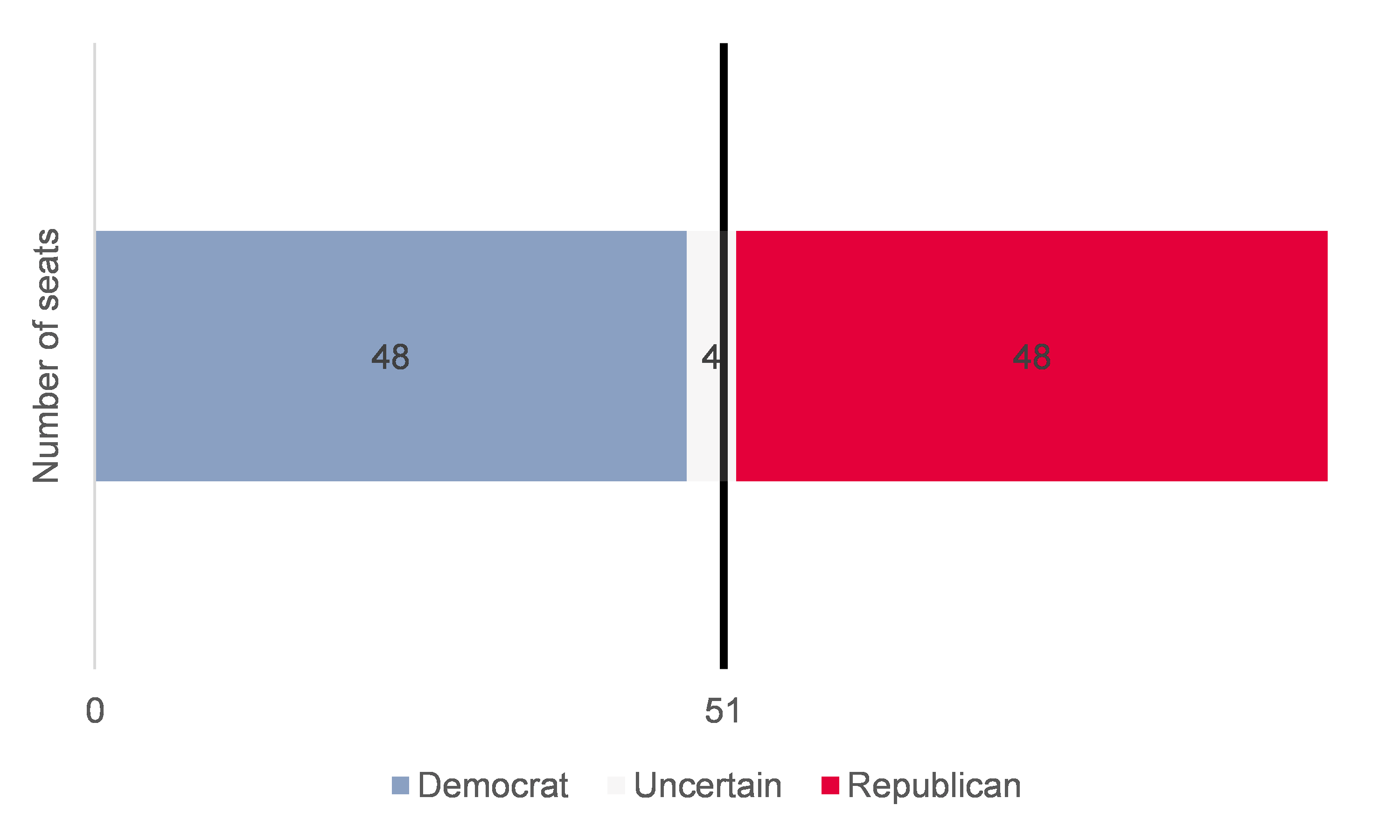

The outcome of the Senate elections remains unclear. Four seats in Alaska, Georgia, and North Carolina do not have a clear winner as ballot counts are still going on. Three of these seats are trending Republican and the last one will be decided on 05 January in a second round as none of the candidates reached the 50% threshold. As of now, we expect the Republicans to hold on to their majority.

Figure 2: Senate elections (06 November 2020)

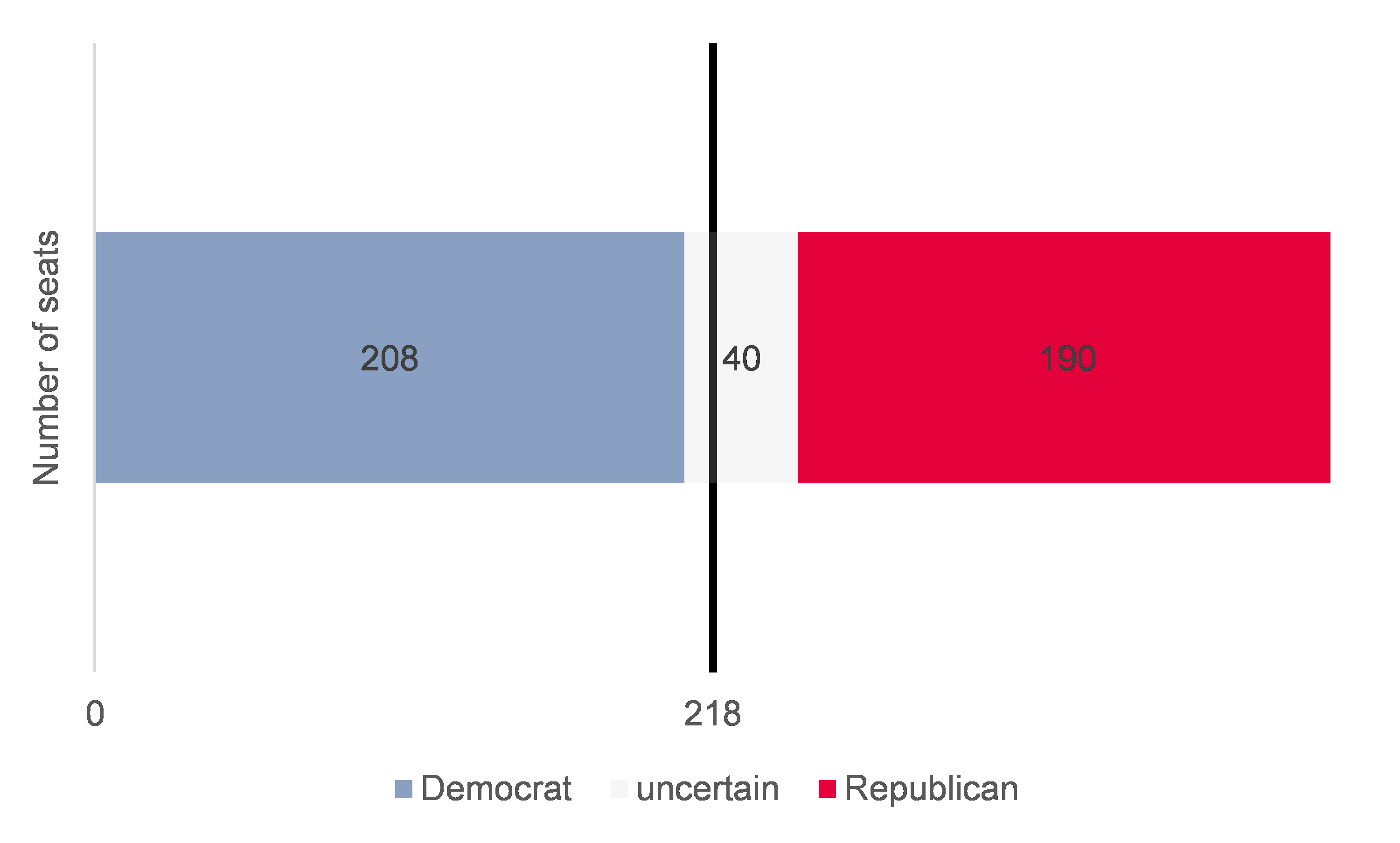

Even though several races are still undecided, we expect the Democrats to retain a slim majority in the House of Representatives. Of the remaining seats, 12 are trending Democrat and 25 Republican. If these trends become official, Democrats would hold on to their majority by only five seats.

Figure 3: House elections (06 November 2020)

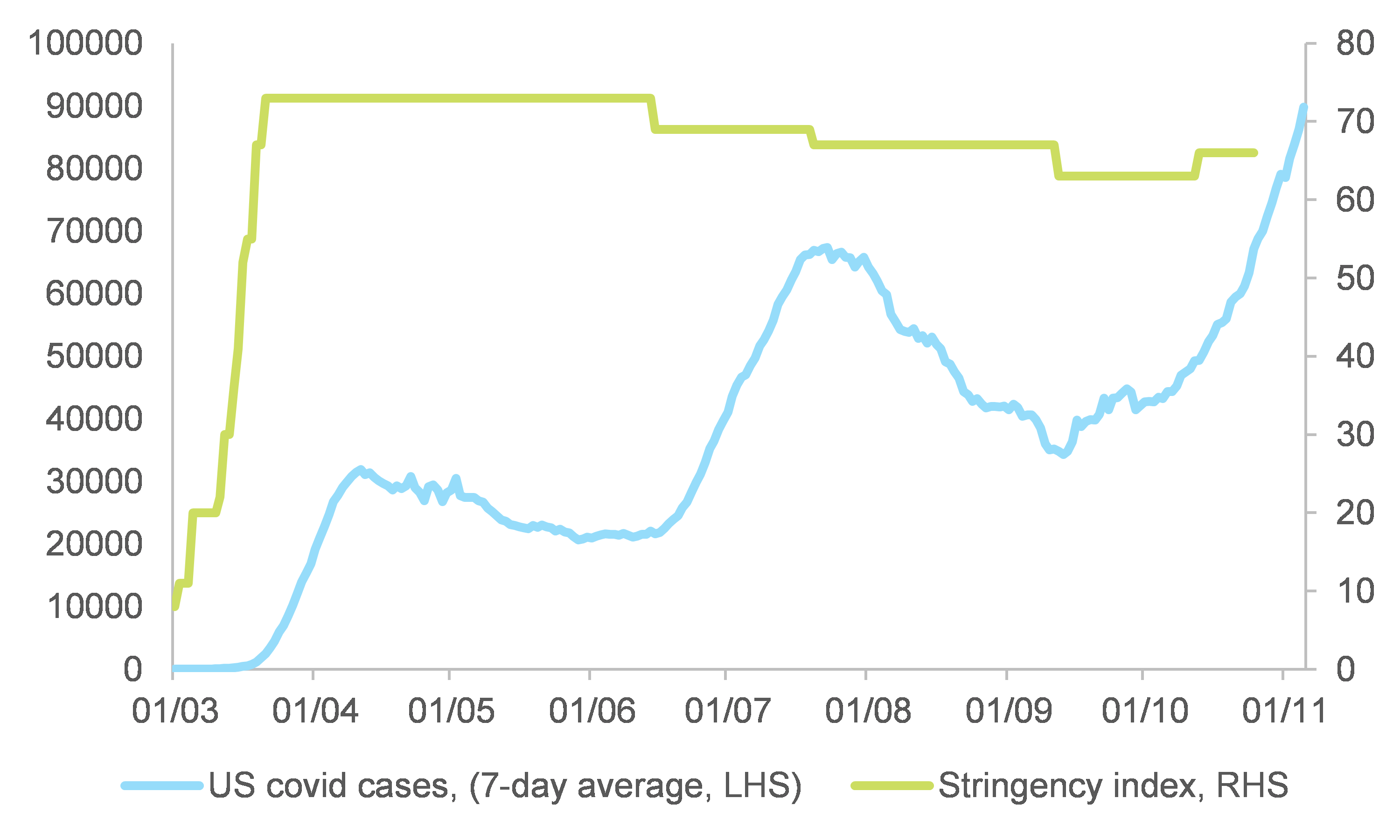

The persistent uncertainty comes amid surging Covid-19 infections in the U.S. We expect stringency measures to increase over the next six to eight weeks to slow down the spread, peaking in January 2021. The U.S. has averaged about 85,000 new cases per day over the past seven days, according to the Covid-19 tracking project data. This represents a 20% increase from the previous week and the highest caseload since the start of the pandemic. On 05 November alone, the number of new cases crossed the 100,000 threshold for the first time (116,225 cases). Over the past week, the number of cases increased in 35 states, in particular in Wisconsin, Michigan, and Pennsylvania, which remain close calls in the presidential race. They remained steady in 10 states and started dropping in five (Alabama, Louisiana, Vermont, Hawaii, and Tennessee). Our scenario projects an acceleration of the increasing trend, aggravated by the colder temperatures, with a peak expected in January or February 2021.

Figure 4: U.S. Covid-19 cases (7-days average) and stringency index

In this context, a delayed stimulus caused by the judiciary dispute and political fragmentation will drag the performance of U.S. GDP growth in Q4 2020 and Q1 2021. We expect the new phase of restrictions to result in 30% of the shock observed during Q2 2020. The most striking difference between Q4 2020 (second wave) and Q2 2020 (first wave) is related to social transfers, which were above USD2trn in Q2 2020 and allowed a swift rebound of growth in Q3 2020. This time, in the absence of an agreement in the Congress on a new fiscal stimulus, and because of the high uncertainty on the final validation of the Presidential election, we cannot expect a new stimulus before late January 2021. As a result, U.S. GDP growth is now expected at -8% q/q annualized in Q4 2020.

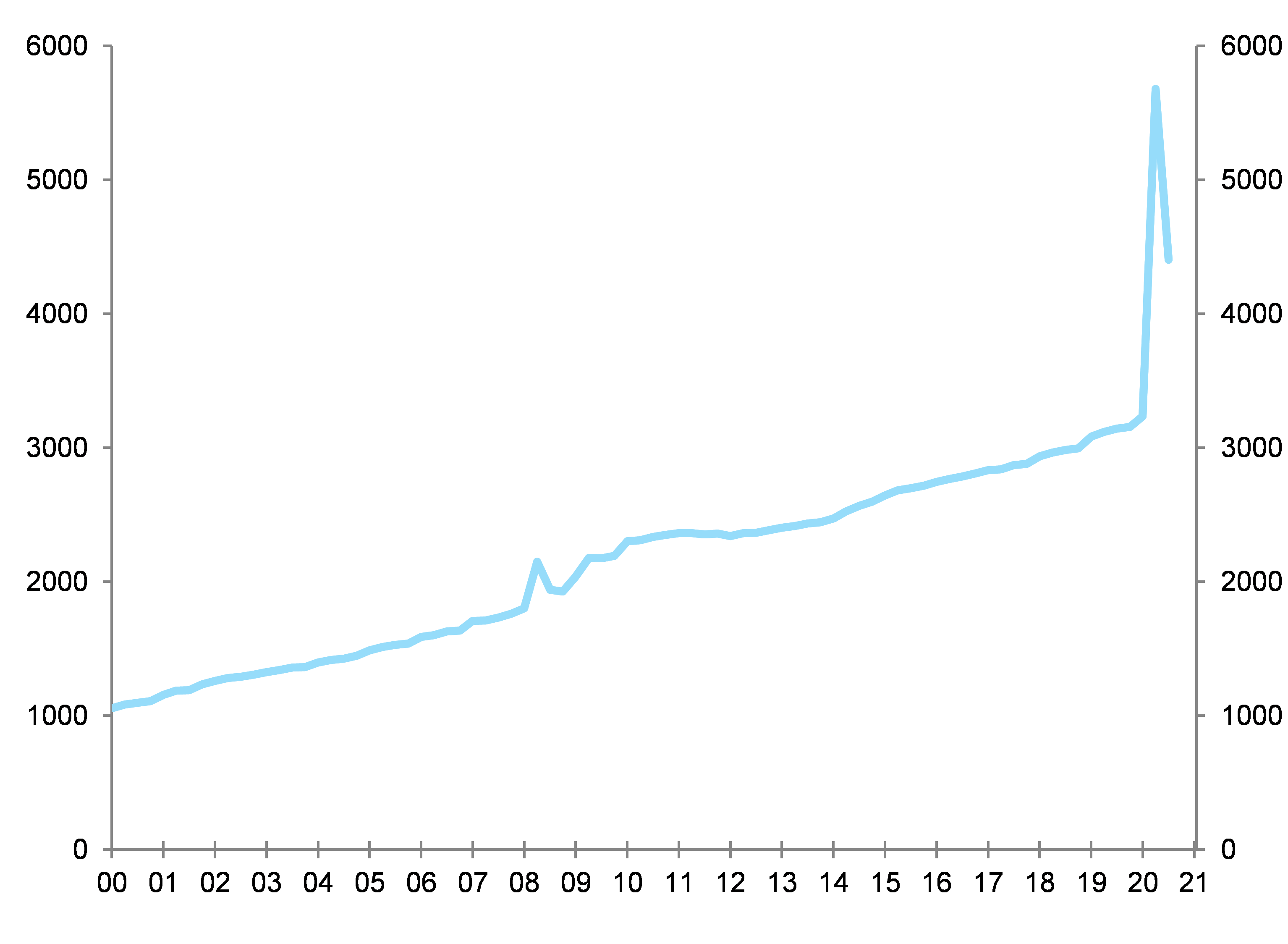

Figure 5: Personal current transfer receipts in the U.S., USD bn

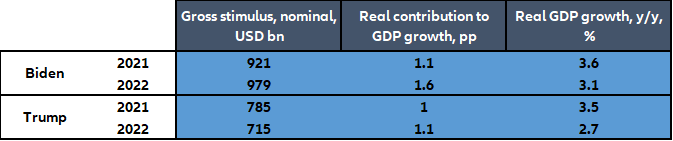

This delayed stimulus should take the form of a new round of income support in H1 2021, while infrastructure spending should prevail in H2 2021, no matter who wins the election, as urgency will prevail and ensure bipartisanship. Biden would advocate for a USD1.9trn package to be spent equally in 2020 and 2021. In the case of a second term for President Trump, we bet on a USD1.5trn fiscal package to be spent over two years, i.e. the lower range of amounts discussed during recent Congress negotiations.

Table 1: The economic impact of a stimulus in the U.S. under Biden v. Trump in 2021 and 2022, expected path of fiscal stimulus implementation

How will the Fed react? During the last FOMC on 05 November, the Fed stated that it was “committed to using its full range of tools to support the U.S. economy in this challenging time”. During the freezing of budgetary decisions until the beginning of next year, the U.S. central bank will be on its own in dealing with the negative shock in Q4 2020 and the beginning of Q1 2021. We expect the Fed to re-accelerate the pace of securities purchases before year end, switching from a monthly pace of USD120bn to USD180bn from December until Q2 2021.

What does this mean for the market? In the run-up to election day, taking their lead from polls that predicted a blue wave sweeping both the U.S. Presidency and the Senate, capital markets had bet on a swift and full implementation of Biden’s economic program (tax increases, regulation, energy transition, infrastructure spending). Accordingly, nominal yields on long-dated U.S. Treasuries had risen by about 25 bp; the Big Tech stocks had fallen by some 10-15% and energy stocks by 20%; implied volatility had risen, as is usually the case when stock markets fall, but gold, a more reliable proxy for uncertainty, had fallen, and the dollar had strengthened by 2% against the euro. In short, markets were not pricing in a lot of uncertainty.

Two days after Election day, even if Biden is likely to become the next U.S. President, it is clear that the predicted blue wave has failed to materialize. Markets have wasted no time in partially unwinding the “reflation trade” they had embraced. On 04 November, nominal yields fell by about 10 bp; the Big Tech stocks, which account for almost a quarter of the S&P 500 market capitalization, rallied by more than 5%, but energy stocks by only 0.1%. The equally-weighted S&P rose by only 0.06%, against 2.2% for the S&P 500 and 4.4% for the tech-heavy NASDAQ 100. At the time of writing, the dollar has given back all of its recent gains and gold, up 2.6% on 05 November, had its best day since early August.

With a sense of déjà-vu, financial markets are now facing the grim prospect of a divided government during a national emergency. Even under stronger Presidential leadership, owing to the federal structure of the U.S., it will not be easy to design and implement a consistent and balanced nation-wide sanitary strategy against the Covid-19 outbreak. Neither will it be easy for a divided government to agree on how to use public expenditures to support the economy. Time is of the essence, but is likely to be wasted, at least until Inauguration Day.

Once again, by default, unconventional monetary policy will remain the only game in town, notwithstanding its well-known side effects or unintended consequences in terms of financial instability. This set up will be seen as a tried-and-tested opportunity by those market participants who trust their ability to time markets. Others will fret about storing and nurturing ever-increasing imbalances between the real economy and asset prices.

A modest steepening of the Treasury yield curves is to be expected, in line with the rapid increase in public deficit and debt ratios that will in any case happen. In a politically conflictual context, markets may fret about the possibility of reining in debt and putting it on a sustainable path. While being ready to expand QE further to offset these market worries, the Fed will be ready to indirectly subsidize commercial banks (which are currently rapidly expanding their holdings of government bonds) by tolerating some yield-curve steepening.

Secondly, even if an increase in the corporate tax rate is less to be feared than in a blue wave scenario, the overvaluation of U.S. equities remains a source of concern as it provides little cushion against adverse outcomes. In the U.S., according to IBES, the operating earnings long-term growth consensus forecast currently stands at +16% for the MSCI USA. For the S&P 500, EPS growth is forecasted to reach +24.5% in 2021 and +16.8% in 2022 by the consensus, following -17.4% in 2020. As correlations between equity markets usually jump to high levels when U.S. equities struggle, the overvaluation of U.S. equities is a sword of Damocles over global equities.

The outcome of the elections will have more impact on performance within the equity market than on the market as a whole, as shown by recent gyrations in the relative performances of sectors (green new deal sectors versus energy, technology and financials).

The overvaluation of U.S. equities is also a downside risk to the USD: having taken part in the U.S. equity rally and by the same token supported the greenback, foreign capital will take part in the correction of both.

Thirdly, our worries regarding the corporate bonds segments have increased, notably for the high-yield segment as it is not part of the Fed’s classic job description to lend to insolvent non-financial businesses. Corporate bonds have attracted a lot of fresh capital since March in the wake of the Fed’s policy announcements in favor of investment grade bonds and fallen angels. It would be a mistake to assume that the Fed can backstop any kind of corporate bonds, regardless of their creditworthiness. The U.S Treasury will have to do that job, hopefully but not necessarily in a timely manner. Spreads at the lower end of the credit spectrum will therefore widen.