EXECUTIVE SUMMARY

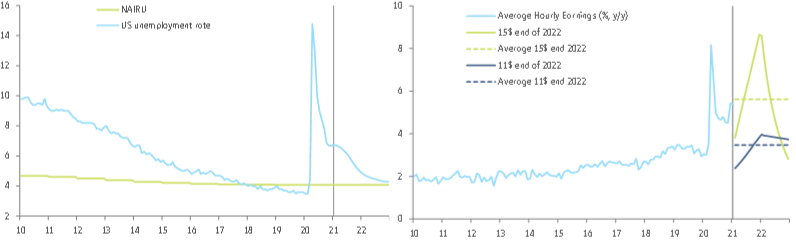

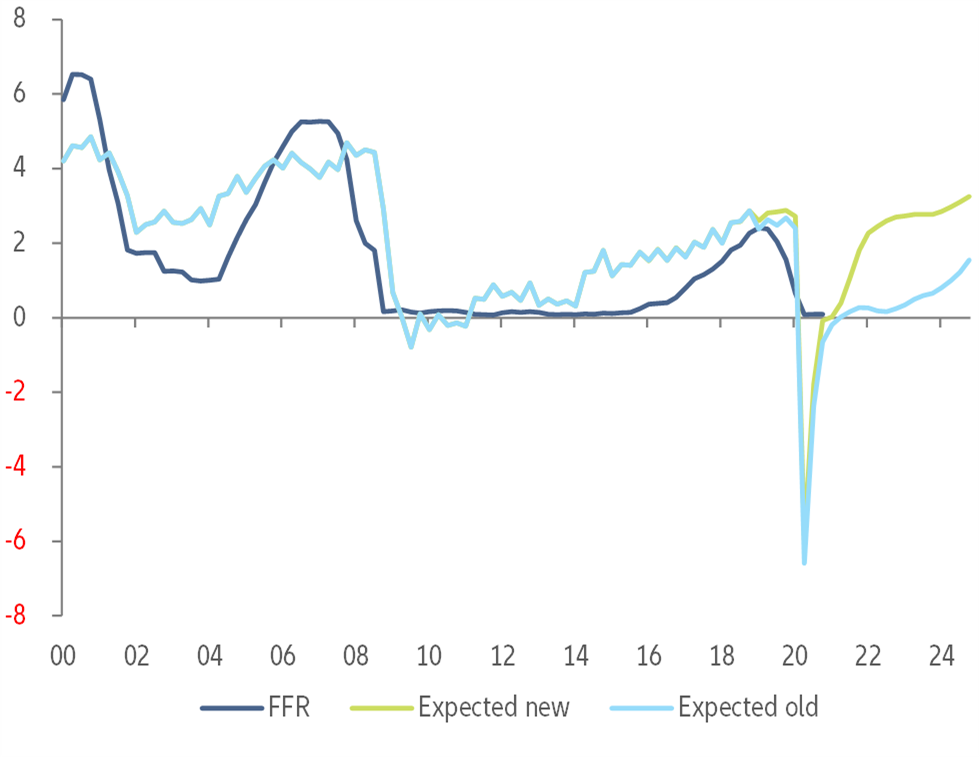

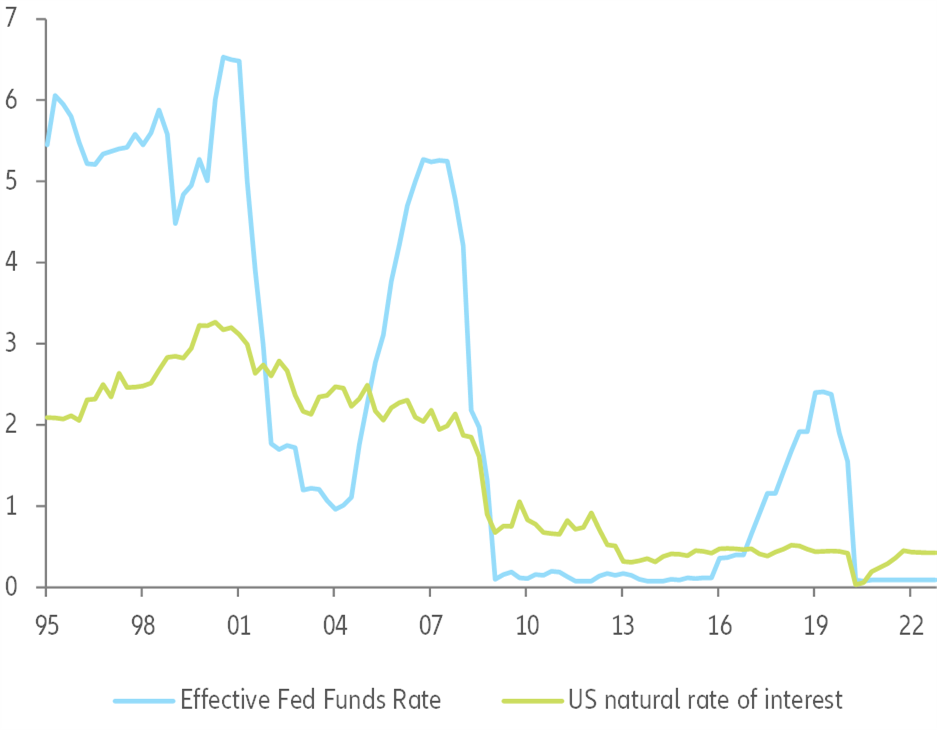

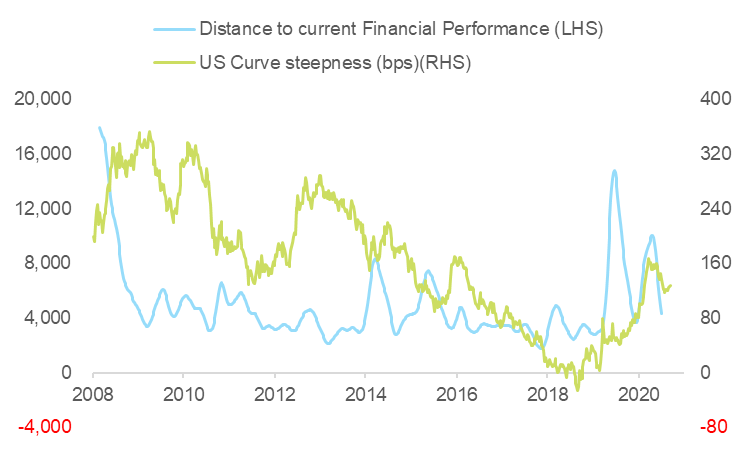

- The Fed will start to normalize its monetary policy rather sooner than later. With the recent USD1.9trn fiscal stimulus package and a new USD2.3trn infrastructure program (our estimate of what could represent the amount of the Build Back Better program), US GDP growth is likely to reach +6.1% in 2021 and +4.1% in 2022. As a consequence, tightening labor market conditions along with higher commodity prices should also lift consumer price inflation to 4.1% in 2021 and 2.2% in 2022. We now believe that the US Fed will consider tapering its bond purchases starting in December 2021, after an announcement in November, and increasing the Fed Funds Target rate mid-2023. Because monetary tightening in the US will certainly generate financial pressures worldwide, we think that the Fed will communicate on its future moves better than it did in 2013, when its announcements surprised markets and caused a taper tantrum. Nevertheless, our pattern recognition model confirms that the risk of Emerging Markets facing another taper tantrum cannot be entirely ruled out.

- Emerging Market initial conditions are more favorable than in 2013, with exceptions. Current account deficits are lower today, credit growth is at more sustainable levels and we expect inflation to remain under control, by and large. EM currencies are likely to remain volatile but we do not forecast a broad-based repeat of the substantial depreciations experienced in 2013-2014, also because real effective exchange rates are currently less strained as currencies already took large hits in 2020. Moreover, monetary policy is currently ultra-loose in many EMs and it should remain accommodative overall in the near future even though a moderate tightening has begun in several countries where inflation exceeds the central banks’ target ranges. Increases in inflation expectations could put pressure on central banks as the need to adapt monetary policy clashes with the need to support the Covid-19 recovery.

- However, external financing requirements and the steady rise in sovereign debt reveal some weak spots. In six countries, the external debt payments falling due in the next 12 months significantly exceed the level of official foreign exchange reserves (Turkey, Argentina, Ukraine, South Africa, Romania, Chile). Moreover, the steady rise in sovereign debt over the past decade poses a significant risk, in particular for those EMs where the share of non-residents’ holdings of public debt has increased over the last seven years.

- Overall we identify seven EMs particularly vulnerable to the eventual Fed tapering, especially if it is not well communicated, the TUCKANS: Turkey, Ukraine, Chile, Kenya, Argentina, Nigeria, South Africa. A stabilization of the money flows after a complicated 2020 would be crucial, but a pattern of relatively steady inflows into EMs is not yet visible, at least not in a generalized way.

- EMs, in particular some of the TUCKANS, have already experienced increases in the yields of their local currency bonds. This was something to expect considering the rate hikes and the inflation expectations, but if the trend continues it could pose severe threats to debt sustainability, which was already an issue for some of the countries before. At the same time, the movements in the hard currency environment have been larger in Latin America and some of the TUCKANS, which reinforces our assessment of the countries at risk.