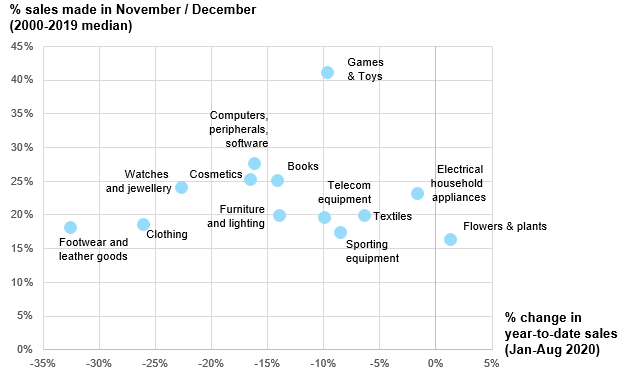

Restrictions on non-essential stores in France ahead of a critical Christmas season are casting a shadow over nearly EUR18bn of retail sales that are normally made in those stores in November and December (Figure 1):

- First, retail data show that the strong demand from June through September was not enough to fully compensate for the eight-week lockdown from the end of March to mid-May: year-to-date sales were still, on average, 10% below their 2019 levels, with strong disparities between segments. While French consumers showed strong interest for home equipment and improvement goods (appliances, gardening, do-it-yourself, interior textiles), as well as leisure and cultural goods to a lesser extent, spending on personal goods (clothing, cosmetics, jewelry, etc.) has remained durably depressed. In other words, the second Covid-19 wave is rubbing salt on wounds that are still very fresh.

- Second, the weeks prior to Christmas are amongst the most important in terms of turnover across a vast majority of segments. Looking at historical unadjusted retail sales, we observe that November and December can account for more than 40% of yearly sales for toy stores and more than 25% for IT hardware, cosmetics, books or jewelry retailers.

However, in our view, the second lockdown could have a somewhat softer impact on demand than the first one, which saw turnover collapse by 78% on average in April: First, retail chains and independent stores are better prepared now than they were in spring, particularly regarding the adoption of digital distribution channels, whether using delivery or click-and-collect options. A survey from the French e-commerce trade association revealed that 71% of online buyers are buying from retailers with physical stores. Second, consumer savings have swollen to unprecedented levels as lasting restrictions on travel, restaurants, cultural activities etc. have freed up purchasing power for French households – as evidenced by generally strong demand across most segments seen since June.

What does this mean for companies? Should stores be allowed to reopen at the beginning of December, the most obvious and immediate impact on the industry would be a net negative impact on turnover. In a base case where retail sales in segments facing restrictions contract by 60% in November, retailers would lose an aggregate EUR4.4bn in turnover – all else unchanged, the equivalent of a -510bp hit to annual turnover growth. As discussed previously, dispersion between segments is high and the average may not be telling of the situation at a product market level. Traditional Christmas gifts (books, cosmetics, consumer electronics, toys etc.) would most likely see a softer impact. In a particularly adverse yet realistic scenario where the sanitary situation demands store closures to last until the end of December, the magnitude of the impact could hardly be understated. A two-month closure would amount to EUR10.8bn in lost sales, or the equivalent of a -1200bp hit to 2020 annual turnover growth.

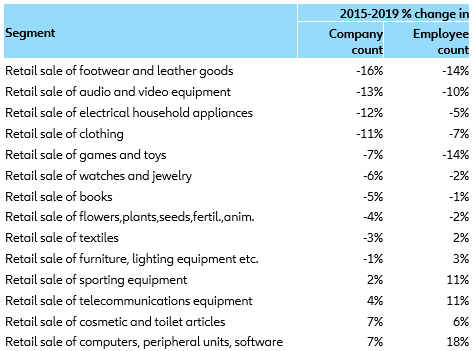

The most remote but dramatic impact will be on retail insolvencies in a country where shops structurally account for 20-25% of the total across sectors, and where the various support measures to businesses have sent retail insolvencies down -28% over the past twelve months . The exact impact and timing of the insolvency wave is too early to tell and dependent on future support policies, but there is little doubt that the ongoing crisis will accelerate the consolidation trend that has been at play in the past years. In segments with the fiercest competition, more than one in ten retailers have disappeared in less than five years (Figure 2).

Figure 1 – Retail sales by segment, change in year-to-date sales (%, horizontal scale); share of end-year sales in annual sales (%, vertical scale)