Don't put all your eggs in one basket! Proverbial as it is, this piece of wisdom suggests that one has recognized the possibility of mitigating risks by means of diversification long before Markowitz gave it a key role in investment portfolio construction. Fine, but is it easy to genuinely diversify a portfolio in today’s capital markets? Markowitz has indeed highlighted that it is not the mere number of asset classes or securities in a portfolio that provides diversification, but the fact that those assets should at least and on average not all move in the same direction at the same time. The present investigation will show that genuine diversification has become harder to achieve in the wake of the Great Financial Crisis as quantitative easing (QE) has become the “new normal”. By triggering a fresh, global and pronounced round of QE, the Covid-19 crisis has struck another heavy blow to diversification.

To provide diversification, the components of a portfolio should at least not be positively correlated. To provide diversification, the components of a portfolio should at least not be positively correlated. Preferably, like the shares of high street retailers and online distributors, they should ideally even move in opposite directions, because what is good for one component – like a recession and deflation for fixed-income securities - should be bad for the other – like equities. In short, efficient diversification requires negatively correlated assets.

One simple way of measuring patterns in the co-movements of asset prices is to create a portfolio in which selected representative asset classes are equally-weighted. In our investigation:

• The five equity market indices of interest are the MSCI indices USA, Europe ex-UK, UK, Japan and EMs.

• The five bond market indices of interest are the FTSE US Government 7-10 year, the ICE BofA Euro government 7-10 year, the JPM EMBI+ total return index, the ICE BofA US cash pay high yield and the Bloomberg Barclays Asset-Backed securities USD.

• The S&P GSCI commodity spot price represents commodities.

• The twelfth asset class of interest is gold.

All returns are total returns measured in USD. The variance of this equally-weighted portfolio is the sum of two terms:

• The sum of the respective variances of the 12 component asset classes, which measures the idiosyncratic risk of our equally-weighted portfolio.

• The sum of the 66 covariances between the 12 asset classes, which measures the systematic risk.

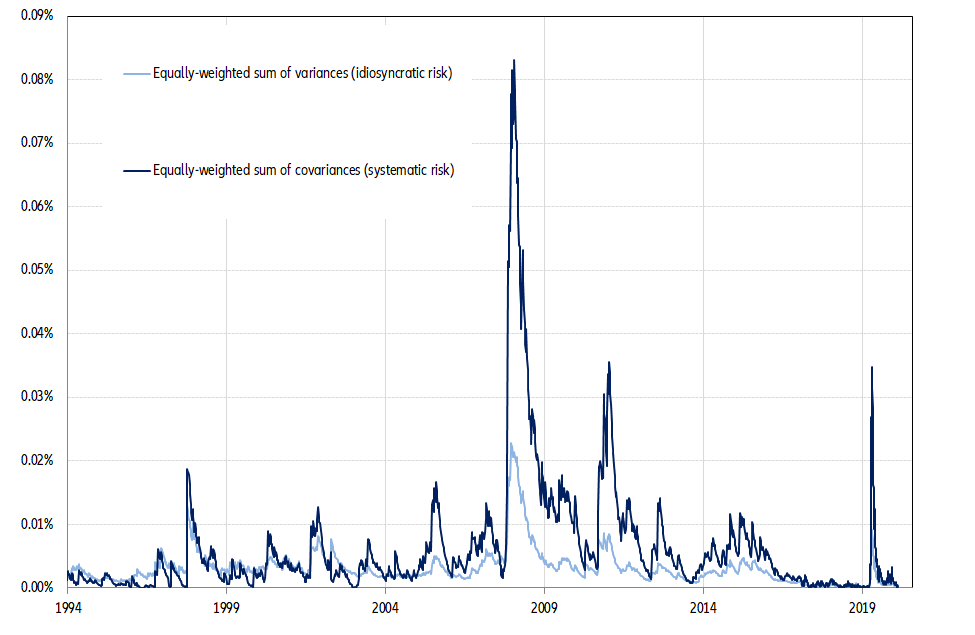

Figure 1 – Idiosyncratic and systematic risks of an equally-weighted portfolio

Figure 1 shows the behavior of these two sources of risk from 1994 to the present day, the variances and covariances being estimated by means of an exponentially-weighted average with a characteristic duration of ten days. Figure 1 reveals a few salient features of systematic risk:

• it is on average higher than idiosyncratic risk,

• it is volatile

• and, most importantly, it tends to increase when idiosyncratic risk increases, i.e. when volatility rises.

In other words, systematic risk is far from being a second-order or negligible source of risk.

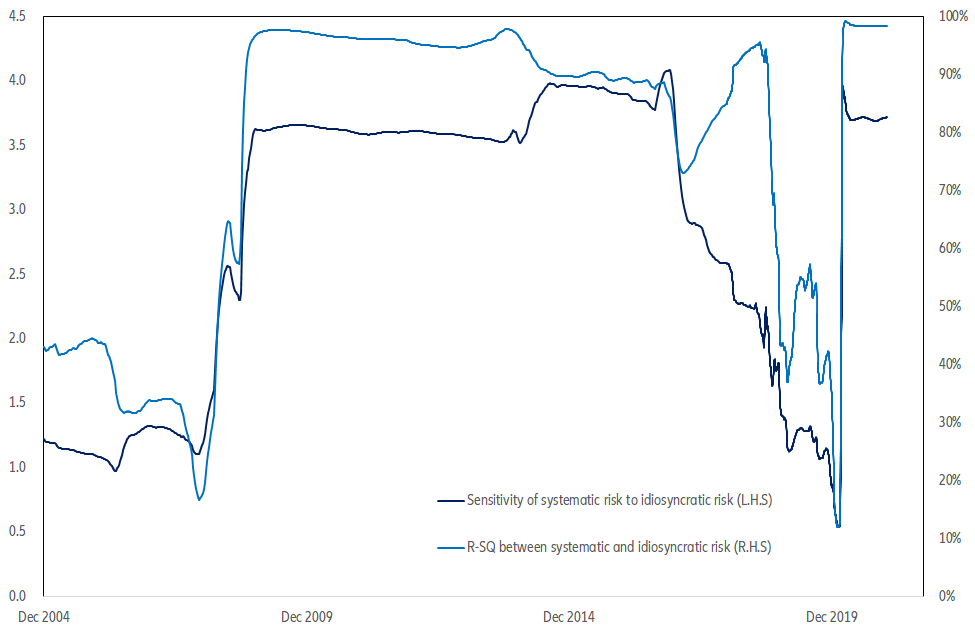

Figure 2 provides a more telling picture of the interaction through time between idiosyncratic risk and systematic risk. The dark blue line shows the intensity of their relationship (the slope of a linear regression of systematic risk on idiosyncratic risk) computed over a five-year moving window. Its final value (3.7) means that on average over the last five years, systematic risk has multiplied idiosyncratic risk by almost four. The light blue line shows the predictability of their relationship as measured by their correlation coefficient computed over the same five-year moving window.

These two lines exhibit two big jumps: the first one in 2008, especially in the last quarter of that year, the second one in 2020 at the beginning of the Covid-19 crisis. In both cases, the intensity of the relationship between systematic and idiosyncratic risk has risen from about 1 to 3.5, while its

R-squared jumped from about 15% to 95%. After the 2008 jump, both indicators stayed on a plateau until 2016-2018. After the 2020 jump, they seem to hold at a new plateau. Put differently, after the Covid-19 crisis, like after the Great Financial Crisis, there is much less room for efficient diversification.

Figure 2 – Systematic risk and idiosyncratic risk: sensitivity and correlation from 2004 to date

Another way to illustrate this phenomenon is to look at the tails of the joint distributions of any couple of asset classes. For example, from 1994 to September 2008, when the S&P 500 return was in its lowest decile (the 10% lowest returns), there was a 68% chance to find the MSCI EMU in a similar position. From September 2008 onwards, this probability has risen to 90%. As for the 10th decile (the 10% highest return), there was a 40% chance of finding the MSCI EMU also in the same decile; this probability has risen to 55% after September 2008. These observations about the joint distributions of returns are not isolated ones, but for the sake of brevity, let’s now turn to interpreting what we have found.

The academic literature identifies two potential causes of asset price co-movements: first, correlated news processes linked to monetary policy and fiscal policy; second, correlated trading and positions in response to the order flow.3 The first factor refers to the fact that the same news can simultaneously be relevant to several asset classes, if not all. The second one refers to the fact that the order flow transforms private information into public information.

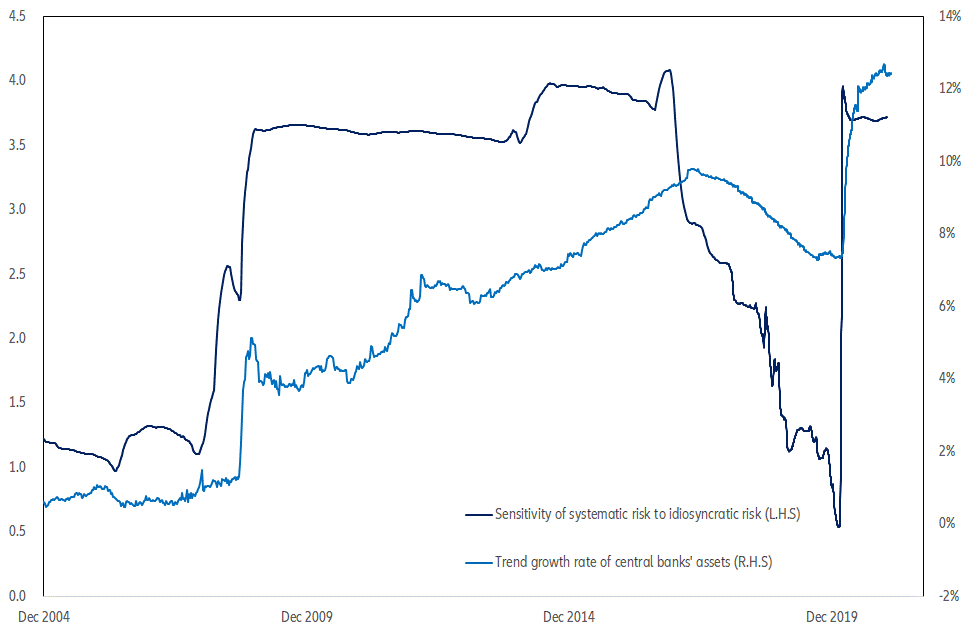

The Federal Reserve was the first central bank to introduce QE in 2008. Other major central banks quickly followed (the UK in 2009, Japan in 2013, the EMU in 2014). Throughout successive rounds of QE, central banks have broadened the universe of eligible assets from sovereign to corporate bonds (including fallen angels in the US) and asset-backed securities or even equities (in Japan). None of this is an irrefutable proof that QE has “killed” diversification, but makes it a rather plausible suspect, as shown in Figure 3. As in Figure 2, the dark blue line shows the intensity of the relationship between systematic risk and idiosyncratic risk. The light blue line now shows the trend growth rate of the aggregated assets of the Federal Reserve, the European Central Bank and the Bank of Japan. Figure 3 speaks for itself. The sharp accelerations in QE in 2008 and 2020 have coincided with jumps in the sensitivity of systematic risk to idiosyncratic risk (i.e. a decline in diversification opportunities). Conversely, the slowdown in QE between mid-2017 and the end of 2019 produced the opposite effect. The impact of QE is most likely to be both direct and indirect.

Figure 3 – QE and the behavior of systematic risk with respect to idiosyncratic risk

Direct, because central banks have dramatically increased their presence in several market segments. Indirect, because their words and deeds have fostered moral hazard and risk-taking by private agents in all kinds of assets, listed or alternatives. This being said, other factors – like passive investing - may have also caused systematic risk to increase

In other words, there has been some correlated trading and positions. Paradoxically, containing idiosyncratic risks may have had the unintended consequence (and cost) of increasing the headroom for systematic risk. Looking forward, it is, for example, hard to see how bonds, with nominal interest rates already close to or below zero, could provide future diversification benefits.

Containing financial instability has never been an easy job; it is not getting any easier.