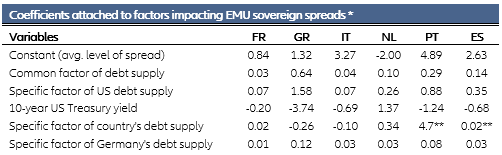

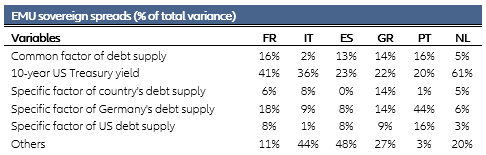

In response to the Covid-19 shock, global public debt will hit an all-time high of 130% of GDP or USD277trn in 2020, exceeding even the levels seen during the Second World War. This won’t be without consequences for debt sustainability, particularly for the most fragile economies in the European periphery. Today’s conventional wisdom tells us that governments benefit from a quasi-infinite capacity to issue debt when facing a systemic shock, especially with the support of central banks resolutely engaged in unconventional monetary policy. Accordingly, the Covid-19 crisis has sparked a strong and globally synchronized increase in public debt, particularly in advanced economies, to smooth the negative impact of lockdowns (see Figure 1). At the same time, central banks have pursued unconventional monetary policies, mainly involving government bonds purchases, with their balance sheets converging above 50% of GDP at the end of 2020. This is simultaneously allowing a quasi-direct financing of world public debt.

Figure 1 - Historic overview on public debt and long-term rates

Figure 1 - Historic overview on public debt and long-term rates