To boost growth after the Covid-19 fallout, Germany and France have introduced large stimulus packages, which, in terms of magnitude, are playing in the same league (4.3% of 2019 GDP in France vs. 3.8% in Germany). Digging below the surface, however, unveils deeply diverging approaches to boost the recovery. In particular, the two economies appear to have taken cues from each other’s economic rule books, with France focusing above all on supply side support (see Appendix for details) while German fiscal policy has taken a textbook Keynesian spin.

Betting the house on the consumer in Germany.

- In Germany, the consumer is at the heart of fiscal stimulus efforts: Around 25% of Germany’s fiscal “Wumms” - i.e. the EUR130bn stimulus package put forward in early June - directly benefits households. The vast majority of these measures are frontloaded in the hope that this will boost consumer confidence and in turn unlock excess household savings at a crucial stage of the economy’s recovery. The bet centers in particular on a temporary VAT tax cut worth EUR20bn in the second half of 2020. But Germany’s newfound consumer love does not end there. While not included in the Konjunkturpaket, additional measures aimed at propping up employment and income, namely easier access to Kurzarbeit, the top-up to income replacement rates as well as the recent extension of the scheme’s duration, all of which together will cost a cool EUR35bn, should not be ommited in this calculation.

- Meanwhile, in France the consumer is getting very little direct support: In its stimulus plan, the French government allocates EUR800 million for direct transfers to students and those with low incomes.The French authorities rule out potential VAT cuts with the rationale that the current VAT rates in France are already below the European average. Yet, when we compare the two countries, this argument hardly holds: the standard VAT rate is at 19% in Germany versus 20% in France. Regarding the reduced VAT rate, it stands at 5.5% and 10% in France (depending on the type of goods) versus 7% in Germany. Overall, the French government seems to have made the strategic choice of favouring targeted transfers to the poorest rather than cutting indirect taxes. After all, disposable incomes in France have so far proved relatively resilient in the crisis (with only a -2.3% q/q decline in Q2), thanks to generous partial unemployment subsidies (EUR31bn) and solidarity fund transfers (EUR7bn).

In a nutshell, private consumption in France is set for a mechanical rebound, with households being expected to deploy the accumulated EUR100bn (4% GDP) of excess savings in the first half of the year, which coincidentally is roughly equivalent to the French stimulus program . - …beyond a focus on curbing unemployment: The French government estimates that the Covid-19 economic shock will cost around 800,000 jobs by end-2020. However, already in Q2 total job losses (in the private and the public sector combined) exceeded 700,000 while the full partial unemployment scheme was in place. Therefore, by end 2020, we expect total job losses to soar further to nearly 1 million. The government stimulus plan may fall short in addressing the short-term needs as it entails various labor-market measures in an effort to create 160,000 jobs in 2021. The “employment” pillar of the package allocates EUR15.3bn for job protection, vocational training, apprenticeships and hiring subsidies, which require strong adminisrative capabilities to be immediately put into execution. In addition, France is maintaining its furlough scheme for two years under part-time subsidies in sectors severely affected by social distancing requirements such as tourism and art. This means some “zombie” jobs will be maintained for a longer period in France. For other sectors, the partial unemployment scheme will be phased out as of March 2020. We find that the “skill creation” item of the plan is likely to fall short of ensuring a quick reallocation of the jobless between sectors and companies. In view of the existing skill shortcomings and structural rigidities of the French labour market, we expect the unemployment rate to soar up to 12.5% in 2021.

Supply-side measures are at the heart of the French stiumulus.

- Germany’s fiscal stimulus does not include much supply-side love. Beyond the financial “bridge support” extended to corporates in the most impacted sectors including hotels, restaurants, bars and clubs for the months of June-August (up to EUR25bn), measures that benefit the corporate sector are hard to find. In addition to the cap on the renewable energy surcharge (EEG surcharge), the Konjunkturpaket only includes some limited tax relief and investment incentives, as well as a cap on social security contributions for 2020 for a grand total of EUR13bn (only 10% of the EUR130bn package). Here we see the key shortcoming of the German stimulus package: An opportunity was missed to ease the bureaucratic and fiscal burden for German corporates with a view to boosting investment and job creation. In the short-term, the fiscal stimulus will help provide some “Wumms” to the recovery, but this blatant neglect of the supply side will only allow for a very short-lived impact. Beyond 2022, we don’t see any impact on German GDP growth from this package that is worth mentioning.

- Last but not least, Germany is finally promising to invest more with its EUR50bn Zukunftspaket. This comes with a focus on health, climate, digital and e-mobility and is coupled with measures to allow for a swift investment, including cutting bureaucracy, fast-tracking projects as well as a simplification of the public procurement law. While we welcome a meaningful investment initiative aimed at modernizing the economy, especially as it is accompanied by measures to speed up implementation, we remain concerned about bottlenecks. Moreover, the Zukunftspaket can hardly cover the investment needs of the German economy. Assuming that it is fully implemented, we expect medium-term GDP growth to be lifted by 0.1ppts at the most.

- France’s recovery strategy relies essentially on boosting investment rather than stimulating demand, thus the French stimulus package is more ambitious when it comes to dealing with the long-lasting supply-side issues. Under the guise of stimulus to boost competitiveness innovation, the French government aims at pursuing a long-delayed structural reform agenda. France’s stimulus package seeks to enhance competitiveness and points at a new strategic direction for the industrial sector over the medium term. The centrepiece of the French stimulus is a EUR20bn production tax cut for French companies over two years. At 9.7% of total value-added, more than double of Germany (4% of value added), this has been hurting the competitiveness of French companies. A EUR10bn reduction in the production tax is expected to increase the net profits of French companies by EUR12.6bn in relation to positive relocalization spillovers. In addition, social charges and record high a corporate tax rate impede profitability of French firms. With the clear purpose of fostering a “made in France” strategy, the government has also maintained its intention of reducing the corporate tax rate to 25% by 2022. The plan also allocates EUR1bn for the “reshoring” of businesses in strategic sectors such as pharmaceuticals and IT.

Who goes greener? Different spending allocations to serve similar ecological goals.

- In a superficial upfront comparison of the stimulus programs, the relative total ambitions and components are similar. In both packages, the share of stimulus measures that can be considered as green amounts to 30%. The German green stimulus is bigger in absolute terms, but the French is slightly larger in relation to GDP. In both packages, the flow of the expected green funds will only materialize over the coming years.

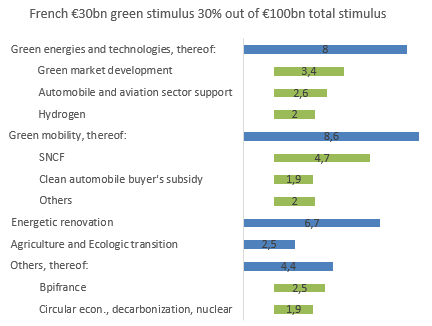

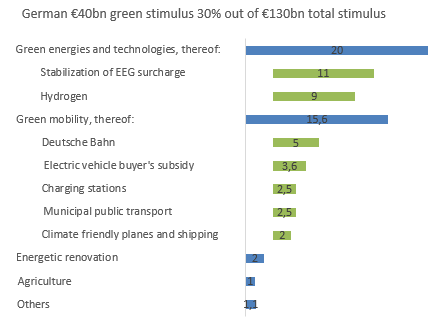

- The funds in the French package, as shown in Figure 1, are fairly balanced between the three categories green mobility, green energy and technologies and renovation of buildings, which make up 78% of the total package. The German stimulus shown in Figure 2 is more focused. Half of the funds are reserved for green energies and technologies. In particular, the funding of a hydrogen economy with EUR9bn considerably larger than the EUR2bn in the French stimulus. At EUR11bn, the green energy support is the single largest part of the German green stimulus. As it is framed in the form of a stabilization of the EEG (Renewable Energy Sources Act) surcharge, it is debatable if it should be included as being green . The French green stimulus lists EUR2.6bn for innovation support for the automobile and aviation industries under the green technology section. It is not clear how far this engagement should be considered green, especially since the description of the measure rather relates to competitiveness issues. A comparable EUR2bn support measure for the German automobile industry has been excluded from the German green stimulus category.

- Another 39% of the German green stimulus is reserved for greening transport and mobility. Interestingly, the EUR5bn equity injection for the German railway Deutsche Bahn is in the same ballpark as the EUR4.7bn support for the French railway SNCF. The German plan is more explicit in the distribution of funds to charging station infrastructure (EUR2.5bn) and electric vehicle buyer’s subsidies (EUR3.6bn), while the French EUR1.9bn is labelled as a clean vehicle buyer’s subsidy, including an unspecified share for extending the charging station network. While the French plan mentions electric and hydrogen vehicles explicitly, it is also open to clean combustion engine cars. It also states a partial conditioning of the bonus on scrapping old vehicles. Past experiences suggest that conditional scrapping is, at least, a questionable policy.

- At EUR2bn, the German funds for green renovation are considerably smaller than the French EUR6.7bn. This seems surprising as energy efficiency gains in buildings are one of the main obstacles for the German energy transition. Still, the utilization and impact of these funds is questionable as the already existing energy renovation programs are unlikely to be fully exploited. Agriculture, forestry and fishing receive only limited attention in the French green stimulus and very limited consideration in the German one. While the French EUR2.5bn includes support on biodiversity, the fight against artificialization, and the ecologic transition of agriculture, forests and fishing, the German EUR1bn only focus on climate resilient forests and improving conditions in animal stables.

Figure 1: Composition of the French green stimulus share