Executive summary

• The Covid-19 pandemic cost the European accommodation industry EUR115bn in lost turnover in 2020 following stringent restrictions on leisure and business travel. A stronger summer season helped France and Germany see annual turnover slide by “only” -43% and -44% compared to -53%, -61% and -64% for the UK, Italy and Spain, respectively.

• The recovery will be patchy and only partial in 2021 because of a terrible first quarter, but activity will materially improve as most markets should see their population reach herd immunity in the second half of the year. Much like in Q3 2020, the progressive lifting of restrictions on both supply (reopening of hotels) and demand (greater freedom of movement) should allow demand to pick up significantly in the crucial summer season. 2021 turnover will bounce back by +28% in Europe, but still remain -39% below the 2019 highs, with France and Germany leading the pack again.

• A full-fledged recovery will take much longer to materialize and is unlikely to happen before 2024 at best, especially because markedly lower occupancy rates will also weigh on average room prices. Because of the different pace of economic recovery among countries and structural differences in local accommodation markets, it will also be felt very differently.

• Countries, regions, cities or hotels relying more on international and/or business guests will lag behind peers serving mostly local leisure guests. In addition, hotel companies with the highest capital intensity i.e. bearing the real estate debt burden (debt repayment and interest) are more at risk than those who switched to an asset-light model, focusing on hotel franchising or management instead. Hotels with asset-heavy business models may consider disposing of their real estate assets to shore up their balance sheets and lower their cost structures.

• While partial unemployment schemes have and will continue to provide relief to an industry where labor costs are the largest single expenditure item, we expect the tug-of-war to continue between hotel owners and hotel managers over past rent payments and the renegotiation of current leases. The deterioration of payment terms and outlook for the industry have already translated into significant asset write-downs for hospitality real estate assets.

• Looking ahead, weak demand will encourage hotel companies to innovate to find new revenue streams by catering to new demographics or new needs, such as remote workers looking for office space, but it is too early to tell if such initiatives will meet success.

• This challenging market environment could translate into greater hotel chain penetration in Europe, a region where independent hotel owners and managers still account for the majority of rooms. Both owners and managers may consider seeking support from chains with greater advertising, marketing and IT firepower to fend off or escape the growing influence of online travel agencies and customer-to-customer vacation rental platforms.

A catastrophic 2020 for the European accomodation industry

The EUR220bn European accommodation industry has faced a threefold impact from the Covid-19 pandemic:

• Restrictions were first placed upon international travel to prevent the spread of the virus to Europe, leading to the cancellation of long-haul leisure and business trips.

• Restrictions on international travel proved too late and insufficient, leading European governments to then impose broad restrictions on economic activities starting in late Q1 2020. While the closure of hotels was not mandatory in all countries, the collapse in demand translated into a de facto freeze on activity.

• Ever since, activity has been chaotic, reflecting the successive highs and lows of the pandemic tide. The low point was reached in Q2 2020, with the year-on-year decline amounting to as much as -95% for Spain, while Q3 figures were more encouraging in France and Germany, where year-on-year declines were limited to -20%/-30% only.

The resurgence of Covid-19 cases in Q4 2020, which translated into another round of restrictive measures, sent activity close to its April lows. For the whole year 2020, we estimate the Covid-19 pandemic has translated into a -52% slump in accommodation activity in the EU27+UK, wiping off more than EUR115bn in turnover and putting an end to ten years of dynamic growth. Structural differences across European accommodation markets and differences in crisis management explain the significant dispersion in performance (Figure 1), with France and Germany faring far better than the UK, Spain and Italy.

Figure 1: Estimated change in accommodation turnover, 2020 (%)

Sources: Eurostat, Euler Hermes, Allianz Research calculations

Progress in vaccination campaigns vital ahead of the crucial summer season

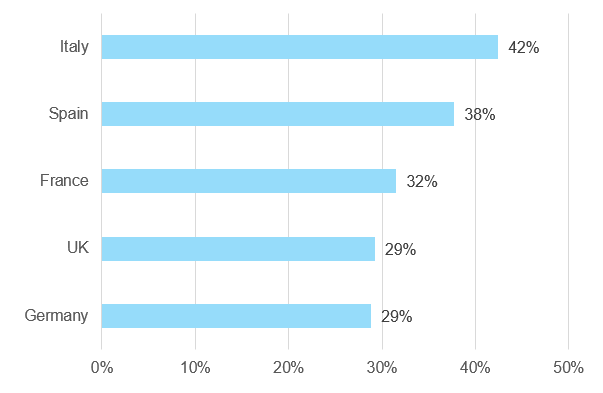

With the restrictions reinstated in Q4 2020 lasting well into Q1 2021, the industry is placing its hopes on the progress made on the vaccination front to ensure a broader and more lasting return to normal. Time is running low for the industry as households are preparing for their summer holidays: the share of Q3 in annual turnover oscillates between 29% (UK, Germany) and 42% (Italy) in top markets (Figure 2).

Figure 2: Q3 as % of annual accommodation turnover, 2015-2019 average (%)

Sources: Eurostat, Euler Hermes, Allianz Research calculations

Progress in mass vaccination will allow a progressive loosening of restrictions on personal and business activity, with Europe reaching herd immunity in the second half of 2021 at its current vaccination speed. The Oxford Covid-19 Government Response Stringency Index, a composite measure factoring nine different metrics, shows that Europe is currently seeing the strongest restrictions compared to Asia-Pacific or North America, with current values for individual countries close to the highs seen in Q2 2020. A slow easing of stringency measures would support the accommodation industry:

- By lifting mandatory restrictions on accommodation activities, which, as of March 2021, still apply in the UK for instance.

- By facilitating intra-country and intra-European travel, giving people the possibility to travel to their preferred destinations. Travel restrictions both domestically and internationally, as of March 2021, still apply in all major European markets.

- By increasing the appeal of leisure travel with the lifting of restrictions on ancillary touristic activities such as food service, cultural and sports activities.

2020 showed a strong correlation between stringency data and business activity in the accommodation sector. Taking into account ongoing trends for Q1 2021 at a national level, different seasonality patterns between countries and using 2020 as a proxy, we derive an estimation of the turnover performance for Europe’s five largest markets based on progress made in mass vaccination, which would allow an easing of stringency measures starting in Q2 2021:

- France would see activity grow by +23% in 2021, standing -29% below its 2019 level. Unlike most other European markets, France enjoyed significant activity in Q1 2021 but is lagging behind in terms of vaccination progress. Much like in the summer of 2020, when occupancy rates were as high as 80% in secondary destinations, we anticipate domestic demand to support domestic supply, while regions more exposed to international travel (the region of Paris, in particular) will not see a significant improvement before the end of the year.

- Germany would recover by +18% in 2021, remaining -34% below 2019 levels. The country had severe restrictions in Q1 2021 and presented a five-step plan to progressively exit from them that began in early March and could be fully implemented, at best, in early April should the sanitary situation continue to materially improve. On the positive side, the country is leading the vaccination race among continental European countries and, much like France, could benefit from higher spending from locals in the coming quarters, like it did in summer 2020.

- The UK accommodation sector would benefit from the country’s rapid pace of vaccination, with demand picking up firmly with the reopening of so-called self-catered accommodation services (including vacation rentals) starting 12 April and hotels from 17 May. However, this would only partly compensate for a terrible Q1 2021, which saw the highest restrictions among top European markets and a ban on overnight stays in third-party residences. 2021 turnover would bounce back by +34%, but remain -38% below pre-crisis levels.

- Q1 2021 was chaotic in Italy, with the progressive reopening of the economy, including the hospitality, food services and recreation sectors on 01 February in most regions before the worsening of the sanitary situation forced authorities to reinstate restrictions starting 15 March until Easter at least. Much like France, Italy could see a slower loosening of restrictions as it is comparatively late in the vaccination race. Italy would see the strongest rebound in 2021 (+40%, but still down -45% from 2019), mostly reflecting a more favorable comparison basis (hotels reopened comparatively late and only in part in 2020).

- The situation of Spain stands out as the country had the toughest restrictions in 2020 and is the most reliant on international travelers, which account for more than half of total travel and leisure spending in the country. Spain is also less populated than other large markets, with households earning comparatively lower income, meaning that domestic demand cannot alone allow for a significant recovery in local activity. After seeing the steepest decline in activity in 2020, Spain would see accommodation turnover grow by +30% in 2021 (-54% from 2019 levels).

Figure 3: Accommodation turnover estimates (2019=100)

Sources: Eurostat, Euler Hermes, Allianz Research calculations

Looking beyond 2021: Structural factors will shape different recoveries

While 2021 will be mostly driven by short-term factors relating to the easing of the sanitary situation, medium-term growth will be driven by more fundamental factors.

GDP growth and the pace at which countries return to their pre-crisis levels will be instrumental – overall accommodation activity is well correlated with the wider business cycle (correlation coefficient >0.9 over the past twenty years in Europe). After the unprecedented slump in 2020, we expect European economies to recovery gradually, with France and Germany returning to pre-crisis GDP levels in 2022 and Spain, Italy and the UK even later. (Figure 4). A specific feature of the current economic situation is the high level of savings among households whose revenues were not hurt by the crisis and were not spent on big-ticket items (including travel) in 2020 because of the sanitary restrictions. Should the sanitary situation materially improve, we believe there is a fair chance that the accommodation industry could see the same similar pent-up demand phenomenon that a few sectors (consumer electronics, household appliances, etc.) experienced in 2020.

Figure 4: GDP growth (%)

Sources: Euler Hermes, Allianz Research

Exposure to international demand is another factor. Looking at the structure of travel and tourism spending across European countries, an aggregate comprising tourist accommodation, food service, transport and leisure expenses, we observe that Spain and France will face more lasting headwinds because of their strong exposure to international demand (Figure 5). This is particularly true for popular international destinations for which long-haul flights account for more than 25% of stays (Paris, Rome, Barcelona, Madrid but also Amsterdam, Zurich etc.). In a recent report, we estimated that international tourist arrivals to Europe would not return to 2019 levels before 2024 at best . We therefore anticipate strong competition, not just between companies but also countries, to lure European travelers to compensate for low arrivals of extra-European travelers (marketing campaigns to retain domestic travelers and attract international guests, typically). Because they have the deepest tourist deficits (arrivals minus departures) in normal times, the UK and Germany would benefit the most from a massive rise in nearby vacations.

Figure 5: Travel and tourism spending by origin, 2019 (% of total spending)

Source: United Nations World Tourism Organization

The recovery in international travel could also be facilitated by international initiatives such as vaccination certificates or passports that would document the health status of travelers. The air transport industry, in particular, has been strongly advocating for such initiatives that could rekindle business and consumer confidence and has already launched various initiatives such as the IATA Travel Pass. As of March 2021, the European Commission was pushing for the implementation, by summer, of a so-called digital green certificate that would prove if a person has been vaccinated against or recovered from Covid-19 or has tested negative. The certificate would be common to all member countries and compatible with initiatives from other regions, but how the certificate should be used would be left to member states. Countries would need to find the right balance between keeping the pandemic in check and not deterring foreigners from travelling. While being asked for a negative test during the summer season would be acceptable for incoming travelers, discriminating against non-vaccinated people in 2021 would be detrimental to people flows, given the patchy progress made in national vaccination campaigns, not to mention the ethical debates such practices would raise.

Exposure to business travel will also contribute to the strong dispersion in performance between countries (Spain has the lowest contribution, the UK the highest) and between destinations in the same country. Leisure and business travelers differ significantly in travel patterns because the latter play in important role in filling room capacities during the low season for tourism and during the week for hotels. Business travel also tends to be more evenly disseminated over the territory, and accounts for the majority of turnover in locations with limited touristic appeal. The extent to which corporate travel budgets will return to their pre-crisis levels remains a major uncertainty: 2020 showed that corporate clients were capable of keeping business continuity despite lower opportunities for in-person meetings. A prominent survey conducted by CNBC in late 2020 showed that a majority of European CFOs were not expecting a return to pre-crisis budgets for corporate travel ever (Figure 6); France-based hotel chain group Accor estimates that 7% to 10% of business travel could be lost for good. After a challenging 2020, the incentive to keep travel budgets low is strong among corporates. It could also arguably help companies reduce the environmental footprint that they are increasingly asked to report to their stakeholders.

Figure 6: "When do you expect your company's budget for employee travel to return to pre-pandemic levels?"

Source: CNBC Global CFO Council Survey, figures for Europe, Middle East and Africa, Q4 2020

All in all, the industry does not anticipate a full recovery before 2024 at best. By then, dispersion will remain very strong, with leisure demand bouncing back faster than business demand and domestic guests returning sooner than European and extra-European guests.

What does this mean for companies?

The combination of short-term (progressive lifting of sanitary restrictions and recovery in economic activity) and more long-lasting factors (return to confidence of international travelers, pressure on business travel) will weigh on overall industry room utilization. Looking at a panel of large listed hotel chains either based in Europe or with significant operations in Europe, we observe that average room occupancy collapsed by -40pp to -60pp on average in 2020. Low room utilization has, in turn, driven prices down: because information on room supply and demand has been made highly transparent, thanks to online travel agencies and other online booking services, room rates adapt to the current supply/demand equilibrium. This is reflected by the fact that the average revenue per available room, the industry’s preferred metric for activity, has fallen even more dramatically than occupancy rates (Figure 7), reflecting declines in average rates generally comprised between -10% and -20%.

Figure 7: Change in occupancy and revenue per available room in 2020

Sources: Bloomberg, company information

Asset-heavy hotel companies are more at risk…

All else unchanged, long-term lower capacity utilization will especially hit those companies with the least flexible cost structure. While the various partial unemployment schemes across Europe have helped hotel companies reduce their cost base (labor cost is the largest single operating expense), the situation is very different when it comes to leasing or real estate ownership costs. The impact is felt differently across companies depending on their business models:

- Companies with so-called asset-heavy business models have to either pay fixed leases for the hotels they manage, or pay the costs of the real estate assets they own (debt repayment, interest, capex related to hotel rejuvenation and refurbishment) irrespective of activity levels and cash generation. Those companies have a higher share of fixed costs in their operating expenses and must reach comparatively higher occupancy rates and revenue per available room to break even.

- Companies with so-called asset-light business models, on the contrary, collect fees either for the hotels that are using their franchise (franchise business model) or the hotels they manage, with no ownership of real estate assets (management business model). Those companies have a comparatively more flexible cost structure. This business model has become dominant among top hotel chains.

… while real estate owners will see the valuation of their portfolios decline

Anecdotal evidence points to tough negotiations between hotel owners and managers in 2020 already, with the latter trying to obtain partial cancellations or postponement of rents due. Covivio, one of Europe’s largest owners of hotel real estate, reported a 72% rent collection rate for the year 2020 (92% including rent-free agreements). Lower-than-normal room occupancy rates will see the tug-of-war between owners and tenants continue for the foreseeable future, resulting in one-off agreements (eg. unpaid rent cancellation or renewed terms in exchange for an extension of lease duration). The anticipation of lower revenues will, in turn, hit the valuation of the real estate-owners portfolios.

Hotel companies will need to innovate to capture new revenue streams…

The slow recovery in traditional business and leisure accommodation services will further encourage hotel companies to innovate to find additional sources of revenues. Plans announced by dominant chains revolve around two main ideas:

- Broadening the guest base by appealing to previously untapped demographics. The slow recovery of long-haul travel, in particular, is creating a strong incentive for hotel companies operating in attractive destinations to target resident guests by offering original “staycation” packages, typically combining accommodation services with other well-being or leisure activities.

- Further diversifying the service offering. Many dominant hotel chains have been making inroads into the co-working market, providing working space and additional services to mostly independent and freelance workers in urban areas under dedicated brands. Anecdotal evidence abound that hotel companies are now trying to appeal to the fast-growing number of remote workers.

We believe that such initiatives, while potentially successful at a local level, cannot be enough to have a material impact at a sector level, largely because hotel assets tend to be specific and not suitable for innovative uses without significant investment.

… and keep pace with web-based challengers and intermediaries

The Covid-19 crisis has played a major role in accelerating structural shifts, especially as regards the digitization of consumer and business services (greater penetration of e-commerce, food delivery, remote working, videoconferencing etc.), with which hotels will have to keep pace. Web-based challengers to and intermediaries of the hotel industry, namely customer-to-customer vacation rental platforms such as Airbnb or online travel agencies (OTAs) such as Booking or Expedia, could not escape the 2020 collapse in travel and did not fare better than the accommodation industry. It is however likely that consumers and businesses will, once restrictions are lifted, make an even greater use of convenient digital platforms. Independent hotels as well as chains have considerably improved their digital and marketing capabilities in the past years, especially as regards direct booking. Rooms booked through an OTA are typically less profitable for hotel companies because of the fees and commissions collected by the platform (typically around 15% to 20% of room price). Hotrec, a European trade association representing the interests of the hospitality industry, says that online platforms account for about a third of all room bookings in Europe, with three companies controlling over 90% of volumes.

Hotel chain penetration could accelerate

2020 financials and credit metrics have us believe that dominant hotel chains are well placed to gain more clout in the European market. While nearly all major players were downgraded by credit rating agencies in 2020 and remain under negative surveillance, they were capable of limiting the cash burn, thanks to their generally lighter business models. Their diversified portfolio across countries and price ranges, greater financial resources and easier access to capital markets also contribute positively to their credit profile. In the light of the challenging next few years ahead for the European industry, we believe those assets could accelerate their efforts to capture franchising and management contracts from hotel owners. Also, while data are too scarce and visibility on sector-specific support measures too limited to precisely assess the impact of the crisis on business count, it is likely that hotel owners may consider picking a dominant chain to replace their ailing independent hotel managers. Europe has the lowest penetration of hotel chains among the key regions of the hospitality sector (Figure 8).

Figure 8: Share of hotel chains in total room capacity, 2019 (%)

Sources: Bloomberg, company information