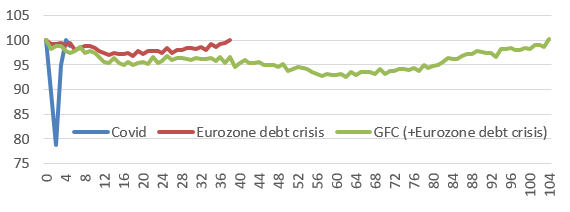

This is particularly true with unemployment set to rise further over the coming months as income-support schemes are phased out and insolvencies are expected to pick up. In fact, it is time to acknowledge that even without a meaningful second infection wave the V-shaped rebound in retail trade will turn out to be solely the first leg of a W-shaped recovery formation.

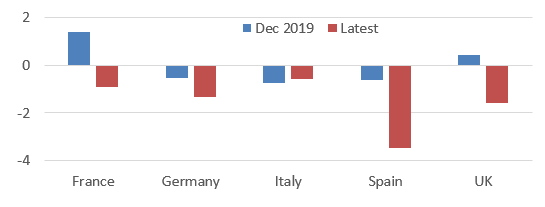

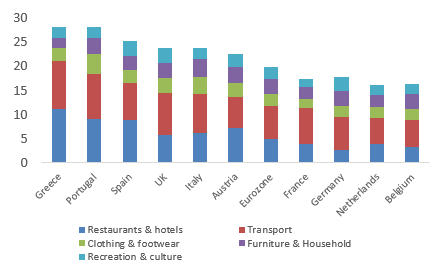

3. Mind the Covid-19 specific consumption headwinds: In addition to the usual recession victims such as cyclical durables but also clothing & footwear, the peculiarities of the Covid-19 downturn, i.e. ongoing contagion concerns, will continue to put additional consumption components under immense pressure. Covid-19 sensitive spending centers on “social expenditure” and therefore includes transportation, restaurants & hotels and recreation & culture services. These vulnerable components represent almost one fourth (23%) of total private consumption in the Eurozone. A return to pre-crisis spending patterns will therefore hinge on the availability and wide distribution of a vaccine.

Taking together these findings, what does that mean for the recovery outlook across European economies? Adding up recession and Covid-19 sensitive sectors as a share of national GDP underlines the highly divergent recovery prospects across Europe. After all, the sum of consumption components at risk during the current downturn range from 13% of GDP in Belgium to twice that with 26% in Greece. Interestingly our calculations see a greater risk for the private consumption recovery in Greece, Portugal, Spain and the UK than in Italy.

Figure 7: Recession and Covid-19 sensitive consumption components (% GDP)