The spreads have been closed but the ECB’s job is nowhere near done yet: Tomorrow’s policy meeting will be all about cues for the ECB’s game plan to tackle mounting deflation risks and a strong euro in the context of an uncertain economic recovery. As if the ECB did not already have enough on its plate with the unprecedented Covid-19-related growth shock, which led to the announcement of additional asset purchases to the tune of EUR1,350bn, it will now need to decide how to deal with two additional headaches to its growing list of worries.

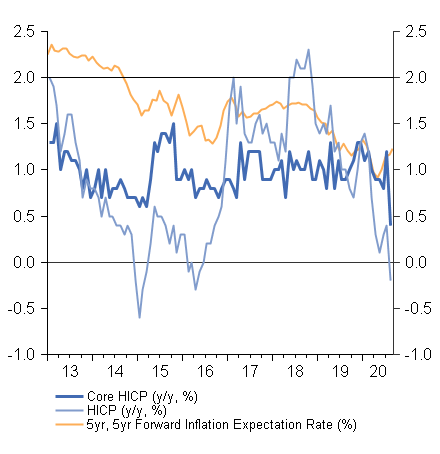

For one, there is the rising risk of Eurozone inflation expectations de-anchoring. A sharp decline in inflation rates, given the disinflationary pressures from the Covid-19 economic shock, was anticipated. But annual core inflation dropping to a record-low of +0.4% in August is not something the ECB can ignore for long without risking damage to its credibility. This is particularly valid as longer-term inflation expectations – whether market or survey based – have continued to creep lower over the past decade (see Figures 1 and 2).

Figure 1: Eurozone inflation vs. market-based inflation expectations

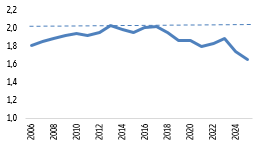

Figure 2: Survey of Professional Forecasters – Longer-term inflation expectations

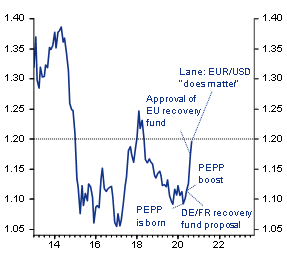

In addition, the high-flying EUR, which since March has strengthened by +13% compared to the USD, briefly rose above the 1.20 mark. This has in the past often led to policy interventions. After all, not only the competitiveness of the region’s exports is at stake, but more importantly, by lowering import prices the EUR appreciation is bound to reinforce deflationary tendencies. Even though the strengthening of the common currency is in part driven by upside policy surprises - such as the increase in the PEPP and the agreement on the EUR750bn EU Recovery Fund (see Figure 3) – the timing is highly unfavorable, with the Eurozone economy currently in a crucial stage of the Covid-19 recovery (We estimate that a 10% EUR appreciation will shave off around 0.2-0.3ppts from annual GDP growth) and core inflation already at an all-time low.

Figure 3: USD to EUR exchange rate (%)

What to do, what to do? For now, probably not much! At tomorrow’s meeting the focus therefore will be on talking the talk to win some time. Expect all-time classics to be featured, including “uncertainty” and “we stand ready to adjust all our tools”, in addition to more recent hits such as “the euro/dollar rate does matter”.

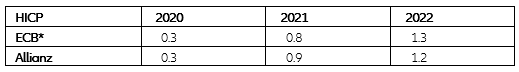

Why the inaction? All signs point towards more easing, but we think that the ECB will choose to remain in a wait-and-see mode in the fall in order to gather more data and insights to allow for a better-informed and calibrated policy response to the prevailing challenges. For one, this includes carefully analyzing the incoming data flow to better gauge the underlying strength of the Eurozone’s economic recovery as well as the persistence and size of the deflationary threat. After all, current inflation readings are messy as a result of temporarily distorting factors such as the VAT cut in Germany and the timing of summer sales. Also, the unfolding recovery in the third quarter is bound to support consumer price growth, albeit with some delay. Hence, rather than reacting to one (admittedly truly terrible) inflation data point, the ECB may want to wait for the September and October inflation releases as well as the results of the Survey of Professional Forecasters due on 30 October. Overall we don’t think that the ECB will cut its 2020/21 inflation forecasts by much, if at all.

Figure 4: Inflation forecasts 2020-22 (%)

As regards the EUR appreciation, the ECB is likely to closely watch the Federal Reserve rate decision on 16 September for crucial evidence on its interpretation and implementation of its new policy framework and in turn the repercussions on the EUR/USD exchange rate. That being said, policy action that goes beyond verbal intervention will remain highly unlikely. After all, as in the 2017-18 period, the ECB is unlikely to fight a stronger currency if it is associated with improving economic prospects.

Walking the walk: Once the ECB has more visibility around these crucial factors determining its policy response, we expect it to act decisively with a EUR500bn QE top-up by year-end, given the rising threat to its credibility. Most likely, we expect the ECB to try to make it until the December meeting and to justify a EUR500bn boost of its asset purchases in 2021 on the grounds of fresh downgrades to its macroeconomic forecasts. Here we think that the ECB will opt to favor the PSPP over the PEPP, announcing an increase in monthly purchases to EUR60bn. After all, the minutes from the last ECB policy meeting showed some resistance to using the full PEPP envelope. Even if PSPP comes with less flexibility, we think it will be easier to rally support around a QE boost.

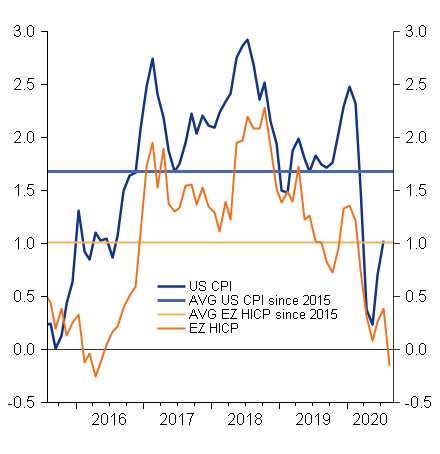

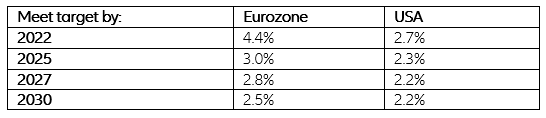

Doves are in the air – also in the medium-term: The ECB has very little leeway to decouple from the U.S. financial cycle. The Fed’s recent announcement of a strategy shift towards an average inflation targeting regime implicitly concluded the ECB’s own strategy overhaul before it even kicked off – at least as far as the inflation target is concerned. This does not mean that the ECB will copy the Fed’s precedent to a T. After all, it does not feature a dual mandate and more importantly switching to a regime that requires making up for below-target inflation would not be very credible given subdued inflationary pressures in recent years (see Figures 5 and 6). For instance, to meet an average inflation target by 2025 would require an inflation rate of 3% over the next five years. But we think that the ECB will probably signal its readiness to also tolerate a temporary inflation overshoot by making its 2% price stability target symmetric.

Figure 5: Inflation in the US vs. the Eurozone (%)

Figure 6: Average inflation targeting - How much inflation would be needed to make up for below-target inflation since 2015?

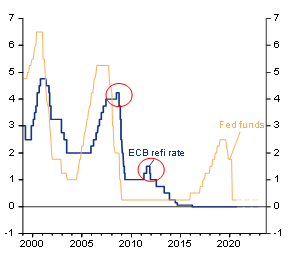

How to meet this slightly higher goalpost while keeping financial stability risk at bay remains anyone’s guess. Going forward, the best proxy for ECB policy action may be the state of the U.S. labor market. Due to this prevailing policy dependency, as the Fed is ready to stay lower-for-longer (we don’t expect a rate hike on either side of the Atlantic before 2023) in an effort to support the labor market, the ECB will have little choice but to do the same. After all, the ECB’s few attempts (remember 2008 and 2011) to swim against the U.S. financial cycle failed miserably (See Figure 7).

Figure 7: US vs. Eurozone key interest rates (%)