What happened: Last night, following an emergency meeting of its governing council, the ECB announced a new temporary asset purchase program worth EUR750bn (around 6% of Eurozone GDP) until the end of the year - or longer if needed - in response to the COVID-19 outbreak. All assets under the APP will be included, with purchases to be implemented in a flexible manner (i.e. frontloading of Italian debt is hence a possibility). The ECB also decided to expand the range of assets eligible for purchase to non-financial commercial paper and to ease its collateral standards to allow banks to raise money against more of their assets, including corporate finance claims.

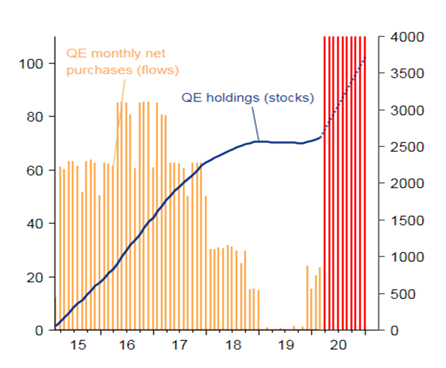

Size matters: The Pandemic Emergency Purchase Program (PEPP) will come on top of monthly purchases to the tune of EUR20bn QE and the EUR120bn envelope announced last week, bringing the total to be purchased for the remainder of the year to EUR 1.1 tn i.e. more than EUR110bn in monthly asset purchases. Of course, in addition, the ECB will also continue to replace maturing securities as part of its reinvestment program. Putting this in historical context: QE monthly net purchases peaked at around EUR85bn in 2016 (see chart below). This will increase the entire APP stock, which has already collected EUR 2.6tn of assets, by 40%.

No limits: Given this sharp increase in the pace of monthly purchases, the ECB essentially said good-bye to the 33% issuer limit – which is a self-imposed limit to not hold more than one third of a country’s debt outstanding. This is not an official decision to lift the limit, but we view this as a formality to follow in short time as the ECB implements the PEPP announcement. Meanwhile, the capital key will be maintained for now, but applied in a “flexible manner”, which allows for temporary deviations. Finally, the ECB stated that it is “fully prepared” to increase the program “by as much as necessary and for as long as needed” and stands ready to “explore all options and all contingencies to support the economy through this shock”. Hence, in the event of a further marked deterioration in financial conditions, expect additional unconventional and creative policy measures to be announced in the near-term.

Close the spread: While the announcement has failed to incite much market optimism on the equity side - futures are only slightly up (0.5 to 2%) - bond markets, however, are very convinced by the ECB announcement, with the spread of Italy opening +85bp lower, Greece 155bp lower and all other spreads also declining by double digits (10y maturities).

Temporary supply issues? Despite the massive fiscal crisis packages, the expansion of the PSPP and the introduction of the PEPP could temporarily reduce the supply of government bonds available on the market, at least till fiscal stimuli kick in - at least for some issuers whose planned net issuance was already low or negative before, certainly having a dampening effect on yields. According to ECB estimates, the previous QE have pushed the 10-year German benchmark down by 100 bp, and the effect is likely to intensify with the new programs. This being said, most countries have already announced vast fiscal packages amounting to more than EUR100bn without guarantees, EUR1,100bn with guarantees, pointing to the right sizing by the ECB ex post.

Figure 1: QE monthly net purchases (lhs, EURbn) vs. QE stock (rhs, EURbn)