The ECB’s December dilemma: Recalibrating the policy response so that it is bold enough in the context of subdued short-term prospects but flexible enough to respond to potential upside risks to the outlook for 2021 and beyond. At the October policy meeting – the week that France and Germany renewed national Covid-19 restrictions following a spike in infections – ECB president Christine Lagarde pre-committed to boosting the monetary policy response come December, arguing that more visibility on the macroeconomic front would allow for an optimal recalibration of the policy stance. The positive news that has since emerged on the vaccine front will not fundamentally alter that plan, but it will influence the parameters of the December policy decisions. After all, while vaccine breakthroughs will have no sizeable impact on the immediate short-term outlook, downside risks to the outlook for economic growth and inflation in 2021 and beyond have notably reduced as a result. Hence, the ECB’s December decision will be all about striking a balance between a bold policy response that continues to put a firm lid on sovereign and private refinancing costs, while at the same time allowing for sufficient flexibility in case upside risks to the macroeconomic outlook materialize as soon as the second half of 2021.

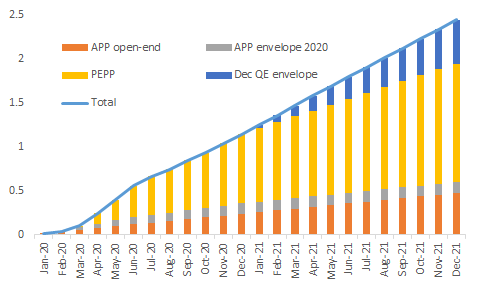

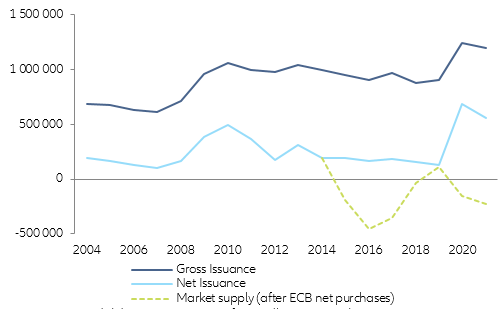

On the asset purchase front, the ECB – applying key lessons from the pandemic management playbook – should opt for a big and bold announcement next week. After all, it needs to reassure markets that it has set aside enough ammunition to provide a backstop for an adequate fiscal response to the pandemic. With borrowing costs in many Eurozone countries at record lows, the key focus of the ECB should be on cementing and extending these favorable conditions in the context of a more protracted economic crisis. So, how much are we talking about? Given the high uncertainty around what QE dose is needed – since it depends on several moving puzzle pieces, including the speed of the economic recovery and the fiscal policy response, as well as market conditions – the ECB should rather err on the cautious side. We think a December QE top-up to the tune of EUR500bn should do the trick. After all, this would allow it to also maintain in 2021 the average monthly asset purchase pace of EUR110bn it has set since March , when added to the EUR20bn in monthly Asset Purchase Program (APP) purchases and the expected unspent Pandemic Emergency Purchase Program (PEPP) powder of around EUR600bn as of end-2020 (Figure 1). In practice, this will mean increasing the ECB balance sheet by another EUR1.6tn in QE purchases in 2021, bringing the total spent on asset purchases between March 2020 and December 2021 to a cool EUR2.4tn.

Figure 1 – ECB asset purchases under PEPP & APP (EUR tn)