Executive Summary

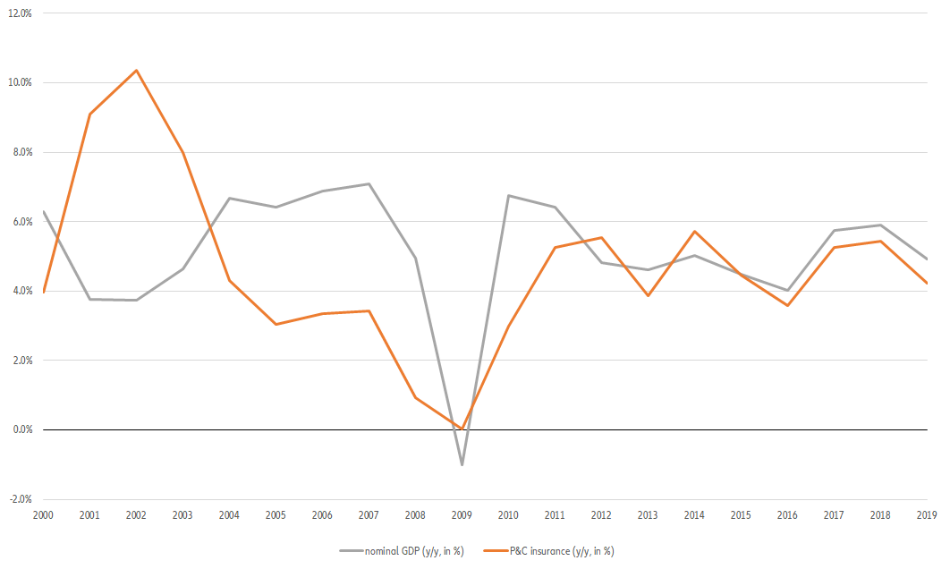

In general, property and casualty insurance demand has reflected the development stage of an economy: The higher the GDP per capita, the higher the gross written premiums per capita and premium income as a percentage of GDP, indicating a positive correlation between economic and P&C insurance market development. However, against the background of new technologies and distribution channels, changing customer behavior and demographic change, the question arises: Does this correlation still hold or have other explanatory variables already replaced GDP as the decisive factor for insurance market growth in recent years?

Our analysis of the P&C insurance market developments in 61 countries between 2000 and 2019 shows that:

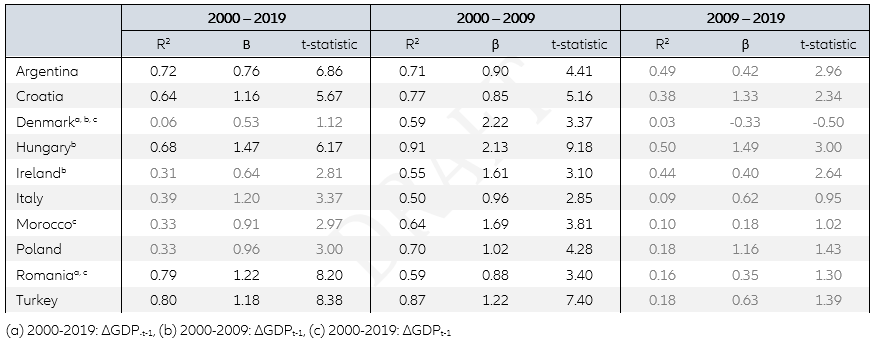

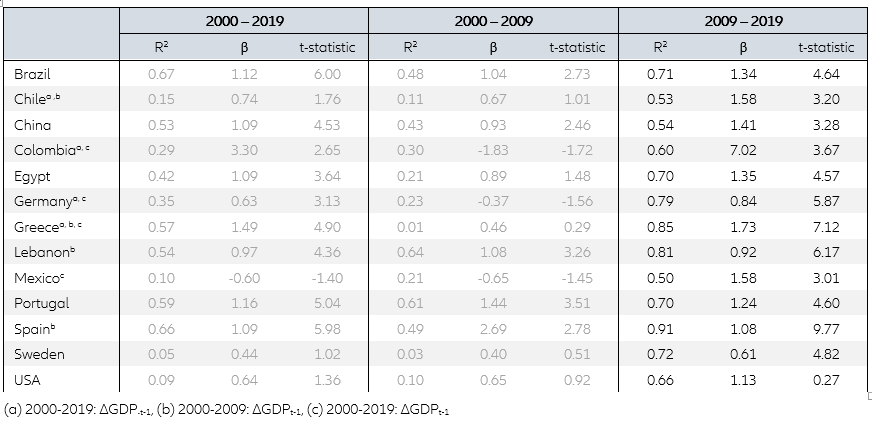

- Nominal GDP growth explains 61% of global gross written P&C insurance premium development between 2009 and 2019. At the country level, however, results are more dispersed: In 30 of the 61 analyzed countries, the explanatory strength of nominal GDP is higher in the first decade; in 31 it is higher in the second decade and only in 25 of the countries is the explanatory power of GDP above 50%. The maturity level of an insurance market has no influence on the explanatory strength of nominal GDP growth.

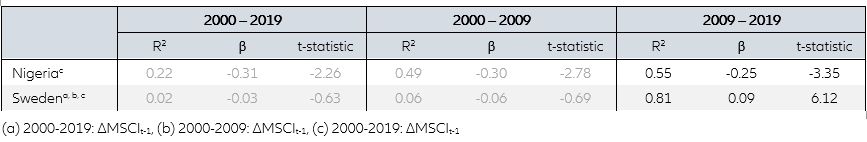

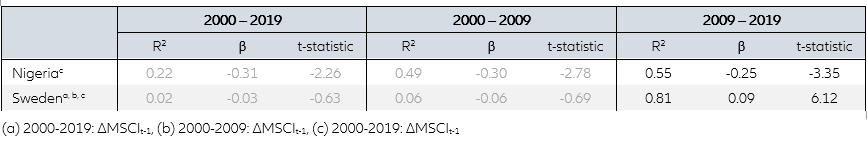

- The development of the Dow Jones index explains 64% of global premium growth between 2009 and 2019 and that of the MSCI World Index 40%, albeit in each case with a time lag of one year. The correlation of total P&C premium growth and stock market developments in the second decade is positive.

- There is no decisive exogenous factor for the development of motor insurance premium income. Even the number of motor vehicles was in most cases not the best indicator for motor insurance premium growth.

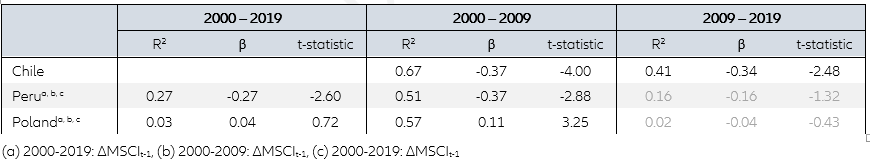

- In most countries, property premium growth since 2000 was influenced by national stock market developments, though the explanatory strength of this exogenous factor was rather low. In the first decade, private consumption expenditures were the dominating explanatory variable, while we could not identify a decisive exogenous factor for the development in the second decade.