Executive Summary

- The Chinese economy is experiencing a difficult start to 2022, driven by renewed Covid-19 outbreaks. Even if the sanitary context eases, private consumption is likely to remain below the pre-pandemic trend level in 2022 (-2.8% or -USD170bn).

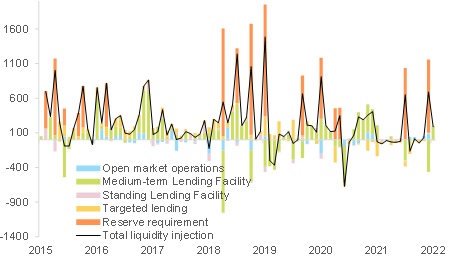

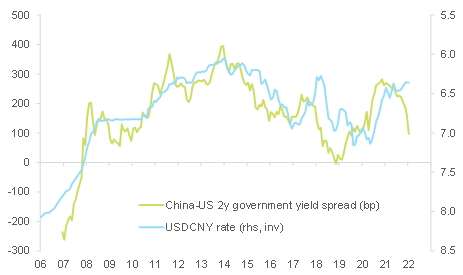

- Going forward, the flailing domestic leg should be supported by further policy rate cuts, public investment in infrastructure (c.3% of 2022E GDP) and temporarily laxer regulation. The external leg should remain robust, in the context of modest depreciation of the CNY, regional trade integration and US-China trade tensions being on hold.

- All this should bring the Chinese economy to a stronger footing in H2 2022. Beyond that, achieving “common prosperity” could imply a volatile medium-term growth pattern, depending on how policies are implemented and communicated.

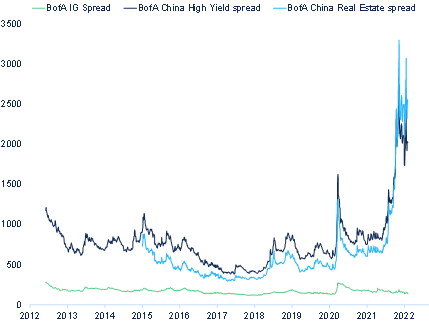

The ongoing slowdown of the Chinese economy highlights the tug of war authorities face between short-term growth and long-term economic prosperity. Since the second half of 2020, China has reemphasized the goal of creating a more sustainable growth model in the long run through “dual circulation” and “common prosperity”. But the ensuing tight regulation sparked adverse consequences for private sector confidence and domestic demand in the second half of 2021 . In the short-term, the “common” effort appears to be putting “prosperity” at risk, and “domestic circulation” is under pressure while “international circulation” is the bright spot – the inverse of the “dual circulation” strategy.

To add to this, the economy is facing a bumpy start to 2022, given the stringent zero-Covid strategy applied to renewed Covid-19 outbreaks, as well as temporary factors such as factory closures ahead of the Chinese New Year holiday, and the implementation of several production limits to reduce air pollution during the Winter Olympics. January data show activity growth moderated: almost all major indices in the PMI surveys declined, suggesting that the manufacturing, services and construction sectors were all hit by a mix of sanitary and seasonal factors.

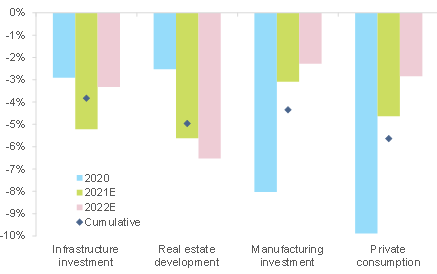

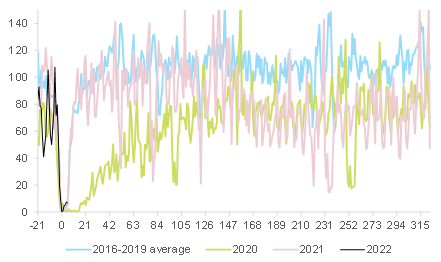

Even if the Covid-19 situation eases, domestic demand, and in particular private consumption, are likely to remain volatile and below the pre-pandemic trend level this year – by -2.8% or -RMB1090bn (-USD170bn), according to our estimates (see Figure 1). This comes in a context of household spending facing other headwinds this year: We estimate that the household savings rate already returned to pre-Covid levels in Q2 2021. In addition, the slowing macroeconomic environment could threaten household income growth. Indeed, even though still in line with the pre-pandemic level, China’s unemployment rate ticked up for the second consecutive time in December 2021.

As a result, we expect a tough first quarter (+1.1% q/q) for the Chinese economy.

Figure 1 – Distance of domestic demand to pre-pandemic trend level (%)