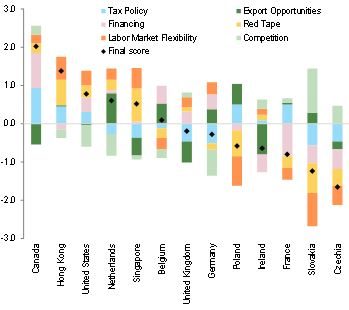

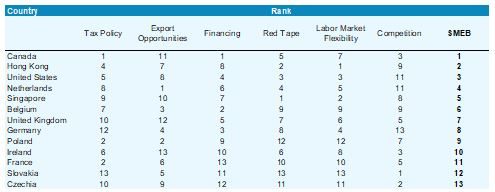

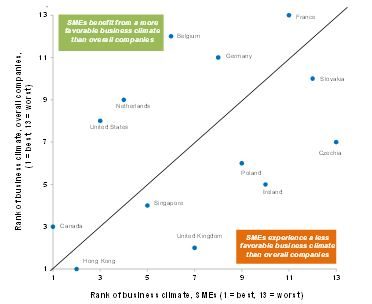

SME business climate by country: from best to worst

Canada – Export opportunities need to be diversified

Canada tops our SMEB ranking for 2019. Among the positives for Canadian SMEs are corporate taxes: While the base rate of 28% is a bit higher than the average of 23% for the countries in this study, the rate on SMEs is only 9%, tied for the second lowest. And the difference of 19% between those rates is the highest among the economies studied, giving Canadian SMEs a distinct advantage over their larger counterparts. Financing is also a significant benefit for SMEs in Canada. The low interest rates provided by the Canada Small Business Financing Program, and other financing available from the Export Development Corporation (EDC), a government agency that helps promote exports, provide significant access to credit.

However, trade is a challenging issue for Canadian SMEs. Over 30% of Canada’s GDP is derived from exports, but approximately 80% of these exports goes to the U.S. alone. Therefore, Canada’s export sector is heavily dependent on the health of one economy. Diversifying into other export markets would be greatly beneficial, but this has proven difficult since so many supply chains have already been established between the U.S. and Canada. There is also a trade feud ongoing between the two countries, with some tit-for-tat tariffs – eliminating them would be greatly beneficial to Canadian trade.

Crude oil is a significant export, but getting the oil out of the ground and into the hands of foreign consumers has proven difficult. A more reliable and comprehensive pipeline infrastructure would be most helpful. The recent formation of the Comprehensive Economic and Trade Agreement (CETA) will open 27 markets and over 500 million consumers to Canadian exports through tariff-free trade, but it has yet to be fully ratified and implemented. When it is fully operational; it will provide a valuable boost to exports.

Hong Kong – Relatively high lending rates are the main issue for SMEs

Among the economies in our sample, Hong Kong scores the second-highest in the SMEB. This is thanks to low red tape, strong labor market flexibility and a relatively favorable tax policy. In terms of red tape, Hong Kong ranks the second best in our sample (after Singapore), on the back of strong business freedom and high regulatory quality. In terms of labor market flexibility, Hong Kong presents the highest score in our sample. The tax policy is relatively favorable, with a basic corporate tax rate at 16.5% vs. 8.25% for SMEs.

On the negative side, the financing and competition components weigh on the business environment for SMEs in Hong Kong. Looking more precisely at the financing component, Hong Kong ranks sixth worst in our sample. This is mainly due to a comparatively high lending rate for SMEs.

Note that over the past month, policy efforts have already been made to support financial conditions for the real economy and SMEs. On 31 October, for the first time since 2008, HSBC and Standard Chartered lowered (by 12.5bp) the prime lending rates they apply in Hong Kong. Policymakers are also targeting SMEs specifically: on 16 October, the “Banking Sector SME Lending Coordination Mechanism”, established by the Hong Kong Monetary Authority (the central bank), held its first meeting. An agreement was found between nine major banks in Hong Kong on measures to support SMEs. These include allowing SMEs facing difficulties to extend or reschedule repayments, supporting SMEs to meet the additional expenses arising from structural challenges brought by the U.S.-China trade tensions and keeping the terms of loans to the real estate sector unchanged (despite lower rents).

U.S. – Competition is the single biggest obstacle for SMEs

What’s most notable about the U.S.’ SMEB score is that the factor where it is tied for second “worst” is also thought to be the one of the most beneficial to the overall economy – competition. Competition is the hallmark of a capitalist system, but it is a double-edged sword. It provides the best choices, and lowest prices, and is therefore greatly beneficial to consumers, investors, and the economy as a whole. However, it also presents the biggest risk to SMEs, and is probably one of the chief contributors to high failure rates: one third of all business started will survive only two years, only half will survive five years and less than 20% will survive 10 years or more.

A significant positive for SMEs, but also one which contributes to the low survival rate, is the relatively easy availability of credit. This is due to a combination of a large, multi-tiered financing system, and the competition in that system to provide loans. Lenders include large and small commercial banks, regional and community banks, savings and loans companies, credit unions and government programs, most notably the Small Business Administration (SBA). While the availability of credit makes it easy to start a business and maintain capital levels, the competition to provide loans also incentivizes lenders to extend credit to those SMEs which will not be able to pay it back, increasing the number of defaults. Of course, for SMEs, having credit widely available is preferable to not being able to take a risk.

Labor market flexibility is also key to U.S. businesses. Most employees are “at-will” employees, which means they can be hired or fired at the will of the employer. Hence, it is much less risky for a SME to hire someone in the U.S. than in other economies. In addition, many states now have “right-to-work” laws which prevent unions from forcing employees to join them, effectively weakening labor unions and their accompanying inflexibility.

However, export opportunities are a weakness for U.S. SMEs. While the U.S. does have a government agency to promote exporters – the U.S. Commercial Service – it has had limited success. The more prominent government exporting agency is the Export Import Bank (EXIM), but it typically caters to larger companies and transactions. The recent trade disputes with China, and tit-for-tat tariffs with China and the EU, are clearly hurting SMEs. Signing a comprehensive trade deal with China, and eliminating as many tariffs as possible, would be the single biggest boost for SMEs in the U.S.

The Netherlands – Best in class for SMEs in Europe

The Netherlands ranks first in terms of the SME business climate among European countries, thanks to a high score in terms of export opportunities, low red tape, supportive financing conditions and labor market flexibility. On the export side, 9.2% of total SMEs are exporting, against 5.5% on average for peers. Trading across borders is very easy in terms of time (one hour) and documents. The cost of exporting is close to 0 against more than 170 USD for advanced economies. In terms of financing, although SMEs in the Netherlands face a slightly higher cost compared to Germany or France (2.4% vs. 2.0% and 1.6%, respectively), finance availability is considered to be excellent/good for 40% of SMES and only 14% of SMEs registered a loan rejection in the past 12 months (against 19% on average for peers).

On the negative side there are two components: competition and tax policy. Dutch companies would describe corporate activity as intense (a score of 5.2 over 7, which is considered extremely intense). This is similar to Germany, but higher than Belgium and France for example. In terms of tax, Dutch SMEs benefit from a special regime with a corporate tax at 20%, 5pp less than the base tax rate. However, the gap is smaller when compared to Belgium (9pp) or France (16pp), for example. Hence, reducing the corporate tax on SMEs further, as planned in the 2020 Budget (to 15% in 2021), is a positive move as it would give 1pp of additional margin to Dutch SMEs.

Singapore – Room to further improve SMEs’ conditions through tax policy

Business conditions for SMEs are relatively favorable in Singapore – it ranks fifth in our sample of thirteen economies. This is mainly the result of low red tape and strong labor market flexibility. In terms of red tape, Singapore ranks as the best in our sample. Our 2019 Global Business Monitor SME survey echoes this result: close to 60% of respondents in Singapore reported that government policy relating to businesses is sometimes favorable, the highest ratio among the sample. Similarly, Singapore exhibited the lowest share of respondents (16%) that chose government regulation and red tape as the most important challenges their companies faced. Singapore also scored the second highest in business freedom and regulatory quality in our sample (after Hong Kong).

In the SMEB, a slight positive contributor to Singapore’s overall score is the financing component. Singapore presents the highest lending rate for SMEs in our sample, and financial conditions are supported by a decent Getting Credit score and a relatively low loan rejection rate over the past 12 months (14% vs. 19% on average in our sample).

Over the past few years, Singapore has made efforts to further improve its business environment, with measures to make exporting and importing easier (by improving infrastructure at the port), as well as starting a business and dealing with construction permits. However, export opportunities are surprisingly the biggest negative contributor to Singapore’s overall SMEB score, with the cost to export higher than the OECD high-income average. The tax policy is another factor weighing negatively on Singapore’s SMEB, with SMEs there not benefiting from a lower corporate tax rate (17% for all).

Belgium – The lack of labor flexibility remains an issue for SMEs

Overall, the business climate in Belgium is supportive for SMEs, albeit to a lower extent than in the Netherlands, for example. Export opportunities contribute positively to our index. Trading across borders is very easy in terms of time and documents. The cost of exporting is close to 0 against more than 170 USD for the advanced economies. The share of Belgian SMEs that are exporters is rather high: 7.1% of total SMEs against 5.5% on average for peers. This could also be explained by the fact that Belgium has an export agency in all its three main regions. Financing is also positive for the SME business climate, thanks to a very low bank loan interest rates (+1.6%). 39% of SMEs said they have had excellent/good availability of financing over the past 12 months, while 20% (against 18% for peers) had a loan rejected over the past 12 months.

Tax policies for SMEs are relatively neutral within our sample of 13 economies but better compared to the overall companies in Belgium. One positive is that Belgian SMEs have enjoyed a reduced corporate tax rate of 20% since 2018 (vs. the normal rate of 29%). This gap boosts SME margins by around +2pp. Belgian SMEs already boast of higher margins compared to peers. In 2017, the EBITDA to turnover ratio stood at 13%, +2pp above the European average. This should alleviate the drag of rising input costs (e.g. rising wages, higher import prices). On the negative side, the corporate tax rate itself is high compared to peers (+5pp higher than France, for example).

The drags for Belgian SMEs are red tape, labor market flexibility and competition. On red tape, the indicators of regulatory quality and business freedom are below peers, while only 31% of SMEs consider that government policy is favorable (against 35% on average for peers). Additional public policies in favor of SMEs could help them increase in size. Like in France, labor market flexibility, i.e. procedures to hire or fire employees, is a constraint for SMEs in Belgium. On this specific point, Belgium could ease strict procedures and shorten the notice periods for dismissals. Reducing the number of collective bargaining agreements from three (national, sectoral and company level), while lowering labor taxes for SMEs which support employment, would be positives for future public policies.

The UK – Exporting is too lengthy and expensive for SMEs

Overall, the UK does not score very well on the SMEB compared to peers, ranking below the Netherlands, the U.S. and Belgium, despite several well-known advantages such as low red tape, reasonable competition and high labor market flexibility.

Financing is one positive factor for the SME business climate in the UK. While the bank loan interest rate remains above 3% (against 2% on average in the rest of Western Europe), the availability of finance is considered excellent/good by 24% of SMEs (against 30% on average for peers) and only 9% of SMEs faced a loan rejection in the past 12 months (against 19% on average for peers). In addition, the score for getting credit in the UK is one of the best in Europe.

On the negative side, SMEs in the UK don’t face a competitive business environment when it comes to export opportunities, which are impaired by the length of procedures. In total, more than 24 hours are needed for a company in the UK to complete all forms, while the total cost of of exporting related to documentary and border compliance stands above USD300, against around USD170 in the advanced economies. Furthermore, despite what one might think, the tax policy for UK SMEs is not competitive either when compared to the 13 other economies in our sample. SMEs don’t benefit from a reduced corporate tax rate in the UK. The overall rate should fall to 17% in 2021, but it would still remain above the current French current tax on SMEs of 15%.

In relation to its peers, red tape and competition don’t appear to be a drag on the SME business climate in the UK. However, going forward, Brexit is likely to further damage the export opportunities score on the back of higher paperwork due to custom checks (probably by the end of 2021). Hence, an SME-oriented policy through specific administrative support in terms of custom checks brokers, for example, would be a plus. After all, UK companies export almost half of their goods and services into the EU, and this is unlikely to reduce significantly in the next five years, even if other Free Trade Agreements are signed (e.g. with the U.S., Japan, Canada, Australia, New Zeeland).

Germany – Strong competition weighs on the business climate for SMEs

The overall business climate for German SMEs is below average in the group of 13 selected economies for this analysis, pulled down in particular by a high level of competition and an unfavorable tax regime. While healthy competition is crucial in driving market efficiency, business productivity, innovation and customer-orientation, SMEs assess it as an obstacle for their business (for example with regard to finding customers and pricing power)[1]. The average corporate tax rate is about 30% in Germany, among the highest in our sample (along with France, Belgium and Canada). But while those peers have a much lower tax rate for SMEs (between 9% and 20%), the German government has announced only this year the plan to limit the tax level for SMEs to 25% of profits. Even taking this reduction into account, German SMEs remain left with the highest tax burden in our sample. Hence, tax policy provides considerable room for policymakers to improve doing business for SMEs. Furthermore, red tape is seen as burdensome by many SMEs and thus makes a small negative contribution to the SMEB for Germany.

On a positive note, German SMEs face good financing conditions, thanks to low bank lending rates (2.0% on average) and a low rate of loan rejections (only 14% of SMEs have experienced this over the past 12 months). In part this is likely to be explained by the comprehensive system of cooperative and mutual savings banks which are focused on financing smaller companies. Export opportunities are also good in Germany, reflected in a 10.2% share of exporting SMEs in total SMEs (the highest share in our sample). Moreover and perhaps surprisingly, labor market flexibility is a plus for German SMEs, thanks to the substantial reforms in this area over the past 15 years, as well as the generally high level of skilled staff in the country. However, the data probably do not reflect the lack of skilled employees in certain sectors such as engineering.

France – Financial information remains the main problem

For France our index shows that the main problem for SMEs is their access to credit. A lack of financial information is the main factor behind this, since credit bureau coverage is 0% in France compared to an average level of 66.7% in the OECD (although credit registry coverage is 47% of corporates in France, better than OECD’s 24.4% average). This explains the credit gap that French SMEs are facing: The loan rejection ratio was 33% over the past 12 months (18% on average for the other economies) and a lower share of SMEs think finance availability is excellent/good (25% vs. 31% on average). If France could find a solution to this information issue, its global index score would converge with the level observed in the UK. Red tape is the other main drag, since SMEs tend to suffer from a higher number of rules and a regulatory quality that is lower. It is true that French SMEs are exposed to longer-lasting insolvencies of bigger corporates (about two years are needed on average) and their ripple effects on smaller corporates. Moreover, Days Sales Outstanding (73 days on average) are longer than what is written in the law (60 days), which means a lower effectiveness of the rules. On other aspects, it is interesting to see that France has made some progress: Reduced corporate tax rates for SMEs are among the main improvements and the labor law implemented has also helped to improve labor market flexibility, enhancing the competitiveness of the French market.

Poland, Czechia, Slovakia – SMEs are clearly disadvantaged

In our sample of 13 economies, Poland, Slovakia and Czechia are among the weakest in the SMEB, ranking 10th, 12th and 13th, respectively. Clearly there is much room for improvement for policymakers. In Czechia, a low level of competition is the only positive contribution to our index. Competition is also a positive in Slovakia, while neutral in Poland. The latter two countries face favorable export opportunities as trading across borders has been made very easy in terms of time and paperwork. Polish SMEs also enjoy a very low tax rate of 9% (vs. 19% for large companies). In contrast, Czech and Slovak SMEs face the same tax rates as all other firms (19% and 21%, respectively).

In all the three Central European economies, SMEs encounter a high level of red tape, labor market inflexibility and financing difficulties. The 2019 Global Business Monitor SME survey revealed that less than one fifth of the SMEs in this region assess government policy as favorable for them, while more than half of them see regulation as the most important challenge. That survey also showed that around one quarter of SMEs have experienced a loan rejection over the past 12 months (vs. 19% on average in our sample). Regarding labor market flexibility, hiring and firing procedures in the three countries are among the most difficult in our sample, while skilled staff are less available than elsewhere.