EXECUTIVE SUMMARY

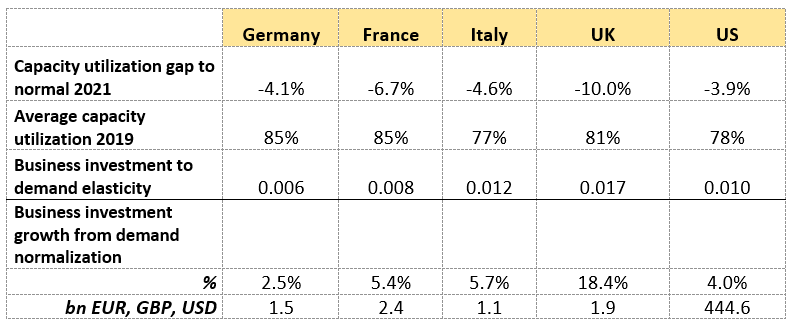

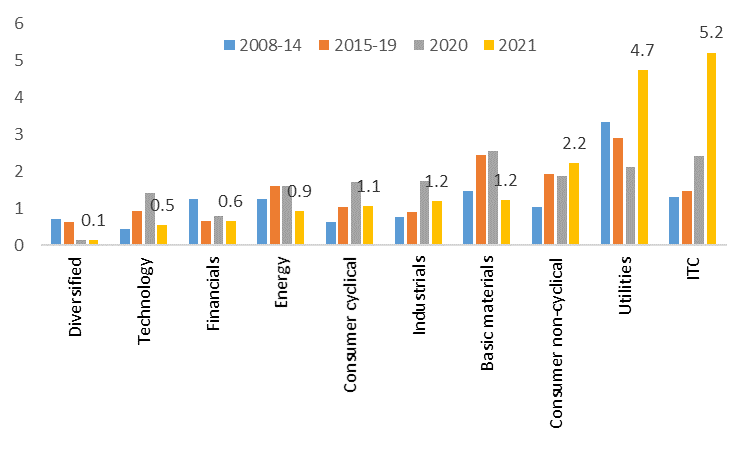

- In the short run, a demand catch-up and the reduction in spare capacities will drive a business investment recovery…With the progressive easing of sanitary restrictions, normalizing capacity utilization levels will push up business investment by +18.4% in the UK, +5.4% in France, +4.0% in the US and +2.5% in Germany. Country-level model elasticities show that business investment in Italy and the UK have the largest sensitivity to increasing aggregate demand and hence the highest potential for a fast catch-up in H2 2021. The key condition will be continued low interest rates: our model shows that loan-supply conditions are a significant determinant of investment growth in all countries, although the relation is weaker in Germany as companies enjoy higher profitability rates and thus self-financing capacity. Most of the rebound in business investment is expected to continue to be in software and IT equipment, where offensive investment strategies should pave the way for a new M&A cycle.

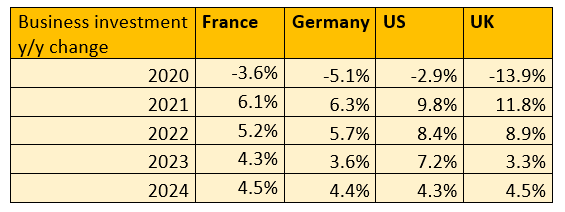

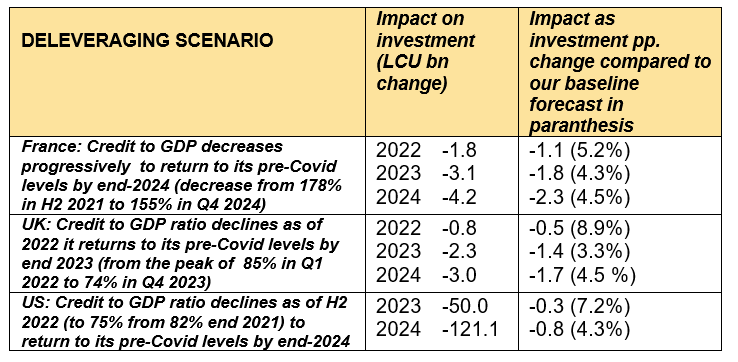

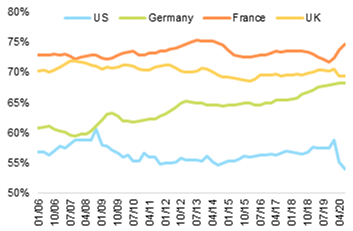

- …But it could take up to four years to return to long-term growth trends. Our multi-country time series panel data model shows that in the medium-term, the business investment recovery will be mainly driven by aggregate demand and productivity, the evolution of fiscal pressure on corporates, public investment dynamics and bank financing availability. In our baseline scenario we find that the US will register the highest investment growth at the horizon of 2024 (on average over 7%), followed by the UK (7.1%), France (5.1%) and Germany (5%). But watch out for a potential corporate deleveraging cycle that could jeopardize our baseline forecasts. Credit conditions during the recovery phase may be tighter and excessive levels of corporate debt could limit companies’ ability to borrow once state-support schemes are phased out. In France, if companies embark on a deleveraging process as soon as H2 2022 to reach pre-Covid-19 bank-credit-to-value-added ratios by 2024, in the absence of further extensions to state-guaranteed loan reimbursements or debt forgiveness, the drag on business investment could reach EUR6bn (-2pp cumulative). In the US, faster deleveraging as of 2022 triggered by a corporate credit event and accentuated by mismanaged monetary policy tapering could also put a brake on investment growth. Returning to the pre-Covid-19 NFC credit-to-GDP ratio is expected to reduce business investment by USD170bn between 2023-2024 (-1.1pp).

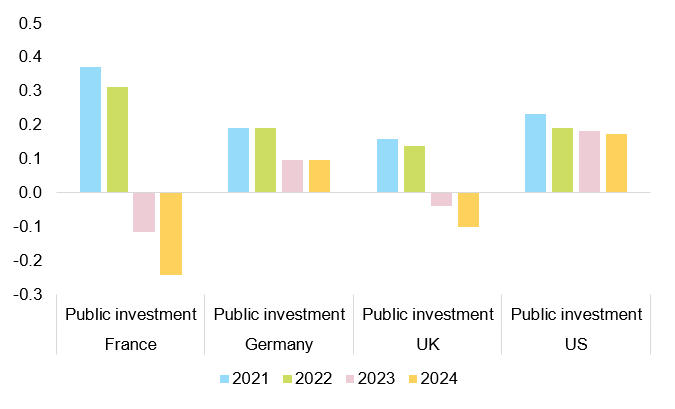

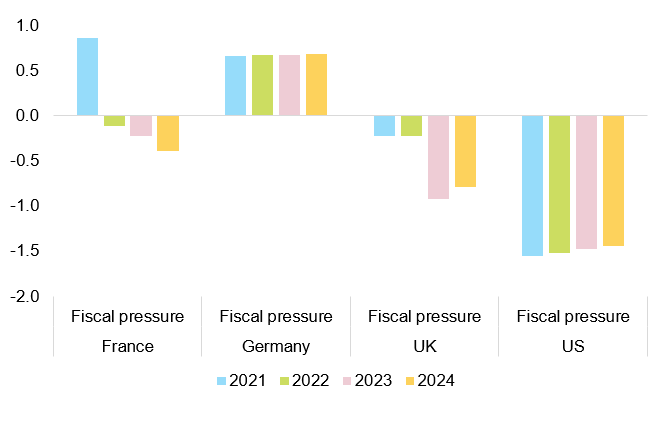

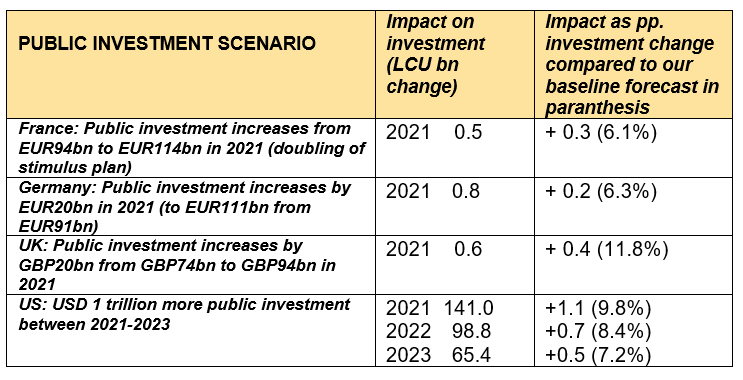

- As an alternative scenario, policymakers can catalyze the new investment cycle through strong crowd-in effects from public investment and supportive tax policies. First, by investing in new technologies, governments can ignite positive spillovers to the private sector that would lift potential growth and productivity. In France, a doubling of public investment spending (EUR20bn additional public investment) in 2021 would boost business investment by EUR0.5bn (+0.4pp of additional business investment growth). In Germany, the same amount of additional public investment would boost business investment by EUR0.8bn (+0.3pp) while in the UK the impact would be stronger (GBP0.6bn or +0.5pp). In the US, USD1trn in additional public investment could boost business investment by USD141bn (+1pp) in 2021, USD98bn (+0.7pp) in 2022 and USD65bn (+0.5pp) in 2023. Second, easing fiscal pressures for corporates could also significantly support business investment in France, where the sensitivity of business investment to tax levels is higher, while in the US and the UK the new fiscal orientation could become a headwind.

- In the long run, sustained economic growth and unspent excess savings will be key. Our panel estimates show that the pace of economic growth and the financial asset accumulation of households are the key determinants for long-term investment. We find that a 1% increase in economic activity leads to a +1.25% increase in business investment in the long term. And 1% of additional households’ savings leads to the +0.4% of additional business investment. In France, an additional EUR100bn increase in households’ financial assets would increase business investment by +2.5% (EUR3.7bn), while in Germany it would boost business investment by +2% (EUR8bn).