Executive summary

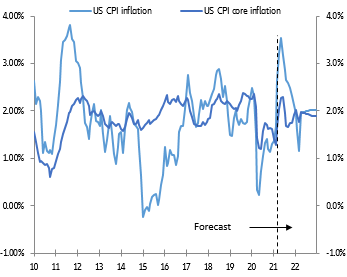

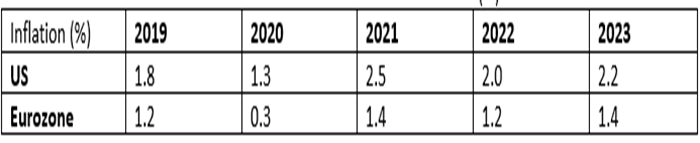

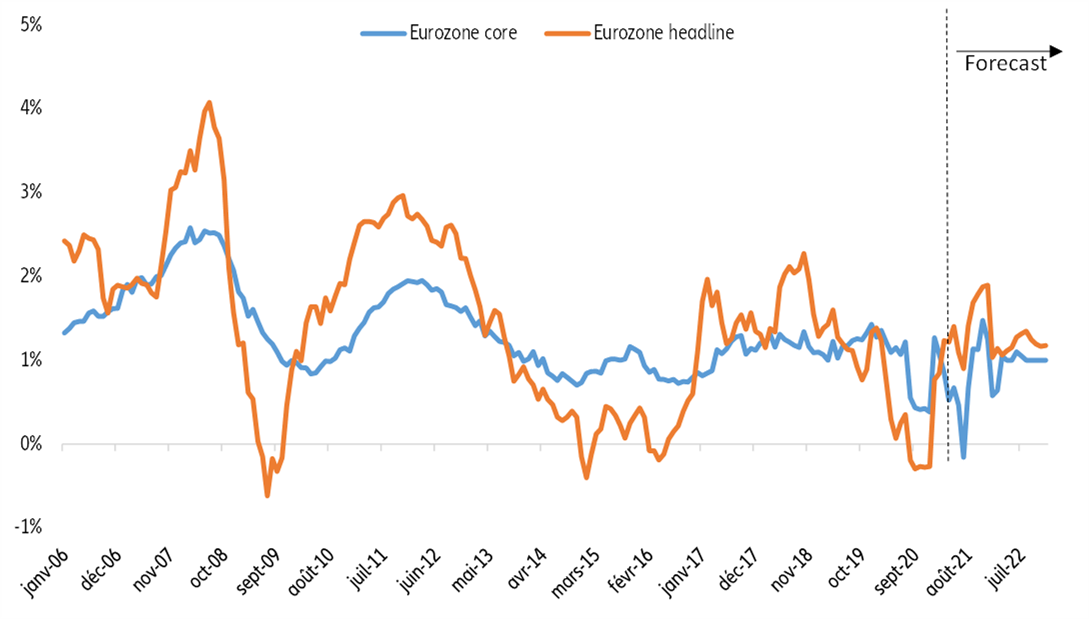

- Will Covid-19 be the inflation game-changer? We are firmly in the “reflation” not “inflation” camp: expect a temporary inflation overshoot in the coming months, rather than consumer prices galloping out of control. While initially the economic setback in H1 2020 stoked deflationary fears, with inflation rates across most OECD countries declining to zero, the debate quickly shifted to the risk of the Covid-19 crisis ringing in the end of the low inflation era, as we first noted in fall 2020. We do expect inflation rates to re-accelerate notably in 2021, thanks to (i) the recent input cost bonanza, driven above all by strained supply chains and recovering commodity prices; (ii) higher services inflation along with the economic reopening in H2 and (iii) strong pandemic-related roller coaster base effects. But these are transitory drivers and their impact should fade as the economic recovery advances. Inflation will hence only stage a temporary overshoot in the US and briefly hit the ECB’s “below, but close to, 2%” target in the Eurozone in 2021.

- But what about the wild cards that the Covid-19 crisis has dealt? We demystify the four horsemen of the inflation apocalypse:

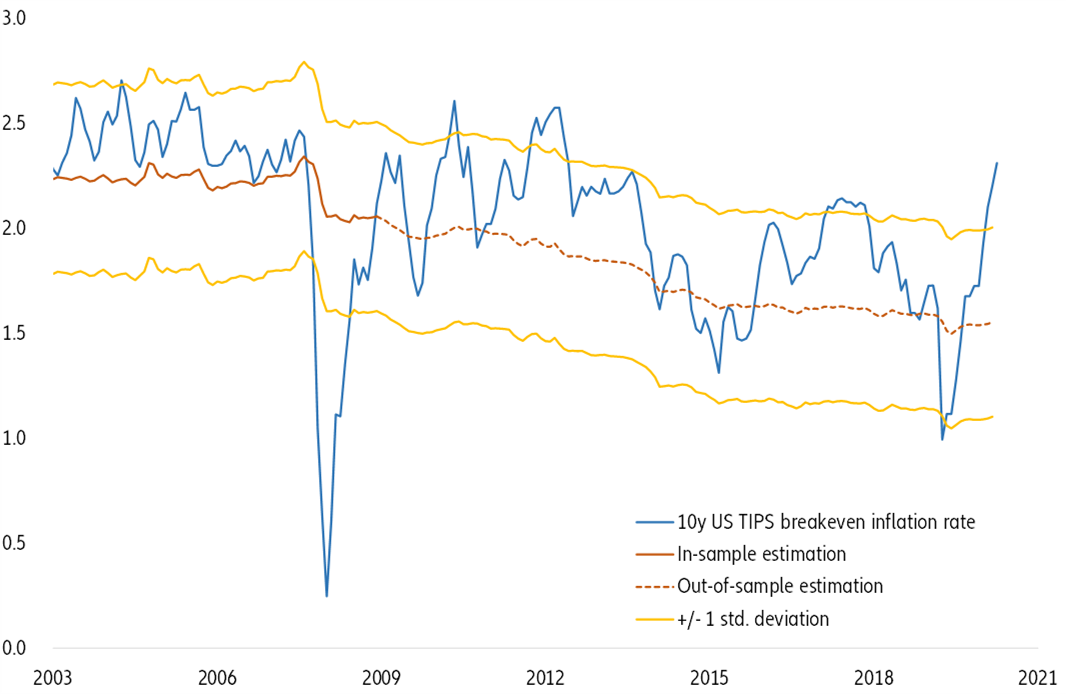

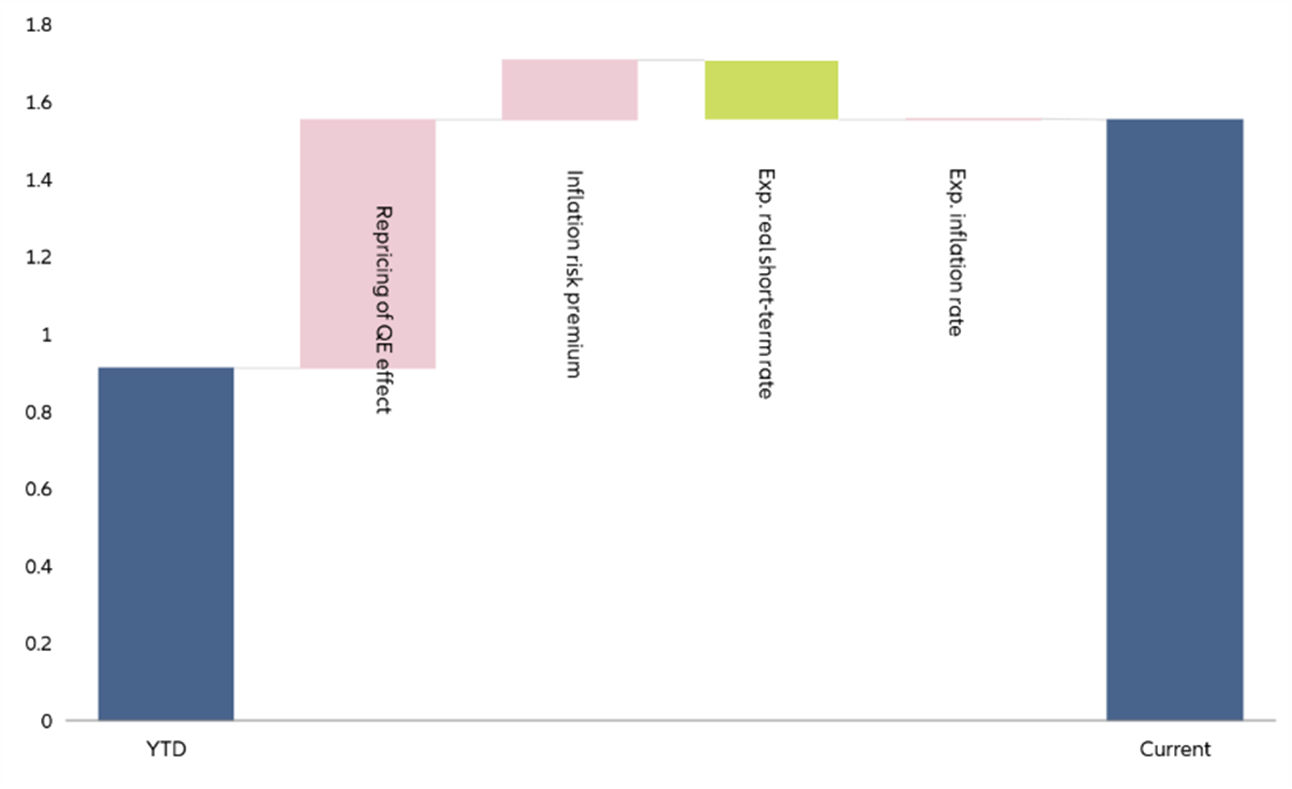

- Markets are sounding the inflation alarm! Market-based measures of inflation need to be interpreted with caution. Actually we think markets are overreacting to the reflation story on the back of taper phantasies rather than developments in the real economy. Our proprietary model for 10y US breakeven inflation rates based on a direct relationship be-tween realized monthly inflation rates (smoothed) and market-based inflation expectations currently shows a remarkable overshoot. Trading at 2.3%, 10y US breakeven inflation lies more than one standard deviation above the fair value estimated at 1.5-1.6%, severely limiting the fur-ther upside potential.

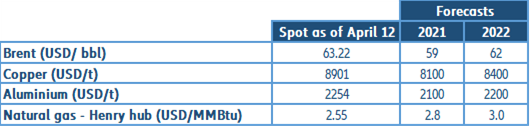

- The recent input price bonanza is a harbinger of galloping consumer price inflation! Far from representing a new super-cycle, we think it rep-resents temporary challenges around the economic restart. While we do expect input prices to consolidate at current elevated levels in the sec-ond half of this year, largely unclogged supply chains and normalizing demand will see input prices settle at a lower price on average in 2022, compared to the start of 2021, so that positive base effects should re-verse and keep a lid on price pressures.

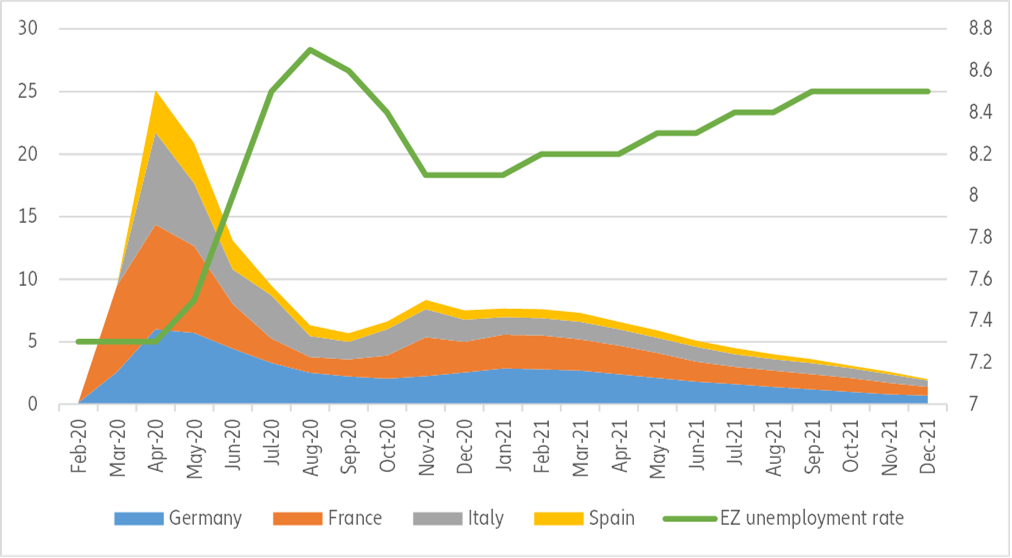

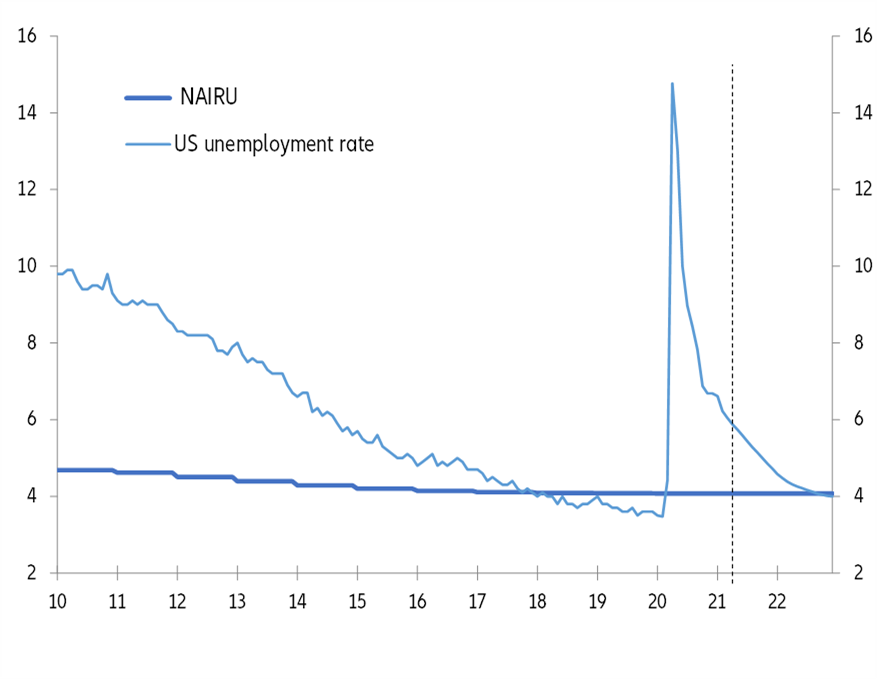

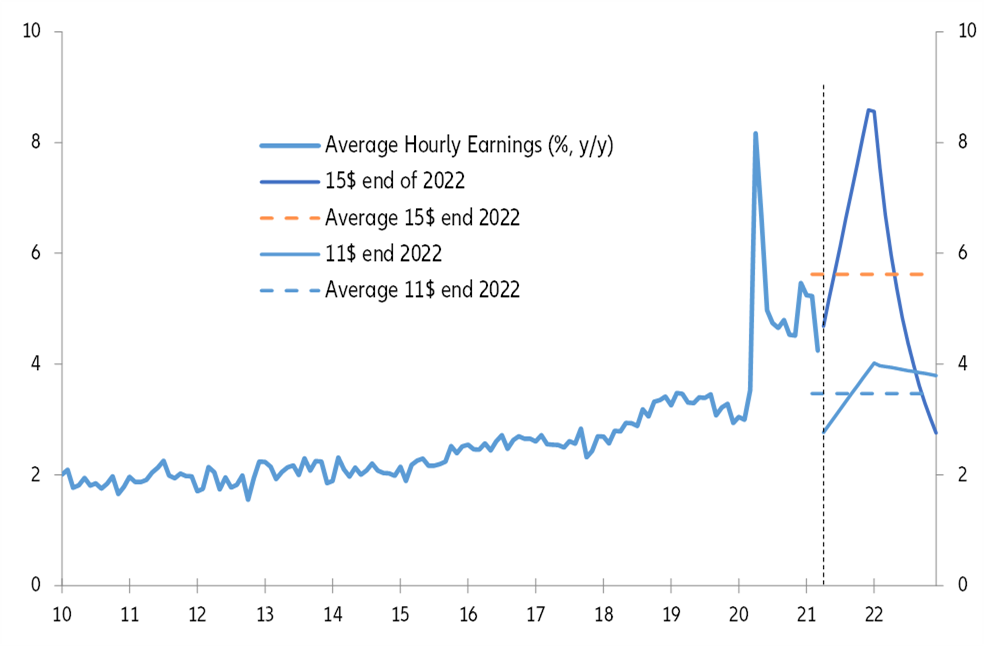

- A looming wage-price-spiral is certain to transport us straight back to the 1970s! The sharp rebound will provide some much needed tailwind to labor markets, but cleaning up the Covid-19 economic legacy will take some time. Subdued labor market prospects in the Eurozone should keep a firm lid on wage growth (below 3%) in the medium-term. Meanwhile even for the US economy – where we have seen strong jobs reports and which is likely to run notably hotter over the next few years – we expect wage growth to remain below 4%.

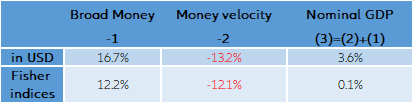

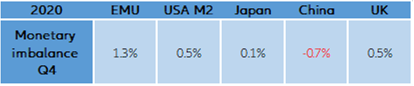

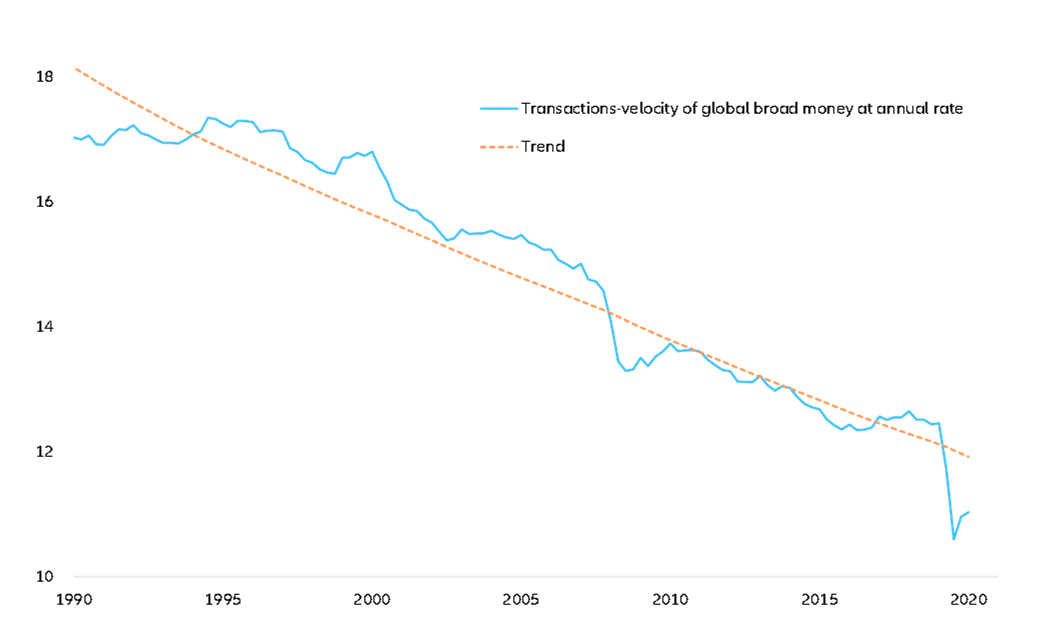

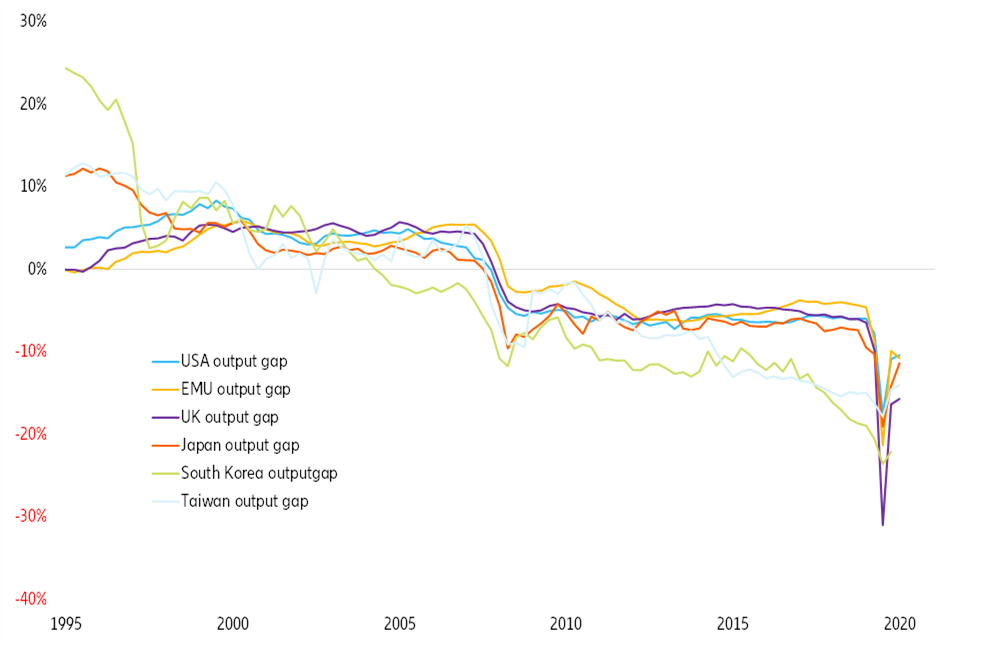

- The unprecedented policy response is bound to bring structurally higher inflation! We think it’s is a free lunch—for now. Money supply growth is a poor guide for realized inflation; the often neglected indicator to focus on is money velocity, which declined in 2020 as part of a long-term trend. Both this long-term trend and its recent acceleration reflect an increase in the demand for money for precautionary purposes. In the unprecedented scenario where money velocity would immediately revert to its long-term trend, it would immediately add 8pp to the growth of glob-al nominal GDP. In front of this very implausible assumption, there is the reality of still large output gaps that could absorb a good deal of such a demand shock before pushing inflation significantly up.