Executive Summary

- The race to find a cure for Covid-19 saw an estimated USD25bn spent on pharmaceutical R&D in 2020 alone, with half coming from the US’s “Operation Warp Speed”. After a record pace of development, the global vaccination campaign against Covid-19 is well underway, but some countries are moving faster than others. Israel, the UK and the US are clearly leading in terms of doses administered per 100 people, with 48, 11 et 7, respectively, far ahead of Italy (2.5), Germany (2.3) or France (1.8). But as the spread of new Covid-19 variants continues, we expect global vaccination campaigns to ramp up as soon as next month now that both the US and the EU have approved the Pfizer/BioNtech, Lonza/Moderna and Oxford/AstraZeneca vaccines.

- Patented drugmakers, i.e. biotech companies and Big Pharma, are set to be the winners of the game at the expense of generic manufacturers that are unable to cash in on the vaccine windfall. ‘Generic vaccines’ would require too high a financial cost in additional clinical trials and manufacturing expenditures that cheaper prices could not make up for. That’s why generic drugmakers are expected to post only +2% revenue growth in FY 2021, compared to +8% for Big Pharma and +21% for biotech drugmakers. In terms of profitability, the operating margin of generic drugmakers is expected to remain below 10% on a global average in 2021, versus nearly 30% for Big Pharma and a lavish 45% for biotechnological companies. However, the latter two segments will still need to watch out for pressure to lower drug prices and (much) less profitable drug wholesalers also wanting their share of the pie.

- In the long-run, the success of previously unknown biotechnological drugmakers, notably Moderna and BioNtech, could be a game-changer for pharmaceuticals as a whole. Barring any unexpected side effects in the long run, the Covid-19 vaccines created using mRNA technology could be the disruption needed in other therapeutic fields, including oncology, a five times bigger market than vaccines. In the future we might see (currently small) biotechnological companies swallowing the world’s largest drugmakers eventually, instead of the other way around. Unlike Big Pharma however, biotech companies often lack knowledge in running drug manufacturing plants. Moreover, there is a huge difference in size: the world’s 13 largest drugmakers – i.e. Big Pharma - account for about USD500bn of total revenues compared to near USD100bn for the 15 largest biotech companies. Partnerships between the two are hence the usual way biotech startups break into the pharmaceutical market, as seen in the collaboration between Pfizer and BioNtech.

The Covid-19 crisis puts vaccine production in the spotlight

After an estimated USD25bn invested in pharmaceutical R&D and a record pace of development, the global vaccination campaign against Covid-19 is well underway. But some countries are moving faster than others: Israel, the UK and the US are clearly leading the race in terms of doses administered per 100 people, with 48, 11 et 7, respectively, far ahead of Italy (2.5), Germany (2.3) or France (1.8).

As the spread of new variants continues, it is all the more urgent to pick up speed. We expect vaccination campaigns to ramp up across the globe as soon as next month, now that both the US and the EU have approved the Pfizer/BioNtech, Lonza/Moderna and Oxford/AstraZeneca vaccines. We also expect the EMA to grant the approval of the German CureVac and the American J&J vaccines by next spring. China’s and Russia’s vaccines also shouldn’t be disregarded since the former is set to be distributed across a few emerging countries.

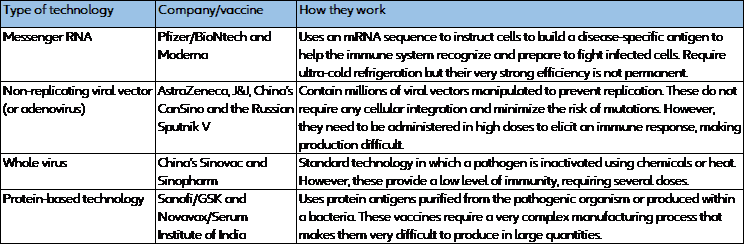

Table 1: Different technologies in use for Covid-19 vaccines

Sources: Allianz Research, Euler Hermes, S&P

Vaccines share several common points with the broader drug manufacturing industry: (i) Significant barriers to entry, (ii) long production timelines, (iii) a high level of copyright protection, (iv) large regulatory requirements and (v) low sensitivity to the economic cycle. However, there are five key differences:

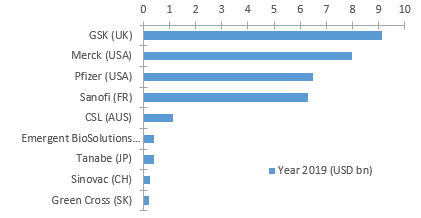

-The vaccine market is oligopolistic (Figures 1 and 2). The global vaccine market generated around USD35bn of revenues in 2019, accounting for 3% of the USD1.100bn global drug market. Historically, the four main players have been GSK (UK), Merck (US), Pfizer (US) and Sanofi (France), which together usually account for 80% of total vaccine revenues every year. The next biggest vaccine players are lesser known: CSL (Australia), Tanabe (Japan), Sinovac (China) and Green Cross (South Korea).

Figure 1: Yearly revenues of the largest vaccine manufacturers

Sources: Bloomberg, S&P, EvaluatePharma

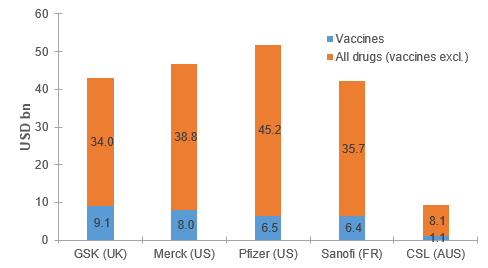

In comparison, world cancer drug sales – all related to the therapeutic area of oncology - were estimated at USD140bn in 2019. To say it another way, the population base of healthy individuals for preventative vaccines is much larger than for curing drugs. Besides, they often target younger people, focusing on childhood diseases. As a result, vaccines are usually considered as a volumes market more than an expensive segment.

Figure 2: Breakdown of 2019 revenues by company

Sources: Bloomberg, S&P, EvaluatePharma

- Vaccines enjoy (very) limited competition from other types of medicines. Consolidation among Big Pharma has slashed the number of global drugmakers over the last two decades and this trend has been even stronger for vaccine manufacturers. Economies of scale resulting in vaccines manufactured in ‘captive’ plants and the tight standards demanded by regulators are significant barriers to entry.

- Unlike other patented drugs, which grapple with copycats as soon as they become off-patent, vaccines appear to be immune to generics’ competing offers. Most of the 15 highest revenue-generating vaccines are actually off-patent but ‘generic vaccines’ – as well as biosimilars - would require too high a financial cost in additional clinical trials and manufacturing expenditures that cheaper prices could not make up for. Patented drugs manufactured out of chemical combinations are always a target for generic makers because they do not require any further clinical trials or a dedicated plant for approval by regulatory agencies.

- Vaccines benefit from substantial help of governments and humanitarian organizations such as UNICEF and WHO. These play an active role in shoring up the required investments for new vaccines and make it possible for vaccines to be sold not only in mature but also developing countries. Moreover, academic and public institutions are usually better positioned to get additional funds in the development of vaccines against epidemics whether they are short-lived or not and to bring private drug-makers into these development projects as a result. Public health institutions also often promote vaccines for national health or national security interests. Governments also account for a large part of vaccine purchases, especially for ones against childhood diseases. The benefits of governments’ substantial financial aid to laboratories is offset by their usual demand of getting a reasonable enough selling price. Public institutions also succeed in asking for low vaccine prices for poor countries because they benefit from significant pledged resources, as is the case for the public-private partnership Gavi whose total funds amount to USD11bn.

- Since they are (very) few within the pharmaceutical market, vaccine makers enjoy good enough profitability on newer and higher-priced vaccines, helped by the lifespan of their products beyond patent expiration. However, vaccine prices usually remain (much) below the dose price of patented drugs such as antivirals. For instance, Gilead sells its Remdesivir drug at around USD2,000 while Moderna’s Covid-19 vaccine price is allegedly sold around USD25 in mature countries. As part of the “Warp Speed” operation in the US, the government said that it would pay the BioNtech/Pfizer partnership USD2bn to produce and deliver 100 million doses of their Covid-19 vaccine, putting the average cost at USD20 per dose. The pricing power of vaccines, more limited than expected, is made up for by the huge volumes of sales across population, especially if related to a global health problem. As a result, despite lower prices, vaccine makers can still reap the fruits of their R&D.

A game-changer for biotech firms, but not generic drugmakers

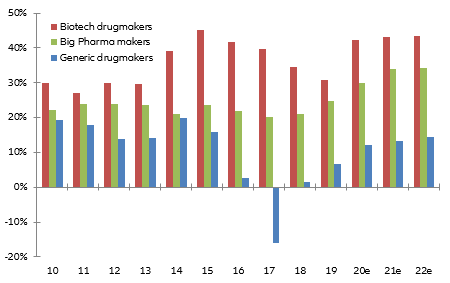

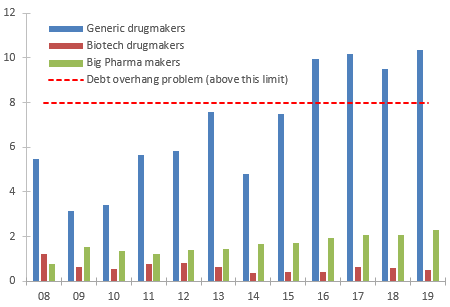

To find out what the Covid-19 vaccination campaign means for the pharmaceutical players, we first need to make a clear distinction between generic and patented drugmakers from a financial point of view. Indeed, the three main players across the manufacturing field of medicines have not enjoyed the same level of profitability (Figure 3) since the beginning of the last decade.

In terms of operating margin, generic makers appear to be three times less profitable than patented drug manufacturers, either biotechnological or Big Pharma .

Figure 3: Average operating margin by type of drugmaker

Sources: Bloomberg, Euler Hermes, EvaluatePharma

More interestingly, generic drugmakers have been almost five times more leveraged than either biotech or Big Pharma makers since 2016 (Figure 4). Their indebtedness ratio calculated by ‘financial debts / total equity’ amounted to 140% in the last two years. This high indebtedness has stemmed from the struggling behemoth TEVA whose long-term financial debt ballooned from USD8bn to USD30bn back in 2016 due to huge operating losses and the (very) difficult merger of Actavis.

Figure 4: Leverage by type of drugmaker

Sources: Bloomberg, Euler Hermes

All in all, generic drugmakers are far away from taking advantage of the vaccine boon. They also have to cope with the absence of new patent cliffs in the two years ahead. So, notwithstanding TEVA being closer to leaving behind its strong difficulties, we do not expect generic drugmakers to see their profitability surging going forward. The irony here is that in the middle of last decade itself they were seen as the way to cut back on too high drug expenditures worldwide, especially across mature countries, which is no longer a priority for governments.

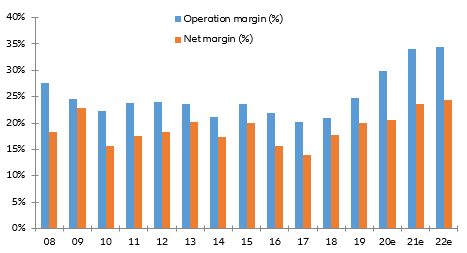

In contrast, we expect patented drugmakers, especially biotechnological firms, to hit the jackpot. However, there is a distinction to be made between Big Pharma (Figure 5) and biotechnological laboratories, firstly because Big Pharma accounts for more than half of global pharmaceutical sales and secondly because biotechnological firms are usually much less known by the public, except for Gilead and Amgen, and more recently Moderna and BioNtech of course.

Before the pandemic, Big Pharma’s average operating margin evolved around 20% and would hardly rise above this level (Figure 5). But the Covid-19 crisis should enable them to break through this limit: we expect their profitability to surge to 34% as soon as next year, representing a ten-point rise in operating margin.

Figure 5: Average profitability rate for the 11 largest drugmakers

Sources: Bloomberg, companies, consensus estimates, Euler Hermes

The new vaccines require most of Big Pharma’s manufacturing base to work at full speed, taking full advantage of economies of scale. Big Pharma is also in a better position than biotechnological start-ups to negotiate a right vaccine price from governments and public institutions, and more comfortable with supporting a high Working Capital Requirement due to the close link with public client payments. The drawback is the fate of liability issues that manufacturing laboratories are theoretically in charge of. As technologies used for the Covid-19 vaccines are mostly innovative, notably the mRNA one, drugmakers should take care of putting some cash reserves aside to address any future penalties in case undesirable secondary effects surge.

The second category of patented drugmakers, biotechnological laboratories, are the real winners and could even be entering a golden era if governments make it easier to gain approval for their innovative drugs. In 2020, these companies proved their agility and flexibility, developing Covid-19 vaccines on a very short timeline instead of the average of eight years. Biotechnological laboratories are poised to benefit from the global vaccination campaign as the number of people to be vaccinated is more than enough to make up for a low selling price, especially if these vaccines need to be taken once a year as is already the case for classical flu vaccines.

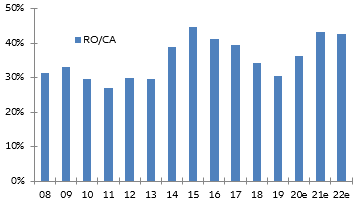

Their success could see new investors financing R&D or other spending and they even could turn the pharmaceutical business model upside down, taking over Big Pharma players and not the other way around. The biotechnological drug segment is expected to boast a copious 40% operating margin as soon as this year itself and to keep up this level of profitability next year (Figure 6).

Figure 6: Largest biotech drugmakers

Sources: Bloomberg, companies, consensus estimates, Euler Hermes

More importantly, through the innovative mRNA technology, some of these biotechnological firms might be closer to finding out a revolutionary way of curing much more deadly diseases, including cancers. This would be a kind of Copernican revolution across that could mark Peak Big Pharma. However, biotechnological companies usually lack enough producing plants and manufacturing factories. So they give product licenses to Big Pharma as well as subcontractors, which is why they are often bought out eventually.

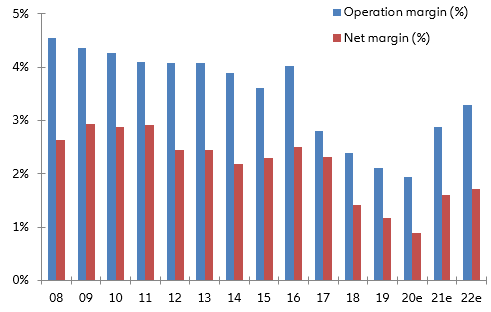

Overall, Big Pharma has already started cashing in on the Covid-19 vaccine fallout but they would need to be wary of new entrants in the game that hold up the independence of their shareholding structures. Big Pharma is known to be generous in its distribution of dividends to keep shareholders in place but this has made their financial structure weaker. The skyrocketing price they would have to pay for taking over any successful biotechnological firms could make them too highly indebted. Big Pharma should also be worried by the downstream part of the industry, namely the drug wholesalers (Figure 7). Hardly profitable over the last 10 years – and 40 times less profitable than biotechnological drugmakers in terms of operating margin - drug wholesalers aren’t able to take their share of the pie as they are forced by governments into selling vaccines at as low a price as possible.

Figure 7: Average profitability rate for 11 largest drug wholesalers

Sources: Bloomberg, companies, consensus estimates, Euler Hermes

Sector Advisor for Retail, Technology and Household