What Does Accounts Receivable Insurance Cover?

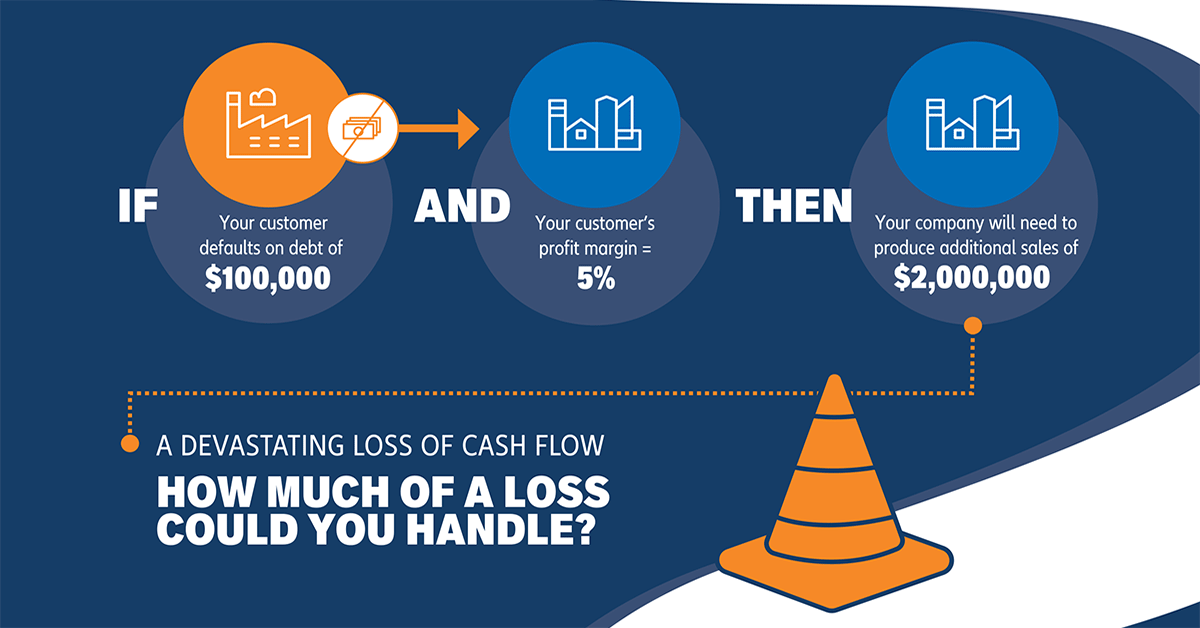

Accounts receivable insurance is designed to protect your business from non-payment of commercial debt. That means that if a customer does not pay you because they go bankrupt or insolvent, or if they simply do not pay on time, an accounts receivable insurance policy will pay you up to the insured credit limit. Accounts receivable coverage helps you protect your capital, maintain your cash flow and secure your earnings while extending your competitive credit terms and helping you access more attractive financing.

There are four types of accounts receivable insurance:

- Whole Turnover – This type of accounts receivable coverage protects your business against non-payment of commercial debt from all customers. You can choose to have this coverage apply to all domestic sales, international sales or both.

- Key Accounts – With this type of insurance, you choose to insure your largest customers whose non-payment would pose the greatest risk to your business.

- Single Buyer – If most of your transactions are with one customer, you can choose accounts receivable coverage that insures against potential default from just that customer.

- Transactional – This form of accounts receivable insurance coverage protects against non-payment on a transaction-by-transaction basis and is best for companies with few sales or only one customer.

Benefits of Protecting Accounts Receivable Insurance

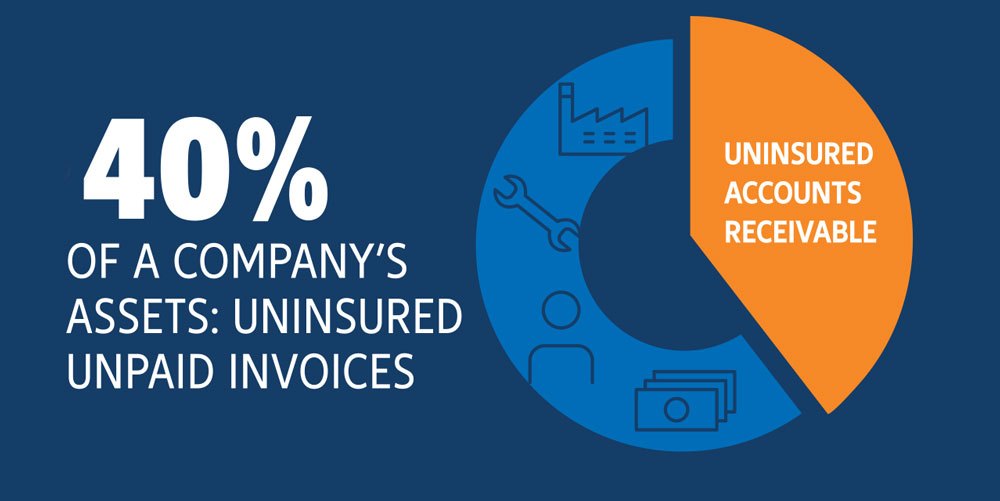

From the definition of accounts receivable insurance presented above, you know that this tool helps companies protect themselves against non-payment risks and maintain their balance sheets.

However, while your accounts receivable coverage policy is a shield, it can also act as a sword to help you grow sales and obtain better financing terms.

Expand Sales with Receivables Insurance

An accounts receivable insurance policy allows companies to feel secure in extending more credit to current customers, or to pursue new, larger customers that would have otherwise seemed too risky. The protection it provides allows a company to increase sales to grow their business.

Insured companies can sell on open account terms where they may have previously been restrictive or only sold on a secured basis.

“Accounts receivable insurance has allowed us to take on customers and transactions we wouldn’t have felt comfortable taking on by ourselves,” commented Mike Libasci, President of International Fleet Sales, in our case study, Reducing Concentration Risk Helped Drive Growth. “It has not only allowed my company to take on larger deals, but be more liberal in terms, and the result has gone straight to our bottom line.”

Gain a Competitive Edge by Offering Better Terms

With access to extensive knowledge about the creditworthiness of new and existing customers, companies with accounts receivable insurance can prevent losses. Companies can improve their internal procedures, make credit decisions quickly, and gain a major competitive advantage by extending more attractive offers to customers and prospects. Overall, this allows companies to sell more in foreign markets which means more revenue opportunities.

“This is a fast-paced business, and companies want an answer quickly. If you wait days or weeks, a deal can be gone,” said Ori Ben-Amotz, Chief Financial Officer of Hadco in An Efficient Credit Management Process Accelerates Business Growth. “We were not able to make quality decisions, especially under pressure. We were over conservative and held back limits.

“With [accounts receivable] insurance, we don’t have to ask for cash up front or payment on delivery, which makes us much more competitive. This is the tool we needed to take more market share from our competitors.”

Get Better Financing with Accounts Receivable Coverage

Banks typically limit what you can borrow based on the perceived risk of international receivables, concentration of sales to large customers, or age of certain accounts.

When your domestic and international receivables are covered by an accounts receivable insurance policy, you may be able to borrow more — often at more favorable rates.