Updated on 27 August 2025

Companies typically view insurance as a safety net, a cost to mitigate risk. But what if it could also be a catalyst for growth? This data deep dive explores how Trade Credit Insurance (TCI) transforms from a protective tool into a powerful growth engine, using insights and real-world data from the Allianz Trade guide.

Summary

Key takeaways

- Growth catalyst: TCI allows you to safely increase sales by extending more credit and expanding to new buyers.

- Real-World profits: A TCI policy can lead to a significant increase in gross profit, as demonstrated by the $60,000 gain on a single account.

- Better financing: Insured receivables are more attractive to banks, leading to better loan terms and increased working capital.

- Global expansion: TCI protects against export risks, giving you the security to expand into new international markets.

Introduction: The TCI growth engine

While protecting against bad debt is the primary function of Trade Credit Insurance, its true value lies in its ability to empower companies to grow sales and expand into new territories with confidence. It’s a tool that provides you with the security to do more.

Data insight 1: Unlocking sales with increased credit limits

A key benefit of a TCI policy is the ability to extend more credit to existing customers and attract new, larger buyers that were previously considered too risky. The data speaks for itself. On average, a TCI policy can help you increase sales by up to 20%.

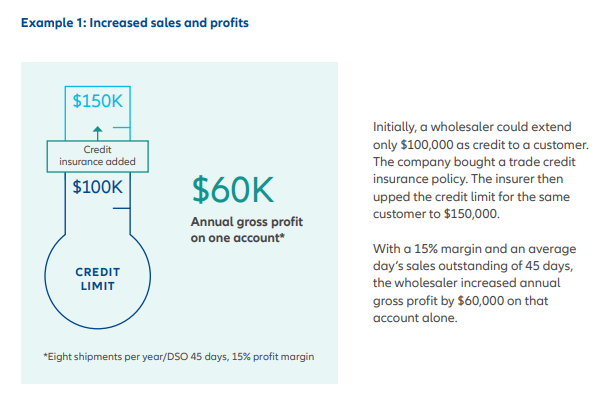

Consider the case of a wholesaler:

- Initial Status: The wholesaler could initially extend only $100,000 as credit to a customer.

- TCI Action: After purchasing a TCI policy, the insurer upped the credit limit for the same customer to $150,000.

- Result: With an average day's sales outstanding of 45 days, the wholesaler increased annual gross profit by $60,000 on that account alone.

Data insight 2: Enhancing your standing with the bank

Insured receivables are often considered stronger collateral by banks, which can lead to better financing terms. A TCI policy can help you secure better asset-based loans and free up working capital.

Here’s another data-driven example from our guide:

- The Challenge: A $25-million electronics wholesaler had a business overly concentrated on only a few active accounts, which made its bank uncomfortable.

- The Action: The company secured a TCI policy for just $25,000 to include potential payments as collateral.

- The Benefit: Assured by the TCI policy, the bank increased its loan advance rate from 80% to 85%. This action alone provided the wholesaler with an extra $400,000 in working capital.

Data insight 3: Expanding confidently into new markets

For exporters, a TCI policy provides a significant advantage by allowing them to sell on open-account terms, which can be a key differentiator from competitors. With protection against export risks and valuable market knowledge, you can make more accurate growth decisions.

Conclusion

Trade Credit Insurance is not merely an expense; it is a strategic investment in your company's growth. By turning a volatile risk into a predictable cost, it frees up capital and provides the confidence to seize new opportunities, both with existing customers and in new markets.

Our expertise and commitment

Allianz Trade is the global leader in trade credit insurance and credit management, offering tailored solutions to mitigate the risks associated withbad debt, thereby ensuring the financial stability of businesses. Our products and services help companies with risk management, cash flow management, accounts receivables protection, Surety bonds, business fraud Insurance, debt collection processes and e-commerce credit insurance ensuring the financial resilience for our client’s businesses. Our expertise in risk mitigation and finance positions us as trusted advisors, enabling businesses aspiring for global success to expand into international markets with confidence.

Our business is built on supporting relationships between people and organizations, relationships that extend across frontiers of all kinds - geographical, financial, industrial, and more. We are constantly aware that our work has an impact on the communities we serve and that we have a duty to help and support others. At Allianz Trade, we are strongly committed to fairness for all without discrimination, among our own people and in our many relationships with those outside our business.