Updated on 27 August 2025

Trade Credit Insurance can seem complex, but understanding its core functions is key to leveraging its benefits. This FAQ-style guide provides clear and concise answers to your most pressing questions, based on insights from the Allianz Trade Guide to Credit Insurance.

Summary

Key takeaways

- It's a safety net: TCI protects you from unpaid debt.

- It's a growth tool: It provides the confidence to sell more and expand into new markets.

- It's a complete solution: It includes risk monitoring, credit information, and debt collection.

- It's a strategic partner: Allianz Trade’s global expertise and robust data network make us a leader in the industry.

What is trade credit insurance?

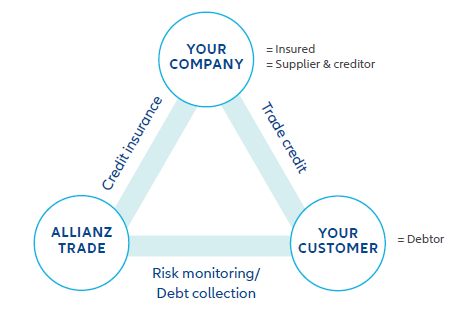

Trade Credit Insurance is an insurance policy that protects a seller against losses from unpaid trade debt. It ensures that invoices will be paid, allowing you to focus on growing your business.

How does a trade credit insurance policy work?

The process is straightforward:

- Creditworthiness Review: We first review your customers' financial health and their ability to pay.

- Credit Limit Assignment: We then assign a specific amount (credit limit) that will be paid to you if your customer fails to pay, which we call an indemnity.

- Ongoing Monitoring: Throughout the policy period, we monitor your risks and alert you when a customer is in financial trouble, so you can act early to avoid a loss.

- Payment and Collection: If your customer doesn't pay, we will pay you instead and can also help you collect the unpaid debt.

What services does it provide beyond paying claims?

A TCI policy is not just for paying claims; its goal is to help policyholders avoid foreseeable losses in the first place. Allianz Trade provides key services including:

- Credit Information & Risk Assessment: We provide market intelligence and monitor the financial health of your customers.

- Debt Collection: We can also assist in collecting unpaid debts, often while helping you maintain the customer relationship.

How does the claims and collections process work?

If a customer fails to pay you on time, you simply pass their details to our Collections team. Our specialists contact your customer, and if a legal route is needed, we can handle that for you as well. Our collections network operates in 170 countries.

Why choose Allianz Trade?

- Global Authority: As part of the Allianz Group, our name is taken seriously. We are the #1 player in trade credit insurance globally, with a 34% market share.

- Unmatched Expertise: We have over 120 years of experience and a proprietary intelligence network that analyzes over 80 million corporates' solvency daily.

- Comprehensive Service: We are a one-stop shop for all your claims and collection needs.

Conclusion

Trade Credit Insurance is an essential tool for any business looking to secure its trade and grow with confidence. It provides a comprehensive solution for managing and mitigating credit risk, backed by global expertise and powerful data.

Our expertise and commitment

Allianz Trade is the global leader in trade credit insurance and credit management, offering tailored solutions to mitigate the risks associated withbad debt, thereby ensuring the financial stability of businesses. Our products and services help companies with risk management, cash flow management, accounts receivables protection, Surety bonds, business fraud Insurance, debt collection processes and e-commerce credit insurance ensuring the financial resilience for our client’s businesses. Our expertise in risk mitigation and finance positions us as trusted advisors, enabling businesses aspiring for global success to expand into international markets with confidence.

Our business is built on supporting relationships between people and organizations, relationships that extend across frontiers of all kinds - geographical, financial, industrial, and more. We are constantly aware that our work has an impact on the communities we serve and that we have a duty to help and support others. At Allianz Trade, we are strongly committed to fairness for all without discrimination, among our own people and in our many relationships with those outside our business.