What is trade credit insurance?

What does trade credit insurance cover?

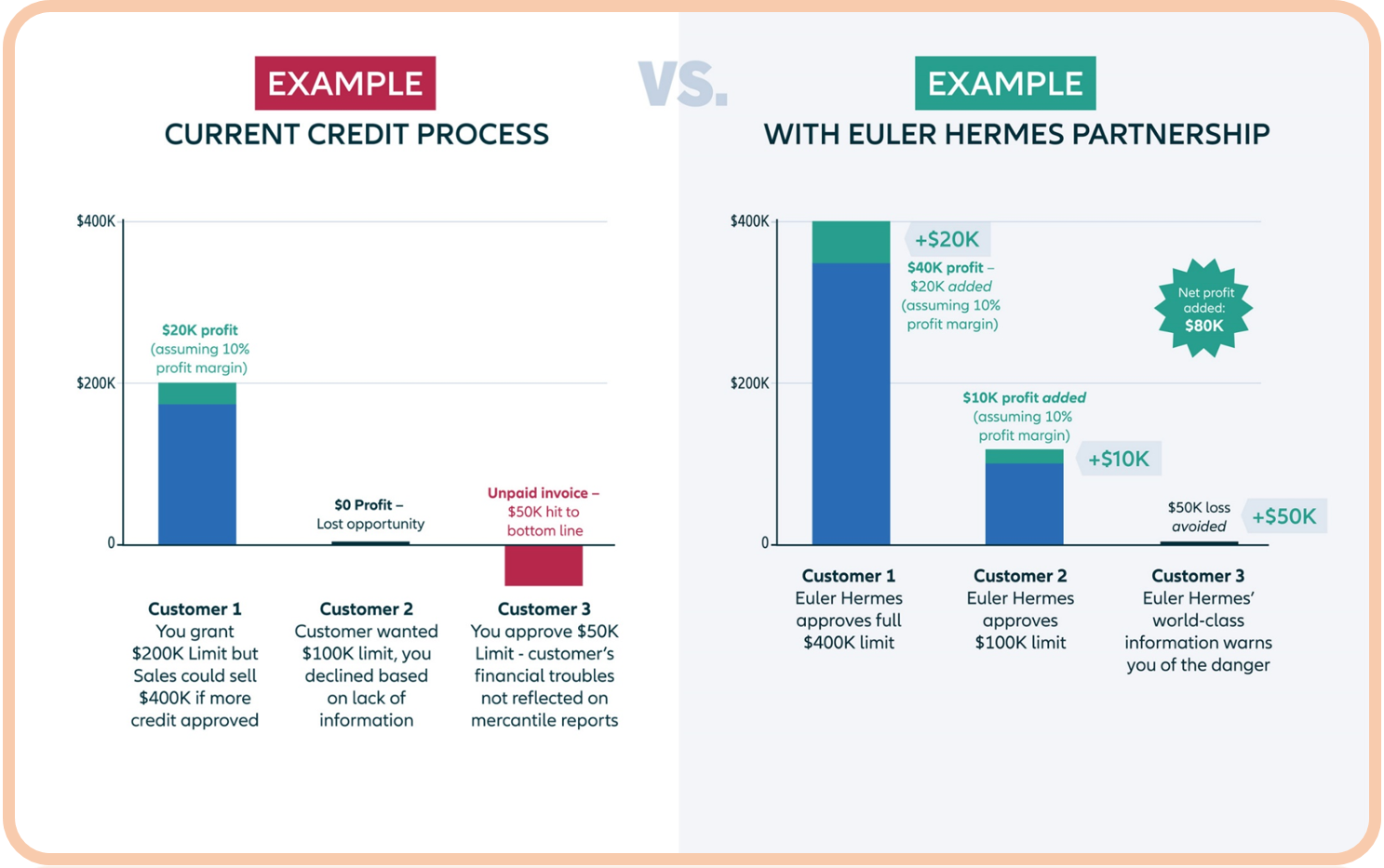

It protects businesses from non-payment of commercial debt. It covers your business-to-business accounts receivable. If you do not receive what you are owed due to a buyer’s bankruptcy, insolvency or other issue, or if payment is very late, the policy will reimburse you for a majority of the outstanding debt. This helps you protect your capital, maintain your cash flow and secure your earnings while extending your competitive credit terms and helping you access more attractive financing.

With trade credit insurance, you can reliably manage the commercial and political risks of trade that are beyond your control. It can help you feel secure in extending more credit to current customers or pursuing new, larger customers that would have otherwise seemed too risky.

To learn more about "Bad Debt Reserves vs. Factoring vs. Letter of Credit vs. Credit Insurance". CLICK HERE

To explore our "Resource Library". CLICK HERE

Case Studies

YOOV

VIKUDHA

How does it work?

Customers Health Check

Credit limit calculated

Business as usual

Trading limit updates

Business building

Making a claim

We investigate and indemnify you for the insured amount if policy terms have been met.

Top reasons to buy

Protection

Peace of Mind

Competitiveness

Funding

Profitability

Cash Flow

Information

Growth

Solutions by company size

-

SMEs

-

Large-sized Companies

-

Multinational Corporation (MNC)

Trade credit insurance policies and features

-

Corporate Advantage

-

World Program

-

Excess of Loss (XoL)

-

Transactional Cover

Why Euler Hermes?

DEDICATION

Clients worldwide

INSIGHTS

Businesses monitored

ASSURANCE

by Standard & Poor's

Let's Get In Touch Today!

Call us: +65 6589 3793

Whatsapp us: +65 8126 7961