3 ways in which Covid-19 has impacted CFOs

It is a word that has been used countless times in the news since March 2020 – but we do indeed live in ‘unprecedented’ times. Amid the global Covid-19 pandemic, businesses and individuals have had to adapt to a new way of operating and working in the face government lockdowns and social distancing.

As well as managing the crisis on a day-to-day basis, business leaders have had to reassess exactly how they will take their organisations forward, and CFOs and the finance function will have a critical role to play.

In February 2020, we surveyed 847 senior financial decision-makers at organisations across Western Europe to get their take on the business world at the time, and what this meant for the future. Little did we know how Covid-19 would change the way we live and work in such a remarkably short period of time.

The outbreak did, however, present us with an unexpected opportunity. By conducting a second survey in May, we were able to directly compare the attitudes of finance leaders prior to Covid-19 with how they felt months into the pandemic.

You can access our 2020 survey report The Finance Leader of Tomorrow by clicking here .

CFO confidence in perspective

Since the World Health Organistion (WHO) officially declared Covid-19 a pandemic on 11 March, numerous media reports have examined its impact on business confidence. It comes as no surprise whatsoever that, generally, business leaders are less confident than they were prior to the outbreak.

However, while there clearly is increased uncertainty, our survey also showed that many CFOs remain optimistic about their businesses, their personal roles and their ability to steer the finance function in the new normal.

This may well be because in the first couple of months after the pandemic hit, CFOs had little idea of what the future looked like. However, in a report released in June 2020, only 4% of CFOs said the impact of the crisis is still difficult to assess – indicating that they have a clearer view of the road ahead.

With that in mind, here are three key observations, through a Covid lens, from CFO responses to our survey.

Confidence and optimism remain

Coming into 2020, finance leaders were largely feeling confident about the year ahead, even in the face of economic turbulence caused by issues such as Brexit. According to our survey, there was clear optimism around sales and profits – with 67% and 69% of finance leaders anticipating an improvement in sales and profitability respectively.

When resurveyed, the figures for sales and profitability fell to 52% and 48% respectively. While it would be easy to take this drop solely at face value, those numbers still represent a high level of positivity considering the massive disruption to normal working practices.

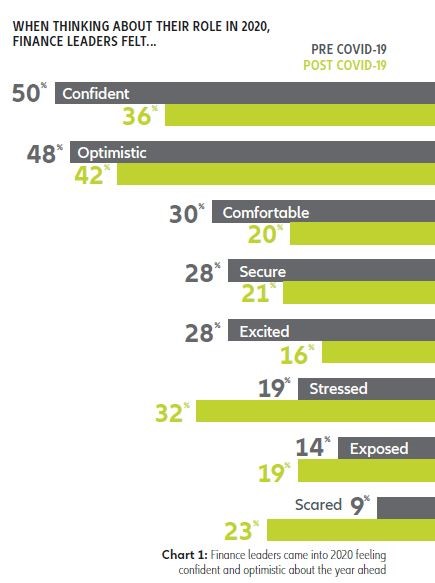

Strong business confidence in the February 2020 survey was reflected in how finance leaders perceived themselves. When asked how they felt about their role in the year ahead, confident (50%) and optimistic (48%) were the two words that featured most highly.

These figures for confidence and optimism were lower in the second survey, to 36% and 42% respectively. Compared to this, there was an understandable rise in those who felt ‘stressed’ or ‘scared’. What was significant, however, is that confident and optimistic still rated higher than any other feeling, which clearly demonstrates resilience on the part of CFOs.