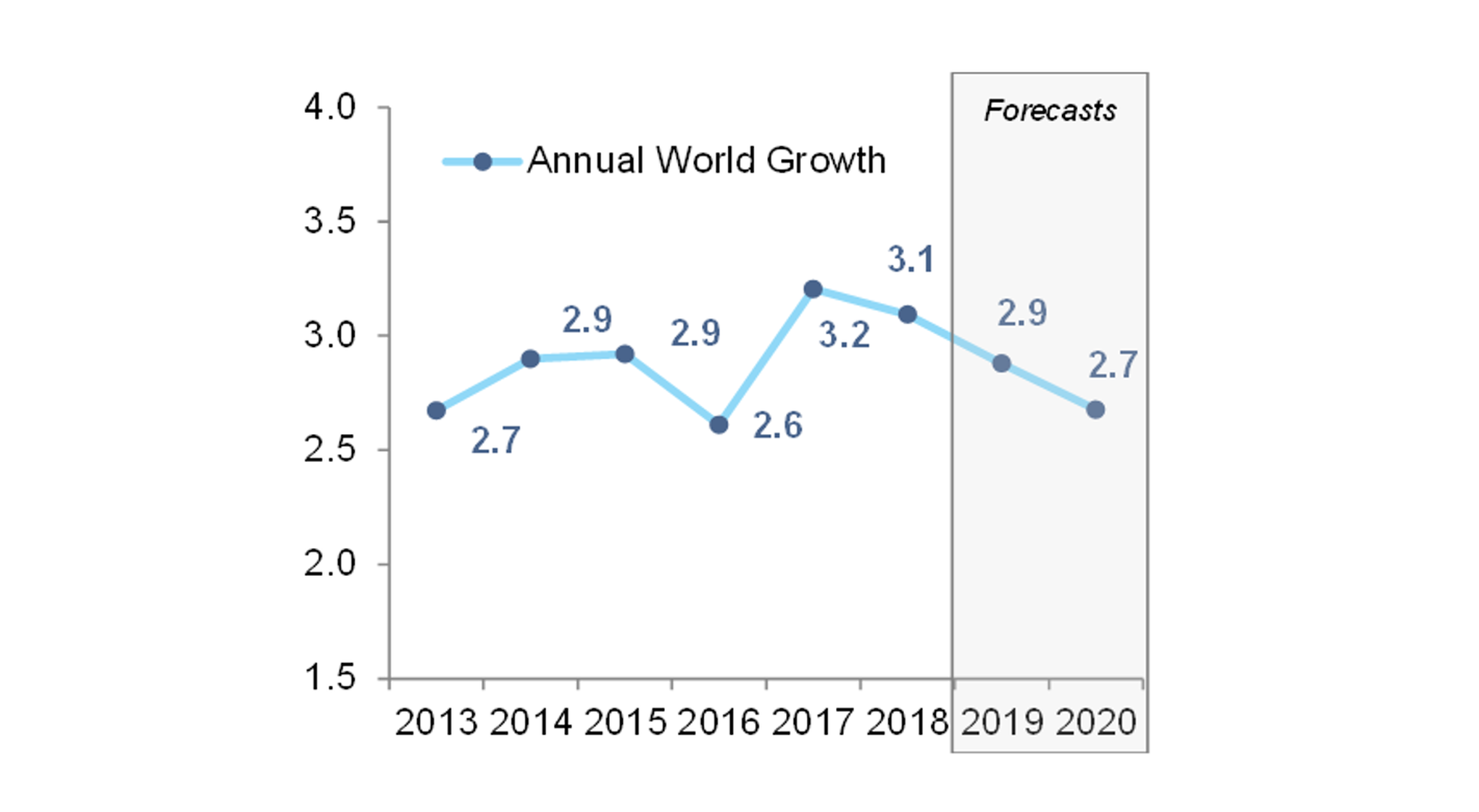

1. Growth

Global economic growth is slowing down, an evolution that can be found in the strongest economic countries too. Expectations for 2019-2020 can be adjusted by developments in trade disputes and the Brexit, but we assume a (slowed down) growth in any case.