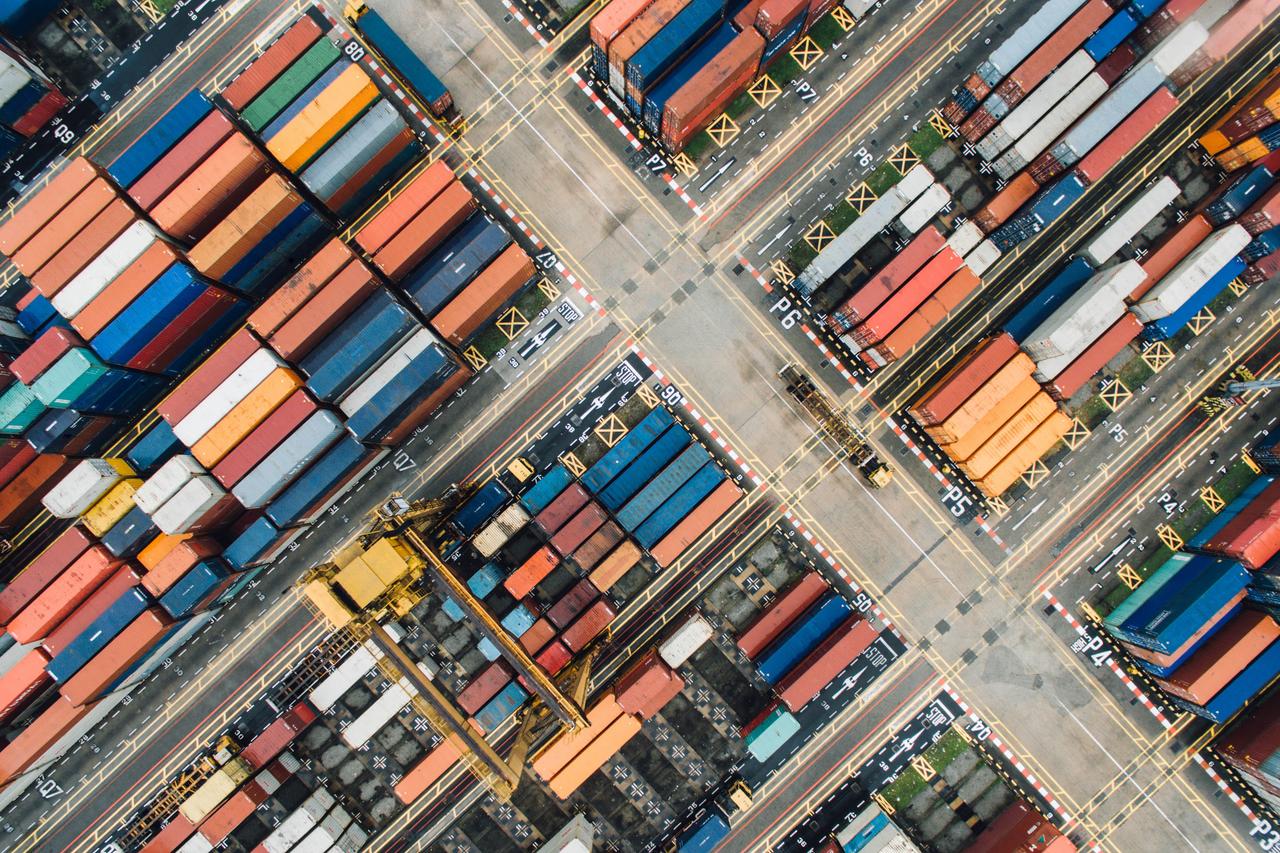

Invoice financing is a great way for small- and mid-sized firms to solve business cash flow problems, particularly in 2021 when many banks are not enthusiastic about business lending.

The UK-government-owned British Business Bank stated earlier this year that “invoice finance will play an important role in helping smaller businesses recover”.

Although simple in principle, there are many types of invoice financing, so it is essential to be briefed before buying. This Buyer’s Guide to Invoice Finance is longer than our usual articles but aims to help businesses make the right decision.

What is invoice finance? Who can benefit?

Invoice finance is simple in concept. When a company issues an invoice it gets paid almost immediately by a finance company. When the customer finally settles the company will receive the balance, minus a fee.

Typically, a company will receive 70% to 90% of the invoice value 24 or 48 hours after invoicing, depending on the payments record of their industry.

Adam Stevens, credit insurance consultant at Euler Hermes UK & Ireland, said: "If a business has a turnover of £1 million on 60-day payment terms, they're going to have more than £150,000 tied up in invoices they can't get their hands on. Invoice finance means companies can generate the cash to deploy where they most need it."

Invoice finance has a long history of helping growing businesses in the UK and Ireland, especially when banks have been reluctant to lend to businesses. Acknowledging its importance, the UK government changed the law in 2018 to make invoice financing easier. Invoice financing was brought into the Coronavirus Business Interruption Loan Scheme, the Recovery Loan Scheme, and Ireland’s COVID-19 Credit Guarantee Scheme.

One important thing to remember: this finance needs invoices on credit terms to function. Companies that don’t issue invoices, or issue invoices for immediate payment, cannot use this form of finance.

Key issues to consider when selecting invoice finance

When looking at invoice finance, there is a crucial decision to make: factoring or invoice discounting?

Factoring

is where the finance company not only advances cash against invoices, it does all the work chasing for payment.

Invoice discounting

is where the company receiving the finance retains its accounts receivables department and chases invoices for payment as usual.

Here are some pros and cons:

A question of size: If your turnover is less than £100,000 or you have less than six months of trading, factoring may be your only option. You may be able to transition to invoice discounting after you grow.

Customer relationships: If you choose to factor, then the finance company, not your finance team, will be chasing your customers for payments. They may be less charming than your own staff. You also lose the ability to offer valued customers payment leeway to further your relationship.

Do you really want an accounts payable department? If you are a lightweight company with a tight focus, you may welcome the reduced admin that comes with factoring. You raise an invoice, send it to the factoring company, get the cash, then get on with the next project.

Adam Stevens commented: "Some businesses see this as positive because they don't need a full-time credit controller within their business. If you're an infant company, maybe you don't want to pay someone to do this."

What does it say about your firm? If you raise funds via factoring, it has to be disclosed to customers. Will they worry you're running low on funds? But Adam Stevens comments: "A lot of people remember the 1990s when factoring was a dirty word because it was the lender of last resort. It's not anymore. It's an efficient way for businesses to generate cash."

Time factor: Factoring is quicker to set up. However, cancellation periods are usually longer.

Disputed invoices: These can be a headache no matter which form of invoice finance is chosen. Disrupted invoices are generally taken out of the finance programme, you will in effect have to pay back the advance made, and you and the customer will have to sort out your dispute. Invoices financing works smoothest in industries where disputes are unusual.

CHOCC and other new developments

The market for invoice financing is changing fast as new players arrive and some traditional ones leave. New variants help ease some of the dilemmas above.

For instance, some factoring providers now act almost as if they were your own finance team. The factoring relationship will be formally disclosed, but if your customer rings the number on your invoice, they will answer with your company's name.

One newish hybrid product is known as CHOCC (customer handles own credit control), also sometimes known as CHOCCs or CHOC. You invoice customers and chase credit as usual, but the payments go into a bank account run by the invoice provider. This can be useful for firms with many low value invoices, which can incur high handling charges in traditional factoring.

Some providers offer selective invoice finance, allowing you to discount invoices from only some of your customers, or even pick individual invoices to discount. This can be useful if you have a new, large customer on lengthy terms or only need occasional financing, for instance to stock up ahead of Christmas.

These extra options make invoice financing more useful than ever, but thorough research is needed before signing up.

How much does it cost?

Typically, a service fee is levied as a percentage of business turnover plus a discount margin, typically ranging from 0.5% to 4%, which is equivalent to the interest rate. There are fees for setup, which can be complex and need careful scrutiny. For selective invoice finance, fees may be levied if the volume of invoices discounted falls below a certain threshold.

One additional issue to examine: what is the cancellation period if you find the policy isn't right or no longer needed? Fees for early termination vary widely.

What if the customer doesn’t pay?

A vital question. Invoice discounting protects you from late payment but it offers no protection against non-payment. If the customer goes out of business, it will be taken out of your facility balance.

Invoice finance providers typically for an additional fee will add bad debt protection. But it's possible to get trade credit insurance from a different provider—and there may be excellent reasons to do so.

First, shopping around may yield a better price.

Second, you can personalise. Trade credit insurance from a specialist provider can be customised for sectors with specific needs, such as media, recruitment, contractors or the travel industry. This can include options such as getting paid if a customer fails before you have issued an invoice but have incurred costs for work-in-progress. You can also broaden cover, for instance getting trade credit insurance for your whole customer base while only financing some of your invoices.

3 reasons to buy trade credit separately from invoice finance:

- It might be cheaper

- You can customise instead of taking the standard offering

- Working directly with a trade credit insurance specialist helps reduce risk in other ways

Adam Stevens comments: “We've saved businesses a lot of money by working directly with us.”

This ability to shop around make buying invoice finance a little more complex. But buying invoice finance is an important step and needs careful consideration. Done right, it can transform a business, releasing cash to fund growth and reducing risk.

You might be interested in...

First female CEO for Euler Hermes UK and Ireland

Why you are now more likely to experience insolvency

Interested in protecting your cash flow?

We are here to help