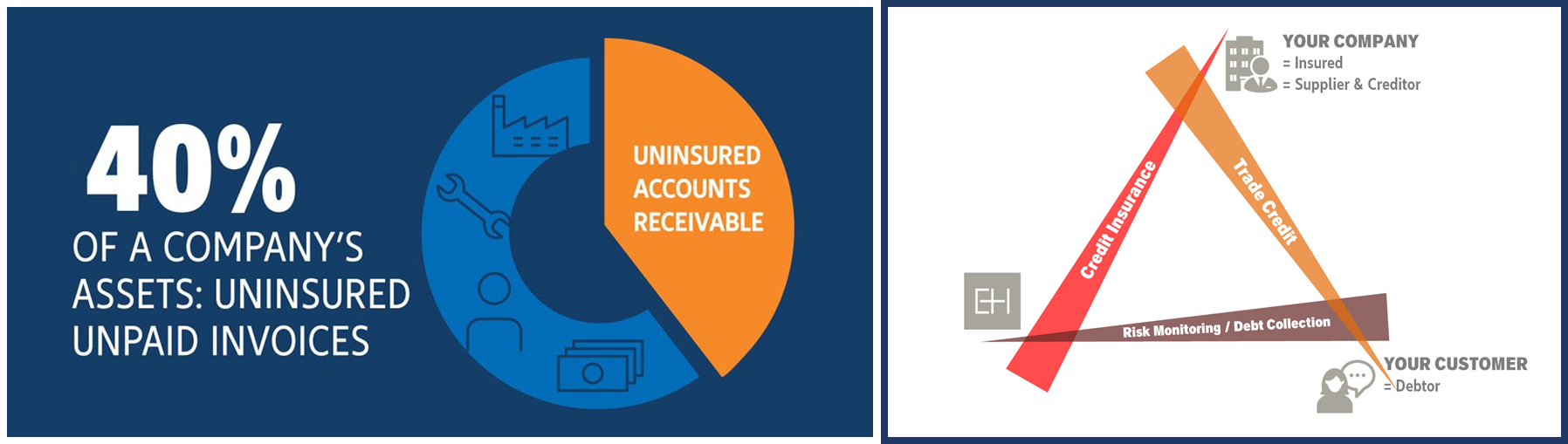

Trade credit insurance – also sometimes called accounts receivable insurance – is different from “insurance” in the traditional sense. It is a partnership that provides world-class knowledge and data to empower your trading decisions, backed by a reimbursement guarantee should an unexpected customer non-payment occur.

Businesses that choose trade credit insurance benefit from safe sales expansion – at home and abroad – to new and existing customers. Trade credit insurance also helps you access to working capital while reducing your overall risk.