Financial risk refers to the possibility of losing money and is an inherent part of any business venture. It can affect the financial stability and business operations of a company. Risk managers and risk professionals must deal with different types of financial risks, many of which are outside their control.

Financial risks can lead to opportunities for growth and development but can also result in significant financial losses.

Good financial risk management involves identifying potential risks, assessing how much risk can be absorbed, mitigating the identified risks, and controlling a variety of risks, using a range of different methods.

Summary

Key Takeaways

- Financial risk refers to the possibility of a business losing money.

- Financial risks cover a wide range of situations including market instability, credit risk, financial obligations and interest rate rises.

- Financial risk management involves creating strategies to identify and assess risk.

- Risk management is a continuous process.

Definition of financial risks

The term “financial risk” refers to the probability of a business losing money or failing to meet financial expectations, due to a range of several factors.Risk is an inherent part of business, as investments, markets, and economic changes can never be predicted with certainty.

Knowing how to identify, assess and manage financial risk is the cornerstone of good business practice and can help protect your company.

Types of financial risks

Market risk

Any company can be affected, negatively or positively, by changes in the market. Unpredictable changes can result in market risks such as interest rate hikes and movements in stock prices which can have a trickle-down effect on small- and medium-sized businesses.

One of the most widespread tools used in market risk measurement is value at risk (VaR), which enables firms to understand their overall risks and allocate capital more efficiently across various business operations.

Credit risk

Any business that extends credit to its customers takes on the risk of the credit not being repaid. Much as banks or other investors extend loans to borrowers, credit risk also applies to customer transactions on credit.

The negative consequences of extending credit can impact cash flow and may require additional resources being invested to recover the debt.

Operational risk

Operational risks refer to the potential consequences of operational failures or discrepancies. This includes risks such as mismanagement, fraud, data protection failures, security issues, and technical failures.

Comprehensive internal procedures, including health and safety, audits, and fiscal management, are the cornerstone of good operational risk management.

Liquidity risk

There are two main types of liquidity risk which can affect a business, market liquidity risk and cash flow liquidity risk.

Market liquidity risk is when a business is unable to complete its transactions due to low demand and high supply in the market. Cash flow liquidity risk is when a business cannot turn its assets into cash quickly enough to cover its debts.

Reputational risk

A company’s reputation can be negatively affected by ethical violations, safety or security issues, sustainability concerns and unethical practices.

Once a company’s reputation is damaged, this can have a knock-on effect on its sales, capital, and market share. It can be measured in lost revenue, increased costs, and a drop in shareholder value.

Risk identification and assessment

Risk analysis

Risk mapping

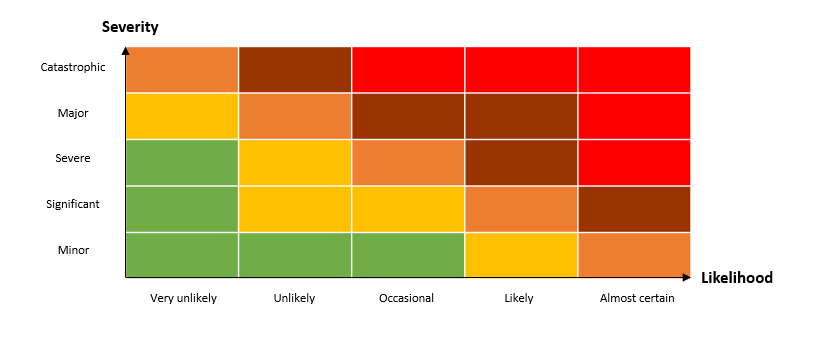

Risk mapping is one way of representing financial risks to establish appropriate risk avoidance and mitigation measures.

Often a risk map takes the form of a two-dimensional matrix representing the impact of the risk and the likelihood of the risk, respectively. A color-coded scheme may be used to illustrate the significance of each risk.

A very simple risk map might look as follows:

Quantitative vs qualitative assessment

Once risks have been identified and mapped, they need to be assessed. Risks can be assessed both quantitatively and qualitatively.

A qualitative risk analysis is based on the perception of risk and usually takes the form of a descriptive analysis, using terms such as “low” or “unlikely.”

A qualitative assessment is based on data which has been established and verified over time. Qualitative risk assessments may involve percentages or probabilities.

Consequences of uncontrolled financial risks

The findings from risk identification and assessment should feed into a risk control strategy. Failing to assess and mitigate risk can result in financial losses and business instability. While a certain level of risk is inherent in any business transaction, taking uncontrolled or unassessed risks is a dangerous strategy.

Proactive risk control, involving risk assessment, avoidance, and reduction, can create a less risky situation and help protect your business.

Risk mitigation and control

Strategy 1: Risk avoidance

Strategy 2: Risk reduction

Strategy 3: Risk transfer

Strategy 4: Risk retention

Risk retention is a strategy which involves a company absorbing the cost of a risk rather than passing it onto a third party. If a company assesses a specific risk as being not particularly significant, it may decide that it makes more financial sense to absorb the risk (i.e., cover the costs from their own budget) than to pay a third party to insure against it.

For example, if a small business assesses the risk of vandalism to its premises is relatively low, it may decide to pay for any damage to its cash flow rather than insuring against the risk.

Strategy 5: Monitoring

Regulatory and compliance measures

Governments and financial institutions can issue regulatory and compliance measures to promote stability, ensure that financial risks are controlled, and prevent excessive risk-taking in the market.

For example, in the banking industry, the Basel III regulation was implemented in 2009 to promote stability in the banking sector, requiring banks to keep certain levels of reserve capital available.

Conclusion

Financial risk is inherent in any business activity and although it can lead to opportunities for growth and development, it can also have detrimental or even catastrophic consequences when poorly managed.

An effective risk management strategy includes identifying, assessing, mitigating, controlling, and monitoring a wide range of risks.

Various methods are available to create and implement a solid financial risk management strategy and specialists are on hand to provide customized advice.

Our expertise and commitment

Allianz Trade is the global leader in trade credit insurance and credit management, offering tailored solutions to mitigate the risks associated with bad debt, thereby ensuring the financial stability of businesses. Our products and services help companies with risk management, cash flow management, accounts receivables protection, Surety bonds, business fraud Insurance, debt collection processes and e-commerce credit insurance ensuring the financial resilience for our client’s businesses. Our expertise in risk mitigation and finance positions us as trusted advisors, enabling businesses aspiring for global success to expand into international markets with confidence.

Our business is built on supporting relationships between people and organizations, relationships that extend across frontiers of all kinds - geographical, financial, industrial, and more. We are constantly aware that our work has an impact on the communities we serve and that we have a duty to help and support others. At Allianz Trade, we are strongly committed to fairness for all without discrimination, among our own people and in our many relationships with those outside our business.